Global miners keen to tap Chinese market

Updated: 2013-04-08 07:59

By Du Juan in Boao, Hainan (China Daily)

|

||||||||

Global producers said they will continue to invest in China because the country's urbanization and industrialization will continue to support iron ore demand.

Fortescue Metals Group Ltd, Australia's third-biggest iron ore producer, will invest $10 billion to expand its iron ore production capacity to meet the growing demand mainly from China, said the company's CEO Neville Power on Sunday during the Boao Forum for Asia Annual Conference held in South China's Hainan province.

He said FMG will have 155 million metric tons of production capacity by the end of 2013 and up to 90 percent of the output will supply the Chinese market.

By then, the company's iron ore supply will account for about 20 percent of China's total iron ore imports.

"President Xi Jinping's remarks during the Boao Forum show that the Chinese government will continue to make efforts on economic development and improving people's living standards and we are honored to participate in the process as a supplier for such an important resource," Power said.

China's GDP growth is set to stay at 7.5 percent to 8 percent, which means the country's steel output will increase at 3 to 4 percent and it will create demand for iron ore, he said.

Sam Walsh, CEO of the world's third-largest miner Rio Tinto, shared similar views with Power.

During the China Development Forum last month, Walsh told China Daily that China's "enormous" economic base will create significant demand and Rio Tinto will continue to invest in China.

At present, a third of Rio Tinto's revenue is from the Chinese market.

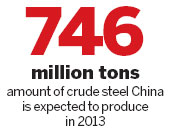

China is expected to produce 746 million tons of crude steel in 2013, 30 million tons more than last year, which will result in new iron ore demand of 50 million tons, according to figures from the National Development and Reform Commission, the country's top economic planner.

Dalian Commodity Exchange, one of the three major commodity exchanges in the country, is preparing to launch iron ore futures, hoping it can give Chinese steel companies a bigger say in iron ore prices in the international market.

FMG's iron ore business has been highly dependent on the Chinese market since it exported the first cargo of iron ore to China in 2008.

So far, it has supplied more than 200 million metric tons of iron ore in total to China.

In 2012, the company supplied iron ore to 52 Chinese steel mills with a closer cooperation relationship.

Valin Group Co in Hunan province, one of China's large steel companies, has become a major shareholder of FMG.

"The global iron ore market is monopolized by giant producers and FMG is working on breaking the monopoly by providing more choices of high-quality iron ore to Chinese customers," said Liu Xiaodong, marketing director of the company.

dujuan@chinadaily.com.cn

(China Daily 04/08/2013 page3)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|