Property prices are still rising

Updated: 2013-05-03 07:34

By Hu Yuanyuan (China Daily)

|

||||||||

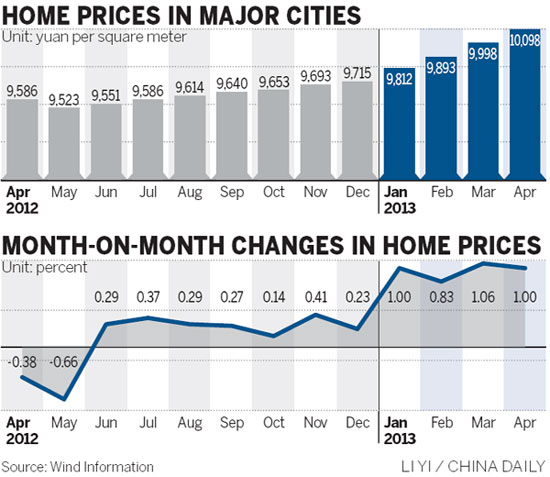

New homes in 100 cities cost $1,600 per square meter on average in April

Property prices in China's major cities rose for the 11th consecutive month in April, according to a report, but the growth rate slowed down slightly as the government's latest tightening policies gradually kicked in.

Figures released on Thursday by China Index Academy, a Beijing-based real estate research institute, showed the average price of new homes in 100 cities monitored was 10,098 yuan ($1,600) per square meter during April, up 1 percent over the previous month.

The month-on-month growth rate, according to the academy's figures, is down 0.06 percentage point from March.

A total of 76 cities saw price increases on a monthly basis in April, compared with 84 in March.

On a yearly basis, the growth was 5.34 percent last month, compared with a 3.9 percent year-on-year increase in March. It was the fifth time that the 100 cities saw a price hike on a year-on-year basis, with the growth rate further accelerating.

The average house price in key cities, including Beijing and Shanghai, was 17,023 yuan per sq m, an increase of 1.31 percent from the previous month and up 7.89 percent over the same period last year, still indicating an accelerating price growth rate.

"In key cities and some second-tier cities, there is still pressure for a further price hike as the demand-supply imbalance has not improved yet," said Huang Yu, the academy's vice-president.

But such a situation may change soon, as the latest tightening policies, especially the pricing limitation policy in Beijing and Guangzhou, begin to work, industry analysts said.

Max Chen, a senior manager of residential sales at international property agency Savills, said the price restriction policy in Beijing has already weighed on property developers in the capital city.

Among Beijing's detailed regulations following the introduction of the State Council's measures to cool the real estate market, the municipal government will not grant sales licenses to projects priced "much higher" than the average rate in the region.

So far, a number of real estate projects in the capital have failed to get sales licenses after planned sales prices were deemed to be much higher than previous projects or average prices in the region.

"I believe property developers can survive the capital pressure for around six months. If there are more rigorous measures rolled out during the period, such as a further hike in mortgage rates for second-home buyers and the levy of a property tax, then they will have a really difficult time," said Chen.

Chen said prices have to be stabilized over the coming months, given the pricing restriction policies, though property developers are striving to figure out ways to dodge the rules.

He Meng, a marketing director at Maoyuan Real Estate Co, said the latest tightening policies have had limited impact on high-end projects.

"Wealthy buyers can handle further increases in down payments," said He.

A recent Chinese homebuyers' confidence index, compiled by real estate consultancy company WorldUnion Properties, posted the first decline since the fourth quarter of 2011.

The index stood at 56.8 in the first three months of 2013, down 0.2 percentage point on the previous quarter.

Despite the government's latest rigorous measures to cool the market, more than 70 percent of buyers still forecast further price hikes, a record-high level.

"That is because most of the detailed regulations from local governments are weaker than expected," said Liu Chunyan, general manager of Beijing WorldUnion.

But the number of homebuyers planning to purchase an apartment in the coming three to six months dropped.

Around 40 percent of those surveyed said they wanted to postpone their home purchase plans, and 14.5 percent of buyers said they planned to bring forward their purchases, the report showed.

huyuanyuan@chinadaily.com.cn

(China Daily 05/03/2013 page13)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|