FDI drops again amid slowdown

Updated: 2013-02-21 07:23

By Li Jiabao in Beijing, Fu Jing in Brussels and Cecily Liu in London (China Daily)

|

||||||||

But signs of an upturn encouraging, commerce official reassures investors

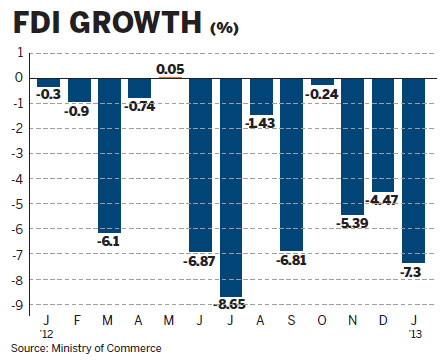

Foreign direct investment dropped again in January as a result of the global slowdown as well as lingering concerns over China's economic recovery.

The country registered $9.27 billion in FDI in January, a drop of 7.3 percent year-on-year, the Ministry of Commerce said.

This is on the heels of a drop of 4.5 percent in December.

Fourteen of the past 15 months have seen a decline in FDI. May was the exception.

But ministry spokesman Shen Danyang said on Wednesday that January's figure does not tell the full story.

China remains an attractive destination, and the driving force for China to use more FDI remains in place, he said.

Global cross-border FDI dropped 18 percent year-on-year in 2012 while in Asia it declined 9.5 percent. The decline in China on the global scale was 3.7 percent, Shen said, citing a report from the UN Conference on Trade and Development.

Song Hong, an economist with the Institute of World Economics and Politics under the Chinese Academy of Social Sciences, said global uncertainty and weak investment sentiment were to blame.

The world's second-largest economy expanded 7.9 percent in the last quarter of 2012, halting a seven-quarter slowdown. The full-year expansion of 7.8 percent last year was the lowest in more than 10 years.

"The FDI decline in January shows that global investors have different views on whether China's economic recovery will be steady and sustainable. Meanwhile, they are also weighing whether further investment in China will bring the same rewards as in the past," said Lian Ping, chief economist with Bank of Communications.

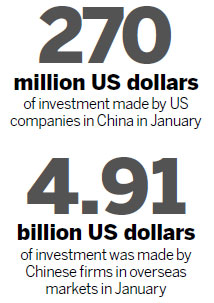

Investment from the United States fell 20 percent year-on-year in January to $270 million while Japanese investment, $640 million, was down 20 percent from a year earlier, according to the ministry.

"Tension over Diaoyu Islands drove down Japanese investments in China. US investors are returning home and favor Mexico more than China where costs keep rising," Song said.

However, European Union investment in China surged 81.8 percent year-on-year in January to $820 million.

Two countries in particular stand out. Investment from Sweden jumped a massive 4,060.4 percent year-on-year and investment from Denmark rose 325.2 percent.

"The rebound of EU investment in China is mainly owing to China's continued economic expansion and the necessity to invest in production facilities close to the market," said Fredrik Erixon, director of the European Center for International Political Economy, a think tank in Brussels.

Arnaldo Abruzzini, secretary-general of Eurochambers, added that EU business has been eyeing the Chinese market for more two than decades and now smaller companies think that the time is ripe to invest.

Lian said that China's economic recovery will further stabilize after the first quarter and FDI inflow is "very likely" to pick up in the second half of 2013.

Meanwhile, China's non-financial outbound direct investment rose 12.3 percent to $4.91 billion in January.

"China is at a stage of fast outbound investment and the pace will be faster in the near future. Outbound investments currently focus on resources and mergers and acquisitions, but more will go to manufacturing as China shifts its over capacity to overseas markets," Song said.

Contact the writers at lijiabao@chinadaily.com.cn

Liu Jia contributed to this story.

(China Daily 02/21/2013 page1)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|