Factory output tipped to accelerate in March

Updated: 2013-03-22 07:26

By Chen Jia (China Daily)

|

||||||||

An expansion of China's manufacturing sector is predicted to accelerate in March - suggesting stable economic growth - stimulated by stronger market demand and increasing industrial production, HSBC Holdings PLC said on Thursday.

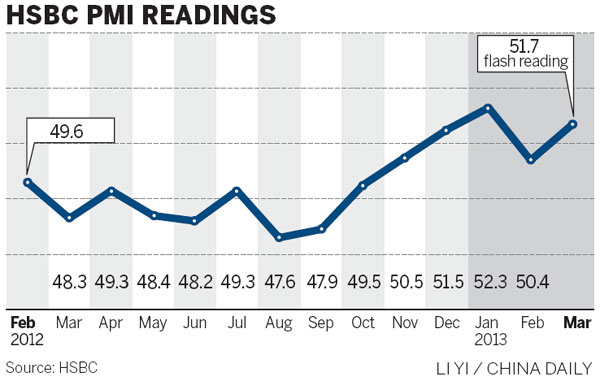

A preliminary reading of the bank's manufacturing Purchasing Managers' Index (PMI) climbed to 51.7 in March from 50.4 in February, indicating faster development of the sector.

HSBC said it may be the fifth consecutive month for the PMI reading to stay above 50, the point separating contraction from expansion.

The output sub-index rose to 52.8 in March from 50.8 in February, and the new-order component increased to 53.3 from 51.4.

Meanwhile, the new export order sub-index rose to 51.1 from 50.3 in February, according to HSBC.

Qu Hongbin, chief economist in China with HSBC, said the March rebound was likely to be supported by stronger new orders and production growth.

"This implies that the Chinese economy is still on track for gradual growth recovery," he said.

The Shanghai Composite Index, which saw its biggest gain in two months on Wednesday, continued to rise on Thursday, to 2,324.24, up by 0.3 percent.

Gao Ting, managing director of UBS Securities Co Ltd, predicted the benchmark index may rise 20 percent this year, boosted by stronger investment in infrastructure construction in the short term, and in the long term, supported by increasing profits for enterprises in sectors including retail and environmental protection.

"We predicted that the growth of A-share profits may increase by 9 percent this year, as the macroeconomic environment shows positive signals," Gao said.

GDP growth in the first quarter is likely to speed up to 8 percent from 7.8 percent in the final quarter last year, he said, and this momentum may continue for the first half. Growth may peak up to 8.3 percent year-on-year in the second quarter.

"Potential risks may come from soaring inflation in the second half and the fast expansion of shadow banking. The government may tighten its policies to control any asset bubbles," Gao with UBS Securities said.

UBS predicted the Consumer Price Index, an indicator of inflation, may rise to 3.8 percent in the third quarter and 4.2 percent in the last three months of this year, higher than the government's annual target of 3.5 percent.

However, Qu from HSBC said inflation remains "well behaved". "It leaves room for the government to keep policy relatively accommodative in a bid to sustain growth recovery."

Influenced by the encouraging PMI data, benchmark Asian stock indices were mixed on Thursday. Tokyo climbed 1.34 percent, adding 167.46 points, to 12,635.69, but Seoul closed 0.44 percent lower at 1,950.82, losing 8.59 points.

Gao said overseas markets will see a recovery this year, based on the financial system in Europe stabilizing and the property sector rebounding in the United States.

chenjia1@chinadaily.com.cn

(China Daily 03/22/2013 page13)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|