Food for thought in the retail business

Updated: 2013-04-01 05:46

By Li Woke (China Daily)

|

||||||||

|

An employee of Wal-Mart Stores Inc asking a man not to take a photo at a Wal-Mart outlet in Nanjing, capital city of East China's Jiangsu province. Wal-Mart said in March that it will close two stores in April after a business appraisal. One is in Wuxi city and the other is in the city where it has its China headquarters - Shenzhen. An Xin / For China Daily |

Openings and closures, faster and slower growth characterize industry

The concept of a "convenience" store jars with 55-year-old retired doctor Xu Zeng ever since her nearest one, just downstairs from her apartment in Liwan district of Guangzhou, closed.

Xu now has to walk for at least 20 minutes every morning to get a bottle of hot milk or steamed stuffed buns for breakfast.

"Store closures are common here. There is always a shop closing while another opens," said Xu with a shrug.

When she worries about her long daily walk, many foreign retailers are worrying about their business performance in the country.

Last year, the world's largest convenience store retailer, 7-Eleven, confirmed store closures in Guangzhou, capital city of South China's Guangdong province, saying it was part of a business adjustment.

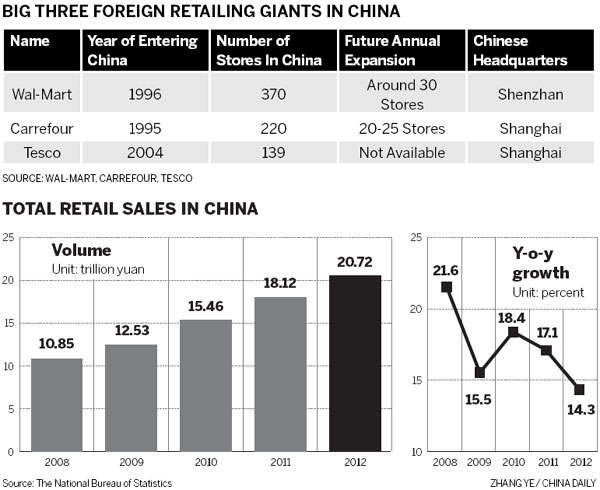

Even the world's largest retail giant by sales, Wal-Mart Stores Inc, said in March that it will close two stores in April after a business appraisal. One is in Wuxi city and the other is in the city where it has its China headquarters - Shenzhen.

In September last year, Home Depot Inc closed all seven of its remaining stores in China after years of financial losses, while Best Buy Co closed its nine outlets in the country in early 2011, after having discovered that their Western business models don't work well in an oriental culture.

In addition to store closures, foreign retailers have slowed down their expansion in the country.

Wal-Mart said it plans to open around 33 stores a year. In past years the figure was around 50.

According to Kantar Worldpanel, a London-based consumer research company, two leading retail groups, the Sun Art Retail Group and Wal-Mart, both experienced declining market share in the last quarter of 2012, with Wal-Mart seeing the most significant drop. Wal-Mart's weaker performance was driven by fewer shoppers visiting the store rather than shoppers spending less with the retailer.

"Store closures were part of the company's business adjustment, which was caused by the poor efficiency of the outlets," said a spokeswoman at 7-Eleven Shanghai.

"Store location, company strategy, business performance and other considerations combine to create a decisive factor regarding the adjustment of stores," Li Ling, senior director of public relations at Wal-Mart China, was quoted by China Business News as saying.

Industry experts said because of severe competition, store closures are common for retailers. Some may need to upgrade or die according to the company's expansion strategies and the country's gloomy economy.

Last year, China's economic expansion slowed to 7.8 percent year-on-year amid external jitters and domestic woes. Last year's figure was the slowest year of growth for China since 1999 and was down from 9.3 percent in 2011 and 10.4 percent in 2010, according to the National Bureau of Statistics.

Following the application of the economic brake, the Chinese retail industry stumbled through the year. Data from the China Chain Store & Franchise Association reveals that total sales of the top 100 large retail chains in China increased more than 20 percent year-on-year to 1.65 trillion yuan ($265 billion) in 2011, and last year's sales growth continued to decline although the figures are not available so far. The total sales in 2010 were 1.66 trillion yuan, a year-on-year increase of 21.2 percent.

Department store sales also reflected the decline in the Chinese retail industry.

Shin Kong Place, which topped sales among department stores in 2011, achieved total sales revenue of 7.3 billion yuan in 2012 with a year-on-year growth rate of 12.3 percent. In comparison, it experienced rapid sales growth from 2009 to 2011 at a rate of 30 percent.

Online rivals

Another retail giant, Guangzhou Grandbuy, saw negative net profit growth for the first time since it was publicly listed in 2007 and its annual operating revenue only slightly increased by 2.3 percent year-on-year to 7.35 billion yuan in 2012, while in 2010, the growth rate of its operating revenue was still higher than 20 percent, according to the annual financial report of the Shenzhen-listed company.

"In addition to standard economic reasons, traditional retailers have been affected greatly by online sales over recent years, especially regarding highly standardized and hard-to-carry products, such as rice, personal care items, cooking oil and beer," said Doreen Wang, head of client solutions at Millward Brown, part of WPP Plc, a British marketing communication giant.

On last year's Singles' Day, which was Nov 11, more than 100 million visitors pushed up Tmall.com's sales to 13.2 billion yuan. Sales revenue figures on this day alone were equivalent to the monthly or yearly revenue figures of other similar platforms in China.

According to a report released by China E-Commerce Research Center, an independent e-commerce research institution, the online retail market in China grew at a very rapid pace in recent years. In 2012, the transaction volume of the online retail market in China surged by 64.7 percent year-on-year to 1.32 trillion yuan. The figure will hit $27.1 billion in 2014.

Although some traditional retailers' businesses slowed down, others have maintained or increased their growth.

French Carrefour SA, the world's second largest retailer by revenue, said it will retain an expansion speed of around 20 to 25 new outlets in China every year. Carrefour announced on March 18 it had opened its first hypermarket in Inner Mongolia autonomous region to further its penetration into lower tier cities. Currently, Carrefour has 220 stores in more than 60 cities in China.

The UK's Tesco Plc is reported to be adding 16 new stores a year, almost the same as previous years.

In 2012, German Metro Group opened a record high of 12 stores, three to four times its original annual rate. The 12 new stores are mostly located in tier two and tier three cities, including Zhongshan and Shunde in Guangdong province.

"China is one of the most important focus countries for Metro Group. We were the growth leader in the industry last year thanks to our correct strategies in areas such as delivery and e-commerce," said the company.

As a modern business-to-business wholesaler, Metro China operates 64 wholesale centers in 45 cities across China, serving professional customers including hotels, restaurants, canteens, small and medium-sized retailers, companies, offices and institutions.

Chinese players

Some Chinese players also did very well last season. Yonghui Superstores Co has been emerging as the fastest-growing retailer in the industry. The Fujian-based supermarket chain said it plans to have 350 stores and 50 billion yuan in sales revenue by 2014.

According to Kantar Worldpanel, Yonghui continues to grow on an annual basis through its expansion into new provinces, allowing the retailer to reach more Chinese households. Yonghui's growth has been most impressive in Beijing where 28 percent of households have now visited the store over the last 52 weeks.

"The success of Yonghui is mainly down to our business model, focusing on the fresh products section, which occupies around 40 to 50 percent of store floorspace," said Ye Changqing, a representative of Yonghui's chairman office. "The fresh goods we are selling are directly delivered from the production bases in order to save costs."

"Compared with local retailers, foreign retailers have better logistics and management skills but they have fewer resources in regional areas," said Chu Dong, vice-secretary-general of China Chain Store and Franchise Association.

"Local retailers have great strengths by knowing what the neighborhood really needs, especially in the fresh goods sector, which can eventually win over local customers' hearts," said Millward Brown's Wang.

Chu added that this year most of the retailers, both domestic and foreign, will focus on same-store sales rather than expansion speed after considering rising labor and property costs.

"Our annual new store target - 20 to 25 stores per year - is a good balance between expansion speed and quality. If the speed is too slow, we will lose the market. If it's too fast, we may sacrifice quality," said Thierry Garnier, president and chief executive officer of Carrefour China.

"Currently, China has entered into a stable development period in the retail sector. In the future all retailers will have to look at untouched areas, such as those to the west or in the countryside," said Wang Tian, chairman of the Hunan-based Better-Life Commercial Chain Share Co.

He added the company will accelerate expansion in Jiangxi, Yunnan and Hunan provinces.

Metro said when it plans to enter a new market, it looks for cities with a good existing base and further potential to support its business model. This means it will look at the local economic development level and infrastructure, disposable income level, as well as local professional customer base including the number and scale of hotels, restaurants, canteens, offices and their market outlook.

"Retailers cannot merely rely on offering low-price goods in order to survive in the market," said Wang. "They should differentiate their markets and provide face-to-face services and lifestyle experiences for customers."

"The next three to five years will be a crucial period for China's economic transition and also a transition period from buying necessities to purchasing a comfortable or luxury lifestyle," said Jason Yu, general manager at Kantar Worldpanel China.

Garnier said: "The rapid development of China's economy and purchasing power of the citizens bring a great opportunity to retailing. Whether it's international or local retailers, their business, product quality, services and supply chain integration will expand."

liwoke@chinadaily.com.cn

|

A 7-Eleven convenience store under construction in Shanghai. As early as last year the world's largest convenience store retailer confirmed store closures in Guangzhou, saying it was part of a business adjustment. Zhang Dong / For China Daily |

(China Daily 04/01/2013 page13)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|