A difficult but necessary beginning to recovery

Updated: 2013-03-28 07:39

By Yu Ran (China Daily)

|

||||||||

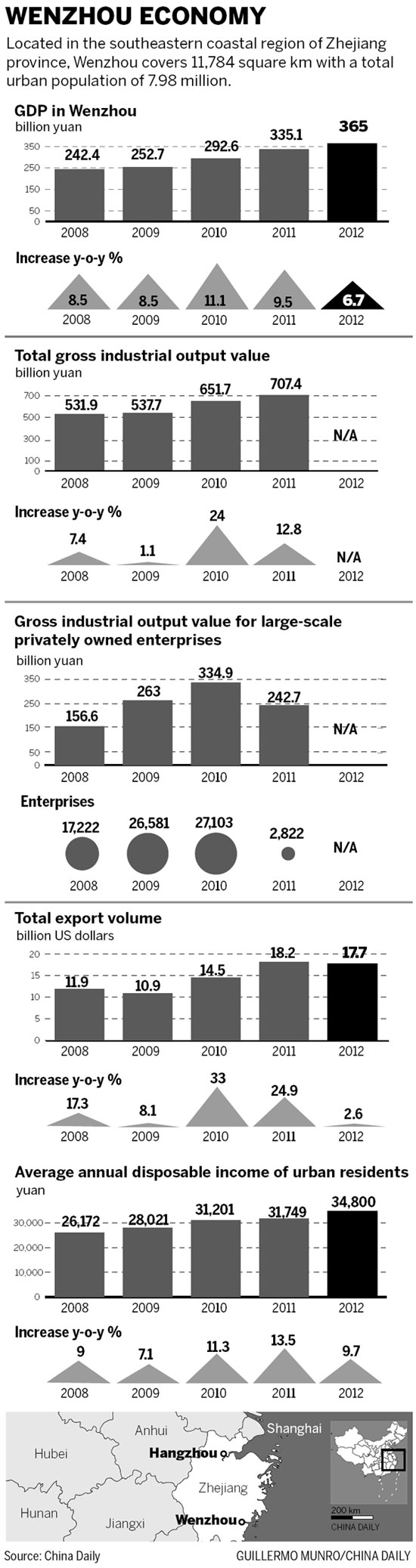

Despite financial reforms, small firms in Wenzhou are still struggling with a shortage of capital, reports Yu Ran from Wenzhou, Zhejiang province

Editor's Note: Wenzhou is marking the first anniversary of landmark financial reforms that are not only of great importance to this center of private enterprise but also to the many other cities and regions that are poised to restructure their own capital markets. Much has been done and much more is expected as the program enters its crucial second year. China Daily is running a series of stories to review these changes:

One year ago, Wenzhou embarked on an ambitious venture of financial reform amid great fanfare.

It was an occasion of significance because it promised to reshape this entrepreneurial hotspot by providing capital for the development of high-value-added sectors to replace struggling low-cost, labor-intensive manufacturing industries, funded largely by an underground money market that had collapsed due to mounting defaults.

Over the past 12 months, the local government has moved quickly to establish the necessary facilities for lenders and borrowers to do business in an environment where transactions are documented and registered. But so far, neither lenders nor borrowers have warmed to the idea of reform.

This is going to change.

The government has initiated the process of passing laws that are expected to give much-needed legal support to the reform program.

In addition, it is poised to step up its efforts to enhance the benefits of reform in terms of fairness and transparency. Government officials interviewed for this story said they are confident that this twin-track approach will fundamentally change the way of doing financial business in Wenzhou.

Officials in charge of the reforms know that it's more than personal pride that's at stake. The fate of the Wenzhou experiment has much wider implications that extend beyond the city. The experience gained here is being closely watched in other cities and regions as they consider launching their own financial reforms.

"This pilot reform in Wenzhou must succeed," said Cen Li, general manager of the government-sponsored Wenzhou Financial Investment Group, which is in charge of Wenzhou Financial Reform Plaza. "The whole nation is watching us."

Brushing off the initial doubts about the reform, People's Bank of China Vice-Governor Pan Gongsheng said recently: "The overall effects of the pilot reform in Wenzhou will require some time for further observation."

In Wenzhou, Zhang Zhenyu, director of the city's financial office and the official in charge of the reforms, said: "We've been trying to move forward the reforms following last year's work, and we're getting prepared to launch new initiatives."

He declined to disclose detail of the planned initiatives. But sources familiar with the plan said the final draft of new regulations on private financing and management by the city's finance office was submitted for review in November 2012 to the Zhejiang provincial government. They said they expect the draft to be approved soon.

Bigger moves

Under the proposed law, the annual loan interest rate would be capped at reasonable levels.

Lenders in the underground money market commonly charge borrowers interest in excess of 25 percent a year. Such high costs are widely blamed for stifling innovation because neither lenders nor borrowers would take the risk.

A new government department is to be established under the proposed law to supervise and regulate companies doing financial and other related businesses. These include moneylenders, loan brokers, pawnshops and investment consultants.

At present, these companies, like all other businesses in Wenzhou, are licensed by the city's commerce department. As such, they are not required to observe any form of banking law although some of them are known to regularly take deposits from clients and lend to borrowers.

When the new law comes into force, all companies doing financial-related businesses will come under the supervision of the new department, which also has the final say in the licensing process, the sources said.

The newly established department is also expected to keep a record of all the loans transacted at companies under its supervision.

In addition, an online credit information system will be launched. It will make available to qualified institutions the credit history of local individuals, with details of credit card purchases and loan repayment records.

"We plan to combine the authorized credit rating database from the People's Bank of China with information gathered by the local industrial and commercial bureau to set up a complete database for lenders' references," said Yu Qian, deputy director of Wenzhou's finance office.

The credit rating database is expected to be up and running by the end of this year.

Other initiatives include the hosting of an investment seminar to showcase Wenzhou's opportunities to more than 1,000 businessmen who have moved overseas.

Cen Li predicted that these overseas entrepreneurs of Wenzhou origin will invest at least 5 billion yuan in various projects in 2013. Last year, they invested 220 million yuan in four projects.

"We're keen to encourage more emigre Wenzhou business people to come back," said Cen.

"The financial plaza will eventually work as a platform to help SMEs and individuals to solve financial problems via multiple methods and with lower risks," said Cen adding that his team has been busy preparing the projects, contacting businessmen, and negotiating with banks over the past year.

The establishment of a 1 billion yuan trust fund was agreed between the Export-Import Bank of China and the Bank of China to solve the loan problems of small and micro-sized enterprises.

Cen also persuaded the Zhejiang branch of China Development Bank and the Wenzhou branch of Shanghai Pudong Development Bank to agree to provide up to 3 billion yuan in standby loans to qualified enterprises at the end of January, with the first batch of loans totaling 9.3 million yuan.

A small and micro-sized enterprises self-service bank is also due to be opened by Huaxia Bank to supply private company owners with loans.

The latest figures from the financial plaza showed that 20 financial agencies had gathered more than 18.6 million yuan for small and micro-enterprises since January.

A website has been launched and a financial reform service hotline will be made available to the public soon.

"We want to let every single individual feel the existence of the financial reform," said Cen.

Setting up an online platform and minimizing the risks for money lending activities are bringing more direct benefits to individual lenders.

"We are applying an online auditing package and examining software to monitor borrowers who need cash, to minimize the risks for lenders," said Wang Xiuzhi, chairman of Wenzhou Small and Medium-sized Enterprises Financing Service Center, which owns E-baijia, an online platform to control and monitor risks before transactions.

The center was launched to ensure that companies get low-interest loans with controllable risks.

Wang added that the center also aims to perform as a credit platform for SMEs, which have experienced difficulties after thousands of businesspeople failed to repay their loans since September 2011.

Nevertheless, the reform also introduced 18 peer-to-peer financing agencies to build platforms for banks and small and micro-sized enterprises with available loans.

"We are able to match potential lenders with borrowers according to their requirements, and allow individual lenders to pledge their assets for bank loans more quickly," said Chen Yan, deputy general manager of Sudaibang, a peer-to-peer loan service provider in Wenzhou.

Sudaibang offers loans at an average annual interest rate of 13 percent.

Chen added that new types of objects of pledge such as second-hand vehicles and second mortgages will be the main area of expansion to enable SMEs to obtain higher amounts of money.

Wenzhou was selected for the pilot financial reform on 28 March, 2011, to regulate the collapsing private-financing system following a crisis arising from widespread loan defaults by factory owners and investors.

In the past two years, there have been reports of Wenzhou factory owners fleeing abroad, leaving behind piles of debt and scores of unpaid workers. The wave of defaults practically wiped out the underground lending market and triggered the outbreak of a local financial crisis that prompted the government to intervene.

Financial officials in the city have established a host of facilities, including several lending platforms that seek to facilitate an orderly and well-supervised flow of capital.

These facilities are supposed to take away the function of the underground banking system that teetered on the brink of collapse early last year.

The infrastructure includes Wenzhou's Private Lending Registration Service Center, Wenzhou SME Financing Service Center, a financial reform plaza, two related financial development zones and a number of high-tech zones in three districts of the city.

Although the full impact of these platforms has yet to be felt due to flagging confidence among moneylenders and borrowers, improvements have been made to protect moneylenders.

A policy was issued at the end of February by the city government, stating that courts have to directly handle disputes if people involved in the case are already registered with the service center.

"It will be a big move to drag the private lending activities out from underground to be regulated and protected by the laws," said Xu Zhiqian, general manager of Wenzhou's Private Lending Registration Service Center.

The center has remained relatively empty since its launch in April 2012.

The 2,300 square meter service hall is usually very quiet, with dozens of cashiers sitting in front of computers with little to do.

According to the latest statistics provided by the city's finance office, the private lending center has offered around 390 million yuan to local individual borrowers, the majority of whom are owners of struggling SMEs, with a borrowing rate of only 33.17 percent. The total amount of money that registered lenders offered exceeded 1.3 billion yuan with few takers.

A joint conference system was launched on Tuesday to create an information platform among the city's financial-related departments and Wenzhou Intermediate People's Court to monitor and regulate illegal financial behavior.

"Hopefully those measures will convince more moneylenders and borrowers to register at the center," said Xu.

Business skepticism

Despite official enthusiasm, the Wenzhou business community has remained skeptical.

"The financial reforms have resulted in hardly any positive changes for manufacturing companies, which are still struggling with financial problems," said Zheng Chen'ai, president of Wenzhou Garments Association.

Zheng added that the solution to solving the difficulties related to moneylending is to rebuild the credit rating system.

At the moment, most members of the association face increasing costs of labor, materials and expenses as they strive to restructure their businesses.

"Hopefully the government will issue policies to encourage private SMEs in the ongoing industrial restructuring to produce more value-added products with higher quality, better designs and at lower costs," said Zheng.

Zheng added more enterprises are focusing on manufacturing and designing high-quality and personalized products aimed at middle-class consumers instead of relying on a large amount of orders to meet mass-market demand.

Holding a similar opinion, Pan Jianzhong recognized that the reform will not bring any changes to his enterprise, which is already undergoing a restructuring.

"Raising the efficiency of all aspects of shoemaking is the only way to stand out amid tough competition," said Pan, manager of Juyi Group Co Ltd, a shoemaker which employs around 5,000 people in Wenzhou and produces 12 million pairs of shoes annually.

It was Pan's bold idea a decade ago to introduce a degree of automation unseen in most of the city's shoemaking factories.

Pan also shortened the workflow process and made the overall production process more efficient.

"I prefer to take the advantage of the developing economic growth in Wenzhou to extend my cooperation with international brands and increase the quality of my products," said Pan.

Pan added that private enterprises have to find their own ways to restructure.

Contact the writer at yuran@chinadaily.com.cn

(China Daily 03/28/2013 page13)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|