Making medical technology more accessible

Updated: 2013-05-09 06:02

By Liu Jie (China Daily)

|

||||||||

|

Medtronic Inc's booth at an international medical device exhibition in Beijing. Revenue of the US-based company reached $16.2 billion in the fiscal year 2012, of which 10 percent was from emerging markets, including China. Provided to China Daily |

Medtronic's chief executive officer presents his vision for growth in the Chinese marketplace

Omar Ishrak is a typical businessman - he loves to speak methodically and systematically, drawing on numbers and facts.

During his first meeting with the Chinese media, the chairman and chief executive officer of Medtronic Inc said his company intends to continue to grow at 20 percent or 25 percent a year in China in the future.

The US-based medical technology business operates in more than 120 countries. Global revenue was $16.2 billion in the fiscal year 2012, of which 55 percent was from the United States and only 10 percent from emerging markets, including China.

"There are three universal healthcare needs defined by us and we will buttonhole two unique strategies (to deal with them)," said Ishrak, who took up his current position in June 2011 from GE Healthcare, where he was president and chief executive officer.

The professional manager summarized the three needs as improving clinical outcomes, expanding access and providing cost-effective therapies and solutions. The consequence is the generation of economic value and globalization are set to be two key developing strategies of Medtronic in the coming years.

Ishrak presented himself in a clear, brief and solid manner, in the same fashion in which he conducts his work - in a straight, ambitious, aggressive and object-targeted fashion.

Aggressive moves

Under his leadership, Medtronic spent nearly $900 million in just one month last year on two merger and acquisition deals in China, making a record in transaction volume not only in terms of foreigners' M&A in China but also in the medical device industry in 2012. It was an aggressive step for a healthcare company to advance its globalization and expand its local presence and accelerate access and competencies in China.

Medtronic completed the acquisition of China Kanghui Holdings, a Jiangsu-based orthopedic devices manufacturer, for $816 million in cash in early October last year. In mid-September it announced the purchase of a 19 percent initial equity investment in Shenzhen-based LifeTech Scientific Corp, a cardiology invasive intervention device provider, for $46.6 million and a $19.6 million convertible note representing an additional 7.4 percent equity.

Ishrak said the primary M&A focus in China is to get low-cost access customizing for the unique needs of Chinese patients. "Secondarily, we think they (M&As) can be used as an export base out of China into other emerging markets," he added.

A sharpened focus on globalization is something new that Ishrak brought to Medtronic as its new chief nearly two years ago.

"I think globalization is not an option. It's a must (for Medtronic)," he repeated several times. "It doesn't matter whether you know us. It doesn't matter how uncomfortable it would be in a different environment. It doesn't matter what risks you might have to take."

Medtronic invented the pacemaker for people with heart problems. Its business now has been expanded in cardiology, diabetes and therapies, which include orthopedics, neurology as well as other surgical tools.

Unlike the strategies of other medical device providers in emerging markets - such as the development of cheaper products - the initial focus of Medtronic's globalization is to provide its current therapies to people who can already afford them. The company estimates the strategy is worth $5 billion a year in opportunities.

According to Ishrak, about 20 percent of the population can afford Medtronic's technologies today and, of that 20 percent, only 8 percent are actually benefiting from them.

"We'll drive that business by also investing not just in technology but in investing and creating patient-awareness, in referring physician-awareness, in physician training. And we think we will get an immediate payback," said the company leader.

At the same time, Medtronic plans to lower the price of its products so that it can address the other 80 percent of the population who currently cannot afford the technologies. It needs time, because of the need for research and development, and money, which can be obtained from the profits obtained through its current therapies.

Medtronic's globalization is closely linked with the generation of economic value, with medical cost-cutting at the top of the agenda for all economies around the world. Economic value means in addition to improved clinical value and better patient care, the therapies adopted will help reduce the overall costs of healthcare. That development requires new technologies and solutions.

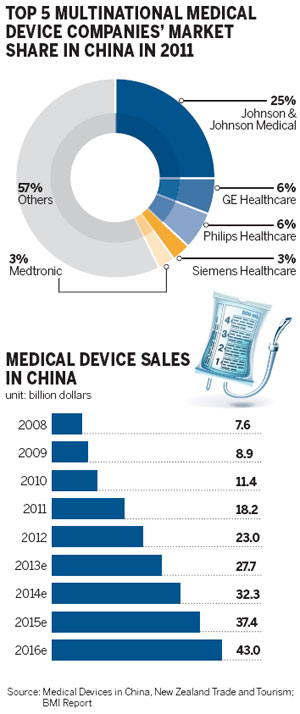

China is a very important market for all medical equipment providers, including Medtronic. China's healthcare expenditure reached $330 billion in 2011 and is expected to exceed $1 trillion by 2020, making the nation the world's second-largest healthcare market, according to a report conducted by the Chinese Academy of Social Sciences. The annual growth rate of China's medical equipment industry is forecast to be more than 20 percent in the coming five to 10 years, said the Ministry of Industry and Information.

Demand for new technology and the huge potential of the market have attracted a series of international medical device providers to set up R&D facilities in China, a move to further cater to local needs.

Medtronic opened an innovation center in Shanghai last September, enabling the company to hire local engineers as well as bringing them in from other countries to bring technology to China. The facility will create products geared primarily to the Chinese market as well as other emerging markets in the future.

Boston Scientific Co, an international developer, manufacturer and marketer of interventional medical devices and solutions, is a competitor of Medtronic. It is opening a new complex composed of a research and development center, training center and head office in Shanghai in September.

GE Healthcare, the medical arm of General Electric Co, set up an innovation center in Chengdu. It is to cooperate with local clients to co-develop tailored products for Chinese patients as well as support its global R&D work for emerging markets.

"Whether they are targeting local demand or the global market, they are concentrating on high-quality, affordable and patient-tailored technologies and solutions. It's a trend globally," said Cai Tianzhi, medical equipment department director of China Chamber of Commerce for the Import and Export of Medicines and Health Products.

Career development

Before joining Medtronic, Ishrak worked for GE for 16 years. As senior vice-president of the group and president and CEO of GE Healthcare, he was one of the decision-makers of the multinational's development framework.

A former member of his staff said he was nice but tough. "Omar is open-minded and kind but, when he makes a decision, he requires the staff to implement it vigorously, promptly and assuredly," he said.

As a Bangladeshi, Ishrak admitted he was lucky to become top executive of a US-based multinational.

"You need to do everything you can to accelerate what you do. Then you have to have the good fortune of someone lending you a hand. I had the good fortune that first Jack Welch and then Jeff (Immelt) put their hands up and took a chance with me," said Ishrak. "I have to deliver and produce the results."

At GE Ishrak led the group's ultrasound division, achieving an annual double-digit growth rate since 1995 and reaching sales of $1.8 billion in 2010 from $400 million in 1998. His technology leadership and business acumen helped GE's clinical systems business obtain revenue growth of more than 40 percent and operating margins to increase 110 percent between 2004 and 2009. "Medtronic is a company grounded in the US. It wasn't easy for the board to take a chance on someone like me. Obviously I see the opportunities and produce the results," he said. "To achieve that, it's a matter of learning, hard work and having some basic values which, generally speaking, many Asians possess."

The conscientious and hard-working executive said that, from a business perspective, to be a minority running a multinational in the US was not too big a deal. "But at the same time, I do bring a more natural understanding of Asia, of the developing world, and I can bridge it with thinking in a Western environment," he said.

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|