Navigating a new growth course

Updated: 2013-04-18 05:31

By He Wei (China Daily)

|

||||||||

|

A China Eastern Airlines' aircraft at Kunming International Airport. The carrier's revenue rose to 85.6 billion yuan ($13.8 billion) last year. Provided to China Daily |

Carriers must look at multiple, diversified platforms to stay afloat, says top executive

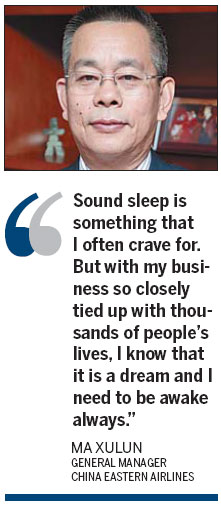

"You can choose anything but aviation as your career choice" are not the words you would normally associate with an aviation industry expert. But Ma Xulun, general manager of China Eastern Airlines Co Ltd, seems more than justified when he makes this remark after more than two decades of service in an industry that has often been buffeted by severe bouts of turbulence.

During his long stint, which included time at China's flagship carrier, Air China Ltd, as president, Ma has seen many ups and downs in the aviation business, especially due to global upheaval.

"It is the stress that really takes its toll," 49-year-old Ma said, pointing to his fast-graying hair, in what is essentially a "high risk, high cost, but low return" job.

"Sound sleep is something that I often crave. But with my business so closely tied up with thousands of people's lives, I know that it is a dream and I need to be awake always," he said.

Ma's fears are not unfounded. The global aviation industry has been going through its worst phase, with sluggish demand and high fuel costs severely denting profit margins.

The airlines sector managed to eke out a meager 1 percent growth in profit last year, according to the International Air Transport Association.

However, China Eastern has managed to buck the global trend. Not only is it working above the global average, but managed to clock revenues of 85.6 billion yuan ($13.8 billion), and profit of 3.43 billion yuan last year. The company's revenue and profit in 2011 was 83.97 billion yuan and 3.6 billion yuan respectively. Much of the credit for the carrier's success can be attributed to the hands-on and deft approach pioneered by Ma.

That, however, was not the case five years ago when Ma joined China Eastern. It was the worst possible time for someone to take the helm of a sinking ship. The carrier was reeling from a financial crisis after its debt-to-asset ratio hit a historic high of 115 percent.

"There was severe turbulence and churn in the aviation industry during those days. There were three major hurdles in the form of high oil prices, negative growth in cargo business, and the stagnant global economy, especially in Europe," he said.

Ma said that the first priority for China Eastern was to reduce its huge debts. "We took several steps like market borrowings, capital injection from government and enhancing profits," he said.

In 2009, the carrier also undertook a painful restructuring by merging with the then cross-town competitor Shanghai Airlines, in a bid to optimize assets and trim debt.

Despite all the efforts, Ma still found it hard to find other sources of income. It was then that he started the campaign to expand China Eastern's overseas routes.

That seems to have more than paid off as more than 47 percent of the airline's revenue now comes from international business, though as Ma admits a still higher percentage is required to gain a global reputation.

"Our vision is to build China Eastern into a world-class airline. We want to realize this goal by fully leveraging on Shanghai's geographic advantage as a transportation hub," he said.

Ma has already sensed an opportunity. From this year, Shanghai has allowed transit passengers from 45 countries to stay in the city for 72 hours without a visa.

According to Ma, the policy, together with the fast integration of the Yangtze River Delta region, will combine to help the Shanghai-based carrier cement its reputation as a major international airline.

Therefore, it is vital for China Eastern to develop more regional tourism products, order more medium- and long-range aircraft, and broaden its overseas sales network to attract more foreign passengers, he said.

Yet another option for the future is to give Shanghai's stereotype as a business-only destination a makeover into a place for leisure travel, he said.

In 2012, more than 1.59 million transfer passengers traveled through Pudong Airport, up 17 percent from a year earlier, according to the company's website. International transit accounted for 88.4 percent of all the transfers, it said. "The high transition rate used to be a largely neglected figure. But we need to revitalize all transfer passengers and bring the visa-free policy into full play," he said.

He cited the example of Hong Kong, whose international airport boasts an annual 2.7 million transit passengers who spend HK$5,000 ($645) on average during their stay. That will effectively stimulate the local economy and boost the city's status as an international hub, Ma said.

But he noted that the scope and depth of the current policy has put a lid on the market potential. Seoul, for example, permits a visa-free stay of 30 days to six months to visitors from 107 nations.

China Eastern is also poised to operate more long-range flights. It has ordered 51 Airbus A330 jet airliners and 20 Boeing 777 airplanes recently for medium- to long-distance travel.

The carrier has also diversified its flight portfolio by embracing new destinations such as Rome, Hawaii and Maldives, and plans its first flight from Shanghai to San Francisco later this month. It has also increased the density of existing routes such as Shanghai to Paris and Shanghai to New York.

China Eastern is also overhauling its overseas sales team by recruiting more seasoned, local personnel. It is essential to cash in on first and business class fares, Ma noted.

"We used to rely on word-of-mouth among overseas Chinese to promote our foreign destinations. Such thinking is outdated and we need to extend our networks to local people," he said.

Currently, the carrier has inked deals with more than 50 corporate clients for first-class and business-class arrangements, which net the most profit in cross-border flights.

He said occupancy rates in these two classes have soared to 70 percent on certain routes such as Shanghai to Frankfurt and Shanghai to Hawaii. A majority of passengers in first class or business class on these flights are foreigners.

"Travelers tend to choose their country's own airlines when taking international flights. Therefore, we need to show what added value we are able to offer."

Backed by dominant market shares in the city's two international airports, with 40 percent at Shanghai Pudong International Airport and more than 50 percent at Shanghai Hongqiao International Airport, China Eastern has counted on diverse intercity travel packages to attract more foreign customers.

While the opening of the high-speed railway in 2010 dealt a heavy blow to the domestic flight market, China Eastern managed to stay afloat by exploring new opportunities.

Last year, it entered into an agreement with the Shanghai Railway Bureau to sell combined air-railway tickets connecting 13 cities that cost less than they would if bought separately. Ma said about 30,000 passengers have benefited from this in the past six months. His goal is to lift this figure to 1,000 passengers per day by 2015.

Ma's other endeavor is to test the budget airlines sector. The partnership with Qantas Group, Australia's national carrier, to run low-cost carrier Jetstar in Hong Kong, is designed to pave the way for the much-neglected low-cost airline market on the mainland.

Being the only national carrier to enter the low-cost segment, China Eastern has its own reasoning. Ma foresaw a surge in domestic travel once GDP per capita reaches $3,000, and that making travel more affordable has been a long-held vision for the carrier.

"Cheap airlines account for up to 30 percent of the European aviation market, but in China it is just beginning to flourish," he said.

Ma said he and his Australian partners have been mulling the expansion since the start of the negotiations. The extension to the mainland may come sometime within three years, around the point at which Ma expects Jetstar Hong Kong to become profitable.

The business may also help lower the debt-to-asset ratio to around 70 percent by the end of 2015 from the current 79 percent.

Like most successful businessmen, Ma has few hobbies apart from his fully packed schedule. One thing he really enjoys is to play chess, and he often encourages his top executives to join him for a game. "The great thing about playing chess is strategic thinking. You need to stay far-sighted, hedge potential risks and act in advance. It is exactly the same as doing business. "

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|