Improving the health of the drugs industry

Updated: 2013-04-11 07:19

By Liu Jie (China Daily)

|

||||||||

|

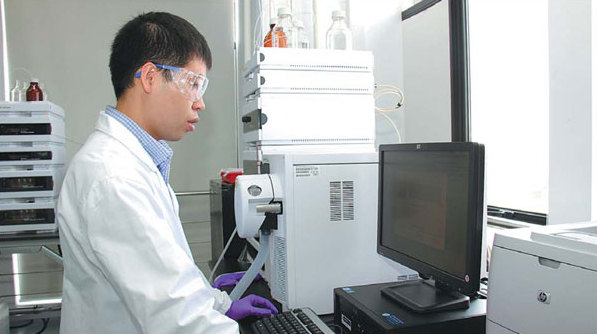

An employee at Eli Lilly and Co's China Research and Development Center. The US-based international drugmaker puts 20 percent of its sales revenue into R&D every year and set up an R&D center in Shanghai last May. Provided to China Daily |

Eli Lilly chief Lechleiter sees China as the company's most promising market

John C. Lechleiter says he loves work and believes everyone has to find his or her own right answer about a work-life balance.

"I find it's very difficult to separate them out: That is work and this is life," said the chairman, president and chief executive officer of the world's fifth-largest biopharmaceutical company Eli Lilly and Co.

With a very supportive wife, Lechleiter said he is very conscious about getting enough sleep at night and tries to get regular exercise. All of these are because, as he said: "I try to make sure that when I need to work hard, I am able to do that."

In addition to being CEO of Lilly, he also works for industrial associations - as chairman of the Pharmaceutical Research and Manufacturers of America and president of the International Federation of Pharmaceutical Manufacturers & Associations - and on the boards of many institutes, such as the Life Sciences Foundation and the Central Indiana Corporate Partnership. Taking multiple roles, none of them easy, means Lechleiter's life is full of meetings, conferences, forums and business trips.

Challenging works

Like many innovative drug producers, Lilly has faced a tough time since 2011, with patents of the company's several blockbuster drugs expiring, leading to generic drugs sold at much lower prices booming in the market. Meanwhile, the development of new medicines has not been completed. That's a crucial threat to any pharmaceutical company that relies on research and development.

"Lilly has been clear from the very beginning: We intend to invest properly in R&D and really depend on our pipeline to help resume growth after this period (of patent expiration)," said Lechleiter, adding that the drugmaker will continue to put 20 percent of its sales revenue into R&D.

He also marked up developing and emerging markets, including China, and exploring the wider potential of current products as part of a strategy to lift the company out of these hard times.

The US-based business opened Lilly Global IT innovations Lab in Dalian, Liaoning province, on March 18, to provide a secure platform for Lilly to collaborate with R&D partners and provide digital solutions for the company's various departments, not only in China but also around the world.

An R&D center, with the goal of discovering innovative diabetes medicines tailored specifically for Chinese patients, was set up in Shanghai last May.

To take a share of China's generic drugs market and explore the business potential of its patent-expired products, Lilly increased its equity position in Novast Laboratories by $20 million.

Novast is a Chinese generic and specialty pharmaceutical company based in Nantong, Jiangsu province. The move will help Lilly to increase the production capacity of its branded generics and facilitate local and regional manufacturing of its potential new medicines currently in the development stage.

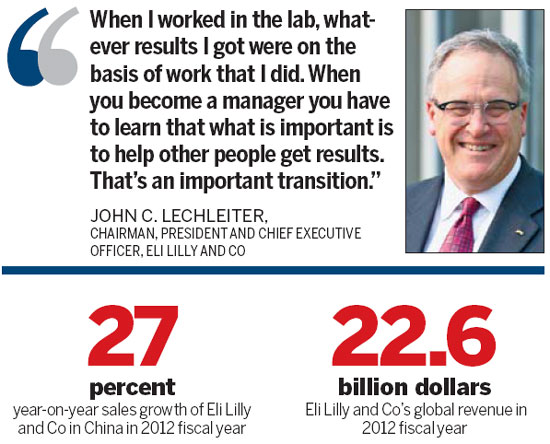

Lilly's 2012 full-year revenue declined 7 percent to $22.6 billion, mainly because of the expiration of the patent for Zyprexa, a commonly used medication to treat schizophrenia. At the same time its Chinese sales increased by 27 percent year-on-year. The company is now among the top 10 multinational drugmakers in China.

Despite good results in China, Lechleiter and executives at other international R&D-based pharmaceutical drugmakers have experienced pressure caused by fiercer competition brought on by the growth of domestic counterparts and price-cut requirements from the Chinese government.

Generic drugs account for 70 percent of China's pharmaceutical purchases. It is an area in which Chinese companies are taking the lead and the quality of their products is constantly increasing. Owing to the Chinese government's support in terms of capital and preferential policies toward domestic biopharmaceuticals' R&D efforts, the self-development capabilities of Chinese companies are increasing.

The National Development and Reform Commission has cut the maximum retail price of a large number of medicines on an essential drugs list - most of which are Western - five times since 2011 by an average of 10 to 15 percent each time. The nation's top price regulator also said that foreign companies should reduce the prices of their off-patent products, which inevitably squeezes the profit margins of drugmakers.

Lechleiter's task is not only to ensure Lilly maintains a top position in the industry but also to represent the industry in communications with the Chinese government on pricing policy formulation.

The chairman of the Pharmaceutical Research & Manufacturers of America visited Beijing last November to call for a fair and reasonable pricing system on innovative drugs under China's medical reform system.

The association represents R&D-oriented drugmakers and biotechnology companies in the United States. It says innovative drugs should be priced higher because it usually takes 10 to 15 years to develop a new medicine at a cost of $1.2 billion on average.

A McKinsey & Co report said despite the affordability of medicine being a government policy, enterprises still need to make a profit today to fund the necessary R&D for future medicines. To find a balance between the two is a challenge for the government decision-makers and the main businesses involved, it said.

"It is important that China should maintain a climate for innovation, for innovative medicines and innovative medical solutions that can be developed to improve the lives of people," said Lechleiter.

Scientific spirit

Lechleiter's devotion to innovation and his hardworking spirit may be attributed to his scientific background. Having earned a doctorate from Harvard University in the US, he joined Lilly in 1979 as a chemist and was put in a series of R&D management positions between 1982 and 1993. Even after being promoted to vice-president and then top leader of the company, Lechleiter says he still likes to visit laboratories.

"I think my background as a scientist is important in this industry in particular because it enables me to sort of understand the basic aspect of our business, which is R&D," the 60-year-old said, adding that his early-stage career as an engineer made him realize that in the pharmaceutical business, in order to get anything done, it requires excellent teamwork combined with consistency and diligence.

Moving from an engineer to a CEO is not an easy route, Lechleiter said, admitting that the greatest challenge is "you have to learn that you really get results through people".

"When I worked in the lab, whatever results I got were on the basis of work that I did. When you become a manager you have to learn that what is important is to help other people get results. That's an important transition," he said.

Now at Lilly, 13 people directly report to Lechleiter - a diversified team with lots of opinions on any subject. Thorough discussions, challenges and debates, then agreement is the usual procedure.

"Lilly is very much a consensus-driven company," he said, adding that scientific methods help him be a more effective leader in the company.

"As the new VP of corporate and government affairs for Lilly China, I have found it so encouraging to work with John (Lechleiter) during his China trip (in early March)," said Vivien Chen, vice-president of Lilly China.

During the course of one week, Chen's team organized a total of 15 meetings, both internally and externally, for the global CEO, who was able to engage all of them without much of a break in between.

"John impressed me deeply with his high level of physical energy, his love of work and his strong passion for learning about China and engaging with stakeholders. He is always very punctual for meetings," said Chen.

Lechleiter believes, despite various difficulties, China is the most promising market for Lilly.

China is now the world's third-largest pharmaceutical market and is expected to become the second-largest by 2016.

Chinese people spent $926 billion on medication last year. The compound annual growth rate of the market was more than 20 percent from 2005 to 2013 and forecast to be 12 percent by 2020, according to the Chinese Academy of Social Sciences.

Currently Lilly has 13 potential new medicines in third-phase testing and wants to launch the products at the beginning of next year. In total, it has nearly 70 compounds in various development stages.

Regarding foreign counterparts, such as Sanofi SA in the diabetes sector and Pfizer Inc in cancer treatment, Lilly has rich experience competing against them in the international market.

Lechleiter, as both company chief and industry leader, has much work to do and tasks to implement. However, he added: "In my life, perfect happiness is sitting on the terrace of our home with my wife."

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|