Producer prices still declining

Updated: 2013-05-10 07:04

By Chen Jia in Beijing and Yu Ran in Shanghai (China Daily)

|

||||||||

Index fall indicates lingering weak market demand and slow recovery

Producer prices - a barometer of future inflation - continued to decline in China in April, pointing to lingering weak market demand and a tepid recovery in the world's second-largest economy.

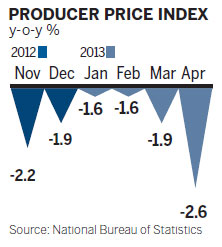

The Producer Price Index, which measures wholesale inflation, fell by 2.6 percent year-on-year in April, the National Bureau of Statistics said on Thursday.

The drop exceeded the 2.2 percent market forecast and follows a trend of declines, which suggests continued weak market demand.

The decline, which decreased by 0.6 percent from March, marked the 14th straight month of falls after the PPI dropped in March 2012 for the first time since December 2009.

"It suggested excess supply of industrial products while market demand is sluggish," said Lu Zhengwei, chief economist at Industrial Bank.

The Consumer Price Index, a main gauge of inflation, rose 2.4 percent in April from a year earlier, compared with 2.1 percent growth in March, the bureau said.

A statement from the bureau said, "The fast increase of vegetable prices was the main factor that fueled consumer inflation."

Food prices rose by 4 percent year-on-year, contributing 1.33 percentage points to April's CPI.

China has set an inflation target for this year of 3.5 percent, higher than the inflation rate for 2012 of 2.6 percent.

Liu Ligang, chief economist for Greater China at ANZ Bank, said that given weak growth activity and relatively subdued inflation, China may lean toward looser monetary policies to keep liquidity flowing to nurture the recovery, while proceeding with structural reforms to sustain long-term growth.

There is an increasing possibility of an interest rate cut later this year, he said.

But Lian Ping, an economist at Bank of Communications, said such a radical move is unlikely, as current liquidity is sufficient to support growth, and further significant easing may once again fan property prices.

Besides, the central bank's sale of 10 billion yuan ($1.6 billion) of three-month bills on Thursday dampened the possibility of a rate cut, he added.

Luo Gang, chairman of Shanghai Ruinian Fine Chemical Industry Co, said: "A majority of chemical product suppliers have stopped increasing inventory since the middle of 2012, as demand from both overseas and the domestic market is expected to become saturated.

"Large enterprises have sufficient funds to upgrade products following the economic restructuring requirement from the central government. Small businesses like ours feel a heavy burden and can only wait for a recovery."

The PPI decrease is in line with the weaker manufacturing Purchasing Managers' Index, which stood at 50.6 in April, down from 50.9 in March, showing a modest expansion in the industrial sector.

Baoshan Iron & Steel, China's biggest steelmaker listed on the Shanghai Stock Exchange, said on Thursday it will cut its main steel product prices for June bookings, the first price fall after nine months, saying it is worried about future orders.

Wu Jile, manager of a steel producing company in Shanghai, which did not want to be named, said: "The government's tightening of infrastructure construction credit has lagged the start of new projects, which directly cuts the demand for raw materials, especially for steel." An effective solution is to encourage mergers and acquisitions in the industry where there is excessive production capacity, to improve market concentration and competitiveness, Wu added.

Instead of fast expansion, the government has vowed to focus more on growth quality, settling the structural reform budget for the year on Monday and highlighting 11 areas, including fiscal, financial and social welfare systems.

Pan Jiancheng, deputy director-general at the China Economic Monitoring and Analysis Center under the NBS, said the earlier rapid growth of investment caused excessive production capacity, especially in heavy industry.

"The moderate slowdown can benefit the long-term development, and reduce pressures on resources and the environment," he said.

Wolfhart Hauser, chief executive officer of Intertek Group, a global quality and safety service provider for industrial and consumption goods producers, with headquarters in London, said: "China is changing. That doesn't mean there will be less production, but it will move to a higher quality level.

"The trend is in line with economic development, and a lot more companies from China will develop good brand names based on quality and technological innovation."

On Thursday, Barclays Capital lowered the full-year CPI inflation forecast to 3 percent from 3.2 percent, in view of lower-than-expected food inflation and subdued nonfood prices.

"We think the current accommodative monetary and financing conditions will be maintained, considering the softer-than-expected domestic and global growth recovery," a report from Barclays Capital said. "But moderate food inflation and falling global commodity prices have allowed the People's Bank of China to be more flexible."

The report warned that the government should prevent a further rise in fiscal and financial risks, and prevent asset bubbles.

Zhu Haibin, chief economist at JPMorgan in China, predicted that the central bank is likely to maintain the current interest rates and reserve requirement ratio this year.

"The key adjustment of the monetary policy is to manage liquidity in the financial system," Zhu said.

The People's Bank of China, the central bank, said in its quarterly report on Thursday, "The fundamental of Chinese economic growth in the long term doesn't change, and it will maintain stable development supported by macroeconomic policies and structural reform measures."

Policies should be proactive to stabilize inflation expectations, as prices may rebound rapidly when demand expands, the report said.

The PBOC decided to maintain a prudent monetary policy, to balance economic growth, control inflation and prevent systemic financial risk.

Policy will focus on improving growth quality and efficiency, and guiding moderate credit growth, it said.

Contact the writers at chenjia1@chinadaily.com.cn and yuran@chinadaily.com.cn

Xinhua contributed to this story.

(China Daily 05/10/2013 page1)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|