Output growth hits 4-month low, says HSBC

Updated: 2013-02-26 07:56

By Chen Jia in Beijing and Xie Yu in Shanghai (China Daily)

|

||||||||

|

Workers manufacture baby strollers at a company in Zaozhuang, Shandong province. The HSBC flash purchasing managers' index for February slipped to 50.4, the lowest in four months. Li Zongxian / For China Daily |

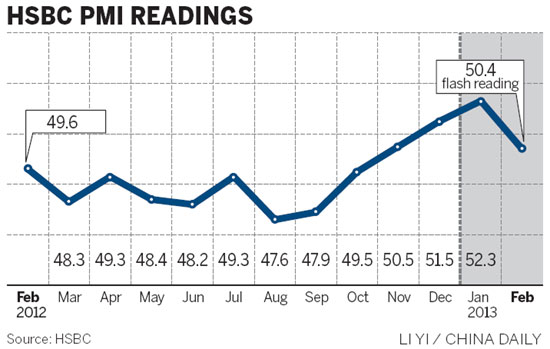

China's manufacturing production growth hit a four-month low in February, dented by the Chinese New Year holiday and continued weakness in external demand, banking giant HSBC Holdings Plc said on Monday.

A prediction saw the manufacturing Purchasing Managers' Index retreat to 50.4 in February from 52.3 in January, but still showing the sector was expanding, HSBC said.

A reading above 50 indicates expansion and it was the fourth consecutive month of growth, after 12 months of contraction.

"It means the underlying strength of China's recovery remains intact, as indicated by still-rising employment and the recent pickup of credit growth," said Qu Hongbin, HSBC's chief economist for China and co-head of Asian economic research.

The preliminary reading was released by the bank a week before the official data by the National Bureau of Statistics, and is the earliest available indicator of conditions in the manufacturing industry.

The moderation in HSBC's PMI prediction was mainly led by weaker growth in new orders, with the relevant sub-index declining to 51.2 in February from January's 53.7, the lowest level for three-months.

Another sub-index showed new export orders fell to 49.8 this month, compared with 50.5 a month earlier, and indicating that exports have turned to contraction from modest growth, according to HSBC.

Sun Yingli, general manager of Shanghai Manlang Textile Co, a garment manufacturer relying mainly on orders from Europe and Japan, said: "Actually, orders have grown this year, maybe due to economic recovery in overseas markets, but costs are surging and we have had to give up some orders to keep the profit margin."

Sun said prices for 90 percent of raw materials are rising, in addition to higher labor costs.

"Everything - thread, yarn, dyes - has become more expensive. We can do nothing but shrink the production scale to survive," she said.

Qu said that over the past three years, the average moderation of the PMI during the Chinese New Year months was 1.4 points, during which most manufacturing production takes a week's break.

He said the manufacturing sector remains optimistic, suggested by the continuous expansion of raw material purchases.

"More importantly, robust labor market conditions should provide additional support to continued consumer spending growth in coming months."

Chang Jian, an economist with Barclays Capital, predicted that the official National Bureau of Statistics PMI, to be released on Friday, could fall below 50 from 50.4 in January.

Despite external weakness and distortions due to the Chinese New Year holiday from Feb 9 to Feb 16, China's growth recovery remains on track since the start of the year, Chang said, supported by continued investment growth and a robust consumption increase.

Chinese banks more than doubled their lending in January from December, granting 1.07 trillion yuan ($171.7 billion) worth of new loans, official data showed earlier this month, as Beijing seeks to boost economic growth.

The domestic economy expanded 7.8 percent last year, its slowest pace in 13 years, in the face of weakness at home and in key overseas markets.

Policymakers cut interest rates twice in 2012 and have trimmed the amount of cash banks must place in reserve three times since December 2011 to encourage lending.

"But the government will face a renewed challenge in balancing growth and inflation risks in 2013," Chang said.

Zhang Zhiwei, chief Chinese economist with Nomura Securities Co Ltd, forecast that consumer inflation this year is likely to rise to 3.5 percent, while that for the second half may increase to 4.4 percent. The prediction came after the National Development and Reform Commission announced a hike in retail gasoline and diesel prices on Monday.

That may be a signal that the government could move to raise other "administratively suppressed" prices, such as electricity and other public utilities in the first half, which will contribute to an increase in the consumer price index, the main gauge of inflation, Zhang said.

Rising inflationary pressure, along with possible 8.1 percent economic growth in the first six months of this year, may cause the central bank, to raise interest rates twice in the second half, he added.

AFP contributed to this story.

Contact the writers at chenjia1@chinadaily.com.cn and xieyu@chinadaily.com.cn

(China Daily 02/26/2013 page13)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|