Brewing up the right recipe for success

Updated: 2013-03-21 07:33

By Wang Zhuoqiong and Xie Chuanjiao (China Daily)

|

||||||||

|

Performers hold replica beer steins at the opening ceremony of the China Qingdao International Beer Festival in Qingdao, Shandong province. Tsingtao Brewery Co Ltd accounts for about 15 percent of China's beer market and around half of the country's beer exports. Provided to China Daily |

Tsingtao boss regards industry as a battlefield with millions at stake

While waiting to fly back to China, Sun Mingbo, chairman of the world's sixth-largest brewery by production volume, took a moment to examine the top sellers at an airport bookstore in the United States.

A book entitled The Generals, American Military Command from World War II to Today caught his eye and was soon added to his collection about the military.

As a fan of military leaders and combat strategy while heading Tsingtao Brewery Co Ltd, Sun didn't read the battle stories just for fun.

Last year, he sent part of his management team to the United States Military Academy West Point on a leadership course. "The education provided by the US army is not only about strategy. It is about training leaders," he said.

He is interested in them because "the business world of the Chinese beer industry - the most rapid growing market on the planet - is very similar to the battlefield", he said.

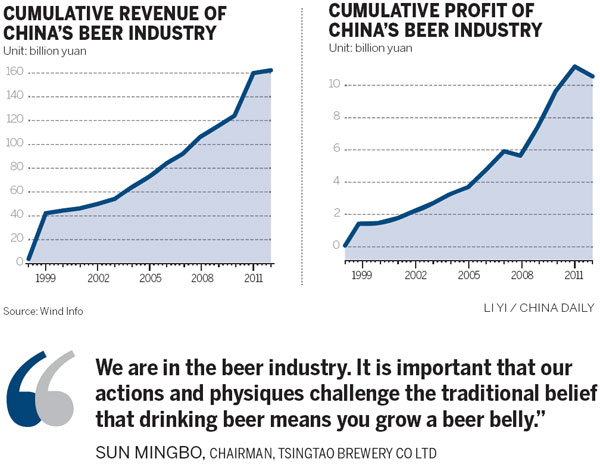

In 2012, Chinese beer breweries produced 49.02 million kiloliters, outnumbering the US as the world's largest beer market.

In comparison with stagnant or declining sales in developed economies, China's per capita beer consumption level has the potential to increase to twice the level in the United States, said Sun.

The former president of China's most renowned beer brand took the job last June after the former chairman Jin Zhiguo resigned unexpectedly.

Under his leadership, Tsingtao Beer, founded in 1903 by German and British merchants, turned in a surprising performance last year, beating its domestic peers in revenue growth and profits.

The industry's growth last year was the lowest after a decade of rapid expansion. Between January and November, the beer industry produced 46 million kiloliters, up only 3.57 percent.

But the Qingdao-based brewery, which accounts for about 16 percent of the domestic market and about half of the country's beer exports, saw its revenue grow 12.8 percent in the first nine months from the same period the year before.

Tsingtao Beer's revenue increase contributed to half of the growth of the industry last year. The brewery made a net profit of 168 million yuan ($27 million) during the first three quarters last year.

Last year, the brewery completed its expansion plans in central China and the northwestern regions, and established plans to produce more than 10 million kiloliters by 2014.

The smooth transition between two executives, sound development of its second-line brands and the clear goal of achieving a production volume of more than 10 million tons took the 110-year brand into a prosperous era, said Fang Gang, an independent analyst of the beer industry.

Domestic battlefield

For other businesses, going global involves expanding beyond their borders but for breweries China is the main battlefield, said Sun.

"It is not sensible giving up such a great market and competing in the saturated markets of developed countries," he said.

At work, Sun has two principles: "Never miss a major opportunity; never ignore a major threat." Failure regarding either of them would create trouble or even be fatal for the company, he said.

The sense of threat comes from a true and deep understanding of the Chinese market, Fang said, and an awareness of the large gap between local and foreign breweries.

After decades of expansion through many acquisitions, the Chinese beer industry is dominated by three domestic brands: China Resources Snow Brewery, Tsingtao Brewery and Yanjing Brewery, as well as three foreign brands - Anheuser-Busch InBev, SAB Miller and Carlsberg.

Anheuser-Busch InBev had a production volume of 5.59 million tons in 2011 and has plans to invest 20 billion yuan in building eight to 10 new manufacturing bases in China to achieve its goal of 15 million tons, Fang said. That's equivalent to more than 30 percent of sales in China.

On the domestic front, Tsingtao, although it is equipped with a strong mixture of local and national level brands and has 60 breweries in 19 locations, has strong rivals.

With 80 breweries and a 21 percent market share, the largest beer manufacturer by production volume is China Resources Snow Breweries. It is a peer of China Resources Enterprises Ltd and the world's second-largest brewery SAB Miller, and experienced sales growth of 5 percent in the first three quarters of 2012 of 9.06 million kiloliters.

The third-largest brewery, Yanjing Brewery, which is focused on a local strategy and has a 12 percent market share, grew 0.77 percent in the same period.

Sun said he believes the market could be further developed and competition lies in the capacity to execute new business models and raising operational efficiency.

"In the past, you only had to run fast. Now you have to run while making yourself really strong at the same time," he said.

Tsingtao's next move is to expand market share and raise sales volumes in central and western regions because the eastern market is saturated.

As for its global market, Tsingtao sells to more than 80 countries and regions and is expanding. Sun said its global presence is aimed at building a high-end brand with products that are among the most expensive.

"It matters if your product can survive in developed markets and be recognized," he said, adding that the brewery is seeking growing markets in Southeast Asian countries. "They are a future market for us. We expect to increase investment and sales in the region," Sun said.

Innovation as a weapon

Sun possesses EMBA degrees from Washington University and Fudan University. The English-speaking chairman believes innovation could change the entire industry.

Innovation could happen within distribution channels, he said, adding that his company is conducting research on the likelihood of adopting e-commerce, which would mean direct contact with retail terminals such as restaurants, supermarkets and convenience stores and the development of the logistics of dealing with them.

"Although we haven't gone too far yet, we should not ignore that direction and possibility. We have to think ahead," he said, adding that innovation is focusing on the development of the strength of Tsingtao beer to be a more functional and healthy drink.

A change in beer consumption behavior has led to a change in products that are tailor-made to suit customers.

"In the past, it was about the capacity of drinking the most volume," Sun said. "Now it is about enjoying what you drink."

To compete in the high-end market where foreign breweries have developed greater advantages, Tsingtao has introduced Augerta, using a German formula, and Yipin Draft, which uses hops from the Czech Republic.

Sun said he believes the competition to be best is not only in the psychological arena but also at the physical level. Every day Sun goes jogging for 18 minutes followed by balancing and upper limb routines.

"We are in the beer industry," Sun said. "It is important that our actions and physiques challenge the traditional belief that drinking beer means you grow a beer belly."

Contact the writers at wangzhuoqiong@chinadaily.com.cn and xiechuanjiao@chinadaily.com.cn.

(China Daily 03/21/2013 page15)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|