Investors taking stock as fortunes start to improve

Updated: 2013-02-18 08:05

By Xie Yu (China Daily)

|

||||||||

|

An investor at a securities company in Shanghai during the stock market rebound. Shanghai's benchmark index has risen by 23 percent since early December when it hit a four-year low of 1,949. AP Photo |

|

An investor in Qingdao, Shandong province. Many observers said that the market has simply rebounded after hitting rock bottom, but investors are hoping that there will be a sustained bull market in 2013. Yu Fangping / for China Daily |

Market rally unleashes bullish optimism as further gains expected, Xie Yu reports in Shanghai.

A recent rally in the Chinese stock market has fueled passions across the board, from individual investors to large institutions.

On Feb 6, days before the start of the Chinese New Year holiday, the normally bustling streets of Shanghai, China's financial center, appeared deserted.

However, the empty streets were in sharp contrast to the hive of activity at a small trading station in the offices of Guotai Junan Securities Co in the central district of Huangpu. Young and old, male and female, stared intently at the screens, their heart rates rising and falling along with the fluctuating red and green figures on display.

On Feb 1, the benchmark Shanghai Composite Index exceeded 2,400 points for the first time in nine months, after rising for five consecutive days.

The index has risen by about 23 percent from early December, when it hit a four-year intraday low of 1,949 points. In January, it rose by an average 4.76 percent on signs that economic growth is accelerating.

"You just can't miss this opportunity. It (the index) has rallied for more than a month. That's rarely happened before," said 57-year-old Zhu Liyong.

As an unofficial guru in the trading station, Zhu, who has plenty of followers and people asking for instruction and advice, said that in the course of his 15 years' trading experience, he has made enough money to buy "several apartments".

But times have often been frustrating, too. Zhu said he'd suffered losses during the past three years as the bear market lingered. Several blue chip stocks he held declined sharply and his investments shrank sevenfold or even more.

Zhu wasn't alone. The bear run hit many investors hard and China Securities Journal estimated that each investor lost an average 76,800 yuan ($12,325) in 2012.

"I always quarreled with my wife. She tends to be cautious and was always pushing me to offload the shares, even though prices were low. But I insisted that the market would rebound," said retired accountant Zhu.

Unlike Zhu, self-employed shop owner Lin Hong, 29, is new to the investment game. "My friends told me the bull market is here, so I want to get in early and make some money," he said, adding that he was concerned about inflation eroding his savings.

Lin's stock market "tutor" is his friend Chen Jiong, now in his early 50s. "I used to work for a former State-run enterprise, but the pay was bad and I had to find some way to support my wife and kid," said Chen, who lost his job during a period of restructuring in the 1990s.

Modern equity investment in China began in 1990, when the Shanghai exchange, originally founded in 1891, was re-established after decades in abeyance. Two years later, a second exchange opened in Shenzhen, Guangdong province, the site of China's first Special Economic Zone, initiated by former leader Deng Xiaoping during the period of reform and opening-up.

In the 1990s, millions of workers were laid off by enterprises that had formerly been run by the State. In response, many, like Chen, gravitated to the stock market as they looked for new ways to earn money.

"As long as you had the time, followed the market closely and remained sensible rather than greedy, it was not hard to make money," said Chen, whose investments not only supported his daughter through college, but won him an army of fans who trusted his judgment and allowed him to run their portfolios.

An investment frenzy in 2006 saw the market gain by 130 percent and by the middle of the following year, market turnover exceeded that those of the UK and Japanese markets combined.

However, the concerns expressed by many investors about overheating turned out to be anything but hot air. During the last three years, the bear run became protracted and China's stock market has constantly been in the dumps. As usual in these circumstances, small investors paid the highest price in losses.

"I couldn't believe that several blue chips I held also performed pathetically. I have lost at least 300,000 yuan since 2008. As far as I know, only a small number of people have made money in the last two or three years," said Chen.

The bleak outlook almost forced him to stop investing in late 2010 and he stopped following the market. "It hurt me when I looked at the money shrinking every day. I just assumed it was all gone," he said.

But since the January rally in Shanghai, many observers, from small-time investors to analysts and economists, have come to the conclusion that the market has simply rebounded after hitting rock bottom. That perception has restored Chen's confidence: "At least it looks as though I can minimize my losses."

And it's not just small investors looking to catch the moneymaking tide. Reports from Hong Kong in November suggested that qualified foreign institutional investors were quietly rebuilding their mainland stock portfolios. However, the news stories barely caused a ripple until analysts, investment gurus and market commentators began latching onto them as a signal of the turning point they'd been hoping for.

The bullish sentiment that dispelled the dark clouds overhanging the moribund stock market has been boosted by a flurry of encouraging macroeconomic data that have assuaged fears of a possible hard landing for the economy.

For example, the preliminary HSBC China manufacturing purchasing managers index or PMI, an important gauge of manufacturing activity, hit a 24-month high in January, rising to 51.9 from the December reading of 51.5. A figure above the midpoint 50 level indicates expansion.

A moderate recovery

China saw GDP growth of 7.8 percent in 2012, according to data from the National Bureau of Statistics. Although that was the lowest level for 13 years and a decline from the 9.3 percent recorded in 2011, it was still far higher than that of many of the world's major economies, under siege by ongoing debt and fiscal crises.

The figure was also higher than the Chinese government's full-year growth target of 7.5 percent. It flew in the face of economists' assertions that the economy faced strong downward pressure. Some had predicted a hard landing, which now seems unlikely to happen.

Meanwhile, the NBS announced that the country's consumer price index, a major measure of inflation, was 2.6 percent in 2012, much lower than the government's target ceiling of 4 percent.

In light of the data, the past few weeks have seen a number of institutions release optimistic outlooks for the Chinese economy in 2013.

"The big picture is that China has avoided a hard landing and has engineered a gradual rebound in growth, starting in the second quarter of 2012. The strong mandate given to the new leadership of the Communist Party of China should boost confidence, and the new administration is likely to add to it by pursuing new development goals," said Dariusz Kowalczyk, senior economist at Credit Agricole SA.

Meanwhile, Qu Hongbin, chief China economist at HSBC Holdings PLC, said the country is likely to record economic growth of 8.6 percent this year, despite the uncertainty in beleaguered overseas markets such as Europe, a major destination for Chinese exports. That uncertainty is likely to present the country with a sizable challenge this year, but on the plus side, a rapid rebound in inflation is unlikely to occur.

"I am optimistic about the market, but yes, there are some potential risks," said Shaun Rein, managing director of the China Market Research Group in Shanghai.

One of the decisive factors will be whether the country is able to stimulate consumption effectively, he added.

In January, the NBS announced that consumption overtook investment in 2012 to become the largest contributor to economic growth. Domestic consumption accounted for 51.8 percent of GDP, as opposed to 50.4 percent from capital investment, while the "contribution" from net exports was minus 2.2 percent, according to the bureau.

That indicates that, rather than simply looking to quicken the rate of growth, the government has focused on restructuring growth and rebalancing the economy.

It seems that better days may be on the way after the new leadership pledged to stabilize the economy, push forward reform and economic restructuring, and remain open to foreign investment.

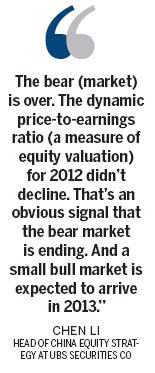

"The bear (market) is over," said Chen Li, head of China equity strategy at UBS Securities Co, predicting that the A-share market will rise a further 20 percent this year.

"The dynamic price-to-earnings ratio (a measure of equity valuation) for 2012 didn't decline. That's an obvious signal that the bear market is ending. And a small bull market is expected to arrive in 2013," said Chen.

Rein echoed those sentiments, "You've seen a bull market in the last month and a half. Actually a raft of data released by the authorities indicates that China's economy is doing all right."

Feeling bullish?

A healthy stock market would provide welcome relief to the army of demoralized investors, but it would also be a boon to many cash-strapped enterprises at a time when easy credit is a thing of the past. According to media reports, around 800 companies are in line to float on the stock market.

But unsurprisingly, a number of analysts and investors remain unconvinced that the market is ready for a massive revaluation, despite the improved economic fundamentals. They contend that the latest earnings announcements indicate little improvement in the potential for corporate earnings.

The average price-to-earnings ratio has already adjusted upward to more than 12 times from about 10 times in the past few months. However, further readjustment will depend on the projected performances of major publicly traded enterprises in key economic sectors such as property, finance, energy and telecommunications.

And that, according to analysts, is a big if.

"At this point, after the recent gains, we no longer think that Chinese equities are that cheap," according to Credit Agricole's Kowalczyk.

Although Chinese stocks remain attractive when viewed through the prism of price-to-earnings ratios, operating margins are relatively high, which increases the chances of a correction, and "our measure of the macroeconomic environment is not favorable either", he said.

However, not everyone is downbeat. "Economic recovery will continue. Macroeconomic policies are stable and the PMI purchasing figures have been positive. The new round of urbanization will expand consumption and investment. QFII and RQFII (qualified and renminbi qualified foreign institutional investors) will support market liquidity. The Shanghai Composite Index will run between 1,950 and 2,500 in the first half of 2013," wrote with Shenyin & Wanguo Securities Co analysts Jian Bijia and Chen Tong in a report in January.

Whatever the long-term result, the current situation has come as a welcome break from the long days of gloom and doom in 2012, when approximately 4.3 trillion yuan evaporated from the A-share market alone.

As long as the market doesn't slip back to those sorts of levels when trading resumes on Monday following the weeklong Spring Festival holiday, investors will feel that their stock is rising.

Contact the reporter at xieyu@chinadaily.com.cn

(China Daily 02/18/2013 page6)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|