Shanghai gaining favor with wealthy as financial center

Updated: 2013-03-07 07:40

By Wang Ying in Shanghai (China Daily)

|

||||||||

Shanghai has overtaken Hong Kong and Singapore to become the world's fifth most important financial center, and Beijing is considered the second most influential political city, in a survey that gauges the importance of global cities.

The joint study, by leading international property consultancy Knight Frank LLP and Bank of China International Ltd, said Shanghai - which is striving to become Asia's top financial center - had passed its two most traditional Asian rivals, who have slipped to 7th and 8th respectively.

New York, London, Tokyo and Paris take the top four spots as financial centers, said the report, while the Chinese capital Beijing is second only to the US capital Washington DC in terms of political importance.

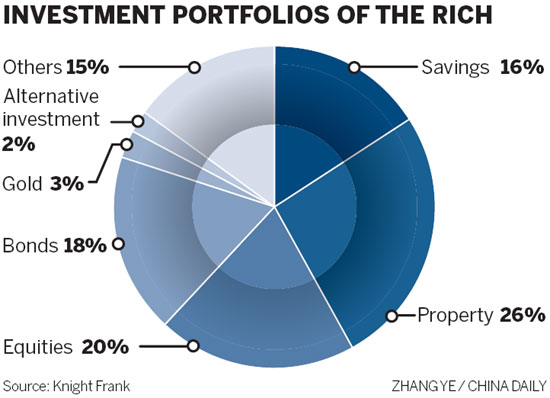

The Wealth Report 2013 gathered the views of 15,000 people with at least $30 million in net assets - which it called "high net worth individuals" - gauging attitudes in four areas: economic activity, political power, quality of life, and knowledge and influence.

Other top-tier mainland cities featured in the survey include Guangzhou and Shenzhen, which Liam Bailey, the head of residential research with Knight Frank, said he expected to see grow strongly in global importance over the next few years.

The study ranked Beijing at 15th overall this year, with Shanghai at 24th, according to the report.

"By 2023, our survey of high net worth individuals will show Shanghai and Beijing joining the top 10 at the expense of Geneva and Paris," said Bailey.

Commenting on the results, Qi Xiaozhai, director of the Shanghai Commercial Economic Research Center, said he thought the two Chinese cities should have higher positions, given their rising lifestyles.

Beijing is still 40th in terms of life quality, and Shanghai is 39th, said the report.

"This reminds us that as we develop the economy we also have to consider lifestyle issues, such as protecting our living environment," said Qi.

Knight Frank's accompanying luxury investment index showed that collectable assets such as art, fine wine, classic cars, coins and watches have accrued cumulative gains of 175 percent over the past 10 years, and 6 percent last year alone.

It said that wealthy Chinese were leading that trend, reshaping the global markets for art as well as antiques, jewelry and other luxury items.

Additionally, the report showed an evolution of the map of the world's wealthy, with a new concentration of wealth in Asia.

Globally, the number of billionaires will increase by 85 percent over the next 10 years, with the biggest increase being in Asia, or 119 percent, it predicted.

The top country for billionaires is still the US with 543 and that will grow by 103 percent by 2022, but China in that time will increase from 154 to 483, an increase of 214 percent.

Knight Frank also predicted further gains in prime property values in Shanghai and Guangzhou, particularly, as both remain targets for investment from other areas in China, benefiting from growing national wealth, especially in lower-tier cities.

wang_ying@chinadaily.com.cn

(China Daily 03/07/2013 page13)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|