E-commerce giants brace for fierce competition

Updated: 2013-05-15 05:30

By Li Woke and Gao Yuan (China Daily)

|

||||||||

|

A customer at a Li Ning store in Shenyang, Liaoning province. Provided to China Daily |

Chinese e-commerce giants are getting ready for a new round of cutthroat competition after business-to-customer website Dangdang Inc launched a promotional campaign offering discounts as high as 90 percent in some clothing items.

Industry insiders said that Dangdang's move is an attempt to reduce the high inventory levels in the garment industry.

For instance, Li Ning Co Ltd's T-shirts are being sold at 19 yuan ($3.09) each, around 80 percent off, according to the website.

Before Dangdang's move, Guangzhou-based Vipshop Holdings Ltd was the dominant player in China's discount shopping sector. But now other websites, including Tmall, Vancl and JD, are also preparing to follow Dangdang and launch similar online promotional campaigns.

"The websites are willing to try out different promotional models to boost turnover," said Zhang Jing, an analyst with iResearch Consulting.

However, reducing prices is not the companies' only strategy.

"E-commerce companies are also shifting their focus from price wars to other areas in a bid to lift product quality and lure more high-end buyers," Zhang added.

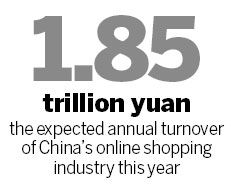

The annual turnover of China's online shopping industry could hit 1.85 trillion yuan this year, an increase of about 40 percent year-on-year, iResearch data showed.

"The whirlwind romance of apparel companies and e-commerce websites is a good idea for decreasing inventory, due to the relatively lower costs and larger sales volumes of online businesses," said Peking Tan, R&D director for Greater China with MillwardBrown, a major research agency. "But large-discount campaigns will also damage brand images that the companies may have cultivated for years."

Li Ning and other Chinese sportswear companies have recently been hit by cash shortages and high stock levels.

During the first quarter of the year, Peak Sport Products Co Ltd closed 125 stores to save costs and bring down inventories, while in the fourth quarter of 2012, 361 Degrees International Ltd closed 96 retail branches.

Last December, Li Ning warned of a substantial loss of $228 million due to a plan to buy back inventory from its distributors.

The inventories of Chinese clothing companies were worth 256.97 billion yuan in the first three quarters of 2012, figures from the National Bureau of Statistics showed.

HSBC Holdings PLC estimates that Li Ning has excess inventory worth about 1.65 billion yuan that could take 11 months to clear, while Anta Sports Products Ltd's inventory is worth about 3.12 billion yuan, which is expected to take about 10 months to clear.

Experts attribute the high inventory levels to the industry's over-expansion since the 2008 Beijing Olympics.

"Inflated stock levels are the thorniest problem faced by local sportswear players," said Tan.

He added that the shrinking business is due to the decreasing number of young consumers in China, the industry's main target.

"The number of Chinese people aged from 15 to 25 will drop around 30 percent in the next 10 years, which will be a catastrophe to the sportswear industry, including local and foreign companies," Tan said.

Other industry insiders also hold a gloomy view.

"Although the domestic apparel industry is showing some good signs of decreasing stock levels since last year, the situation is still grim, as the market and the industry are both suffering from a slowdown after the previous high-speed expansion period," said Wang Zhuo, secretary-general of the China National Garment Association.

Contact the writers at liwoke@chinadaily.com.cn and gaoyuan@chinadaily.com.cn

(China Daily 05/15/2013 page16)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|