Fixed-asset investment up 20.9%

Updated: 2013-04-16 07:58

By Lan Lan (China Daily)

|

||||||||

|

A worker at the construction site of a flyover in Hami, the Xinjiang Uygur autonomous region, in March. First-quarter data showed investment in some industries facing overcapacity, such as construction, had declined. Cai Zengle / for China Daily |

March money supply exceeds 100 trillion yuan

China's urban fixed-asset investment fell in March but growth from the private sector was robust, indicating policies on boosting private investment have taken effect.

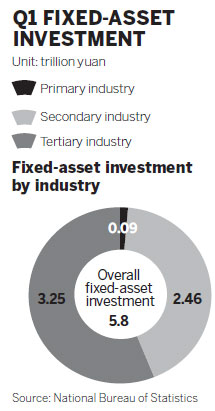

Overall fixed-asset investment, excluding rural, rose 20.9 percent year-on-year to 5.8 trillion yuan ($937 billion) in the first quarter, from 21.2 percent in the previous two months, the National Bureau of Statistics said on Monday.

Investment from the private sector rose 24.1 percent year-on-year to 3.68 trillion yuan during the quarter, accounting for 63.3 percent of the overall investment.

Last year the government launched plans to open up key sectors dominated by State-owned enterprises such as energy, banking, railway and healthcare.

Wang Wenxiang, deputy director of the Institute of Investment at the National Development and Reform Commission, said the latest data showed the policies had worked, especially in boosting the private sector.

"The growth also indicates that entrepreneurs have regained confidence in the recovery," he said.

The latest figures show there was more money available for investment this year, providing greater support for both private and public investors.

Banks made 1.06 trillion yuan of new net loans in March, up from 620 billion yuan in February.

The broad measure of money supply (M2), which covers cash in circulation and all deposits, reached 103.61 trillion yuan by the end of the month, said the central bank, the first time monthly supply has exceeded 100 trillion yuan.

Zhang Zhiwei, China chief economist at Nomura Securities Co Ltd, said although monetary policy remained loose in March, there were incipient signs that the growth momentum had slowed and more policy tightening is needed to contain the debt buildup.

Meanwhile, slower growth in urban fixed-asset investment will ease concerns over China's reliance on investment, a major contributor to the country's economic performance over the past decades.

The first-quarter data showed investment in some industries facing overcapacity had declined, such as investment in construction, coal mining and black metal smelting.

Industries encouraged by the government, such as education, culture and water projects, all enjoyed high investment in the quarter.

Analysts said the trend was in line with the economic restructuring guided by the government.

Investment will continue to rise at a reasonable pace in the long run, but boosting domestic demand remains a complicated process.

The government's new approved projects also illustrate the intention of restructuring its investment, said analysts.

In the first quarter, the National Development and Reform Commission, China's top economic planner, approved 21 construction projects, mostly energy projects involving natural gas, hydro-power and wind-power projects, with a total investment of more than 35 billion yuan in the coming years.

Investment in central government projects rose 11.6 percent in the first quarter, about 7.2 percentage points faster than the two preceding months, while the growth rate of investment in local projects was 0.9 percentage point lower than the first two months, according to the NBS.

Local governments used to unveil aggressive investment plans immediately after new leaders took office, but this year their actions were conservative, partly because local government debt has become such a serious issue, which has curbed local levels of investment, said a government economist, who declined to be named.

lanlan@chinadaily.com.cn

(China Daily 04/16/2013 page16)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|