Nokia signals China ambitions

Updated: 2013-03-07 07:40

By Shen Jingting (China Daily)

|

||||||||

|

Visitors taking pictures of new Nokia devices during the Mobile World Congress 2013 in Barcelona, Spain, in February. Across the world, Nokia remains the No 1 Windows Phone vendor, with a market share of 78 percent last year. David Ramos / For China Daily |

Finnish firm hopes to regain lost ground with its Windows Phone devices

This year could be a tipping point for Windows Phone device manufacturers such as Nokia Oyj with early indications the handsets have achieved a good start in major smartphone markets including China, according to the boss of Nokia China.

In an exclusive interview with China Daily, Gustavo Eichelmann, chief executive officer of Nokia China, expressed confidence in Nokia's turnaround in China, as well as in the global smartphone market in 2013.

Mexico-born Eichelmann took the job in China amid a turbulent time. He has been the third China chief since Nokia devoted itself to developing smartphones on Microsoft's Windows Phone operating system in 2011.

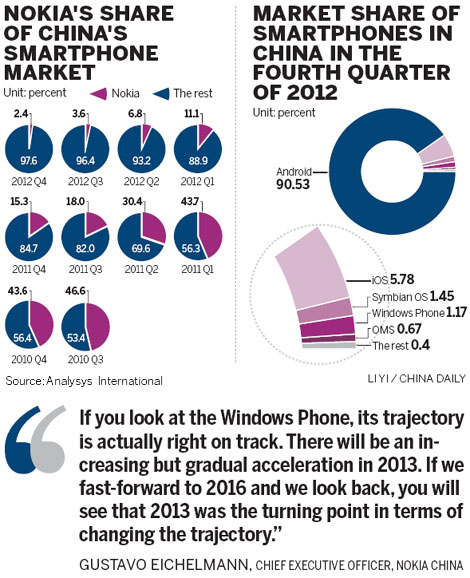

Finland-based Nokia held almost half of the smartphone market share in China more than two years ago, but the figure slipped to a mere 2.4 percent in the fourth quarter last year, according to Beijing-based firm Analysys International.

"It is because it has only just begun," Eichelmann said. "Think about iPhone and Android devices in their first six months. If you look at the Windows Phone, its trajectory is actually right on track. There will be an increasing but gradual acceleration in 2013. If we fast-forward to 2016 and we look back, you will see that 2013 was the turning point in terms of changing the trajectory."

One of the possible reasons why Windows Phone devices may enjoy greater popularity is because more people will get to know about the platform. Microsoft, the developer of the Windows Phone operating system, has begun introducing Windows PCs and Windows tablets with exactly the same user interface.

"More people know about the system. The viral effect - word of mouth - is starting to take place," Eichelmann said.

Competitive market

Stephen Elop, CEO of Nokia Corp, said at the end of last year that China is the biggest market globally for Nokia's Lumia series Windows Phone devices.

The company launched its first Lumia smartphone in China in early 2012. Since then Nokia has introduced eight Lumia models to the Chinese market.

Across the world, Nokia remains the No 1 Windows Phone vendor, with a market share of 78 percent, compared with HTC Corp's 14 percent and Samsung Electronics Co Ltd's 6 percent, according to a Forbes report.

The company sold 4.4 million Lumia smartphones worldwide in the fourth quarter. Nokia Lumia 920, the latest Nokia flagship smartphone that runs on the Windows Phone 8 operating system, received "extremely encouraging feedback" from Chinese clients, Eichelmann added.

"The simple target for Nokia in China this year is growth," he said.

From subways and shopping malls to chic flagship stores in Beijing, various Nokia advertisements, fronted by Chinese singers and movie stars, have been attracting people's attention.

Li Yan is a 28-year-old worker in the finance industry in Beijing who wants a new smartphone. "The first mobile phone brand that popped into my mind was Nokia. It seems that I have a natural affection for the brand," Li said.

When Li was a college student, her father sent her a Nokia device. It was the first mobile phone she ever owned. There are millions of people in China like Li that adopted Nokia as an integral part of their lives.

"Compared with other international smartphone vendors such as Apple and HTC, one of the major advantages of Nokia in China is its branding," said Yan Xiaojia, a telecom analyst at Analysys International.

Nokia has had a presence in China for more than two decades and the company has about 250 million users in the country.

But Li was not very comfortable with the Windows Phone system. "I used an Android phone before so when I tried the new Nokia models I needed time to get used to them," she said. Eventually she gave up and bought an iPhone 4S.

In a China Mobile outlet in Changchun, in Jilin province, salesman Zhao Xin said many people were curious about Nokia phones, especially the latest Lumia 920, but there were too few in stock and the outlet missed out on the traditional Spring Festival shopping season.

"The biggest winners now are domestic brands, such as Huawei, Lenovo and ZTE. People buy them because they are good quality and also are much cheaper," Zhao said.

"The Chinese market is highly competitive. The dynamics of the competition are probably the most advanced I have ever seen," Eichelmann said. With about 1.1 billion mobile phone subscribers, China attracts a lot of industry players both at home and abroad.

"The product cycle in China's smartphone market is the fastest. Nokia needs to drive the consistency of its brand and innovation," he said.

Chinese rivals emerged and gradually snatched the market share that Nokia lost. Huawei, the Shenzhen-based telecom giant, rose to become the world's third-largest smartphone vendor in the fourth quarter last year, with a 4.9 percent market share worldwide, according to a report issued by International Data Corp.

In contrast, Nokia's China ranking dropped to fifth place in the first half of 2012, from the top position at the end of 2011, according to research by IHS.

Samsung topped the list and shipped more than double the number of smartphones than Nokia managed, gaining a market share of 20.8 percent - 14.4 million smartphones - in the first six months of last year, IHS said.

Nokia faced the most direct competition in the territory of Windows Phone devices. Taiwan-based HTC jumped ahead of Nokia to launch the first Windows Phone 8 handset in the Chinese mainland. Samsung, ZTE and Huawei have also expressed an ambition to develop Windows Phones.

"Nokia welcomes the competition, and the competition fuels the strength of the Windows Phone ecosystem," Eichelmann said. Among all the devices, Nokia definitely has its own unique qualities, he said.

The latest Nokia smartphone Lumia 920 has the ability to synchronize content between Windows Phone 8 smartphones, Windows 8-based PCs, tablets and the Xbox, said Flann Gao, Nokia China communications manager.

There are other innovative functions as well, he added. The Nokia City Lens, one of the highlights, is an augmented reality software that gives dynamic information about users' surroundings. "City Lens makes finding the best of what's around you as simple and natural as looking through the smartphone display," Gao said.

"Nokia has a unique position within the latest Windows Phone 8 ecosystem. All our best work and resources is on the Windows Phone 8," Eichelmann said.

What's next?

Unlike other international smartphone players such as Apple that focus mainly on the North American market, Nokia has long positioned the Chinese market as its top priority.

Eichelmann said Nokia would be part of China's progression as it enters the fourth generation mobile network age. Rumors have circulated that China is likely to kick off the 4G commercial rollout in the second half of this year. China Mobile Ltd, the nation's biggest telecom carrier, is conducting large-scale 4G trials in 13 Chinese cities.

Eichelmann did not respond directly to questions as to whether Nokia would develop smartphones suitable for the Chinese homegrown TD-LTE 4G technology but did say: "Clearly that's something we will be part of."

In order to revive its Chinese market performance, Nokia has also started to cooperate with local e-commerce websites and expand its online sales in the country.

"Online shopping is booming in China," Eichelmann said. He emphasized the importance of e-commerce but said Nokia will not open its own mobile phone e-store, a step that Chinese rivals Xiaomi Corp and Huawei have already taken.

"Nokia will strengthen cooperation with third party e-commerce websites," Eichelmann said. All future Nokia devices will sell through online and offline channels in China simultaneously.

360buy.com, China's second-largest business-to-consumer e-commerce retailer, agreed to buy 2 billion yuan ($320 million) of mobile phones from Nokia this year.

About 30 million mobile phones were expected to be sold online in China last year, up 68 percent from 2011, according to a report issued by SINO Market Research. The growth rate is more than 10 times that for mobile phones that were sold in offline outlets during the period, according to the report.

shenjingting@chinadaily.com.cn

(China Daily 03/07/2013 page15)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|