News in review Friday, May 10 to Thursday, May 16

Updated: 2013-05-17 11:40

(China Daily)

|

||||||||

Friday____________________ May 10

Coke to offer low-calorie drinks

The Coca-Cola Company, responding to a trend in China that has seen healthy drinks take a larger share of the market over carbonated beverages, will offer low or no-calorie beverages in every market.

Ahmet Bozer, president of Coca-Cola International, said the low or no-calorie beverages are part of the company's global pledge to help fight obesity in more than 200 countries. The company also will support physical activity programs and not advertise to children under 12. The China Industrial Information Issuing Center report found carbonated beverages' market share reduced to 21.91 percent compared with water's 25.7 percent and juice's 22.24 percent. Carbonated beverages had a 36 percent share in 2000.

Coca-Cola's first-quarter sales in China this year grew just 1 percent due to bad weather and the economic slowdown. (Photo 1)

Producer prices decline in April

Producer prices - a barometer of future inflation - continued to decline in China in April, pointing to continued weak market demand and a tepid recovery in the world's second-largest economy.

The Producer Price Index, which measures wholesale inflation, fell by 2.6 percent year-on-year in April, the National Bureau of Statistics said. The drop exceeded the 2.2 percent market forecast and follows a trend of declines.

The Consumer Price Index, a main gauge of inflation, rose 2.4 percent in April from a year earlier, compared with 2.1 percent growth in March, the bureau said. "The fast increase of vegetable prices was the main factor that fueled consumer inflation," according to the bureau.

Monday_____________________ May 13

Django Unchained is re-released

Film director Quentin Tarantino's violent anti-slavery saga Django Unchained returned to China's screens three minutes shorter and without nudity scenes.

The movie was pulled from the country's theaters on April 11, its opening day in China, by the movie's importer, China Film Group Corp.

Some "minor changes" have been made to the returned film, according to Shanghai's UME Cineplex. It is reported that the new edition is three minutes shorter than the previous one, with nudity scenes omitted.

The then 165-minute film was expected to reap "a conservative 60 million yuan ($9.8 million) in ticket sales" during its April debut.

April fiscal revenue increases 6.1%

China's fiscal revenue grew 6.1 percent year on year to 1.14 trillion yuan ($183.66 billion) in April, according to official data.

The growth rate stayed at the same level as that recorded in March, the Ministry of Finance said in a statement posted on its website.

The central government's fiscal revenue declined by 2.2 percent year on year to 535.7 billion yuan due to the slight growth of corporate income tax, a decline in import-related taxes, as well as the high base number of last April, the statement said.

In the first four months of 2013, the country's fiscal revenue expanded by 6.7 percent from a year earlier to 4.35 trillion yuan. The pace was 5.8 percentage points lower than the same period of last year, the ministry said.

Tuesday____________________ May 14

Foreign investment rules are simplified

China has simplified regulations on foreign direct investment, dropping a total of 24 regulations.

The abolishment of the regulations, including rules on renminbi reinvestment by foreign companies, makes the rules for administration of FDI funds "simpler, standardized and systematic", according to a statement from the State Administration of Foreign Exchange, or SAFE, China's foreign exchange regulator.

"The abolished regulations were not in line with China's economic development and were the target of complaints from overseas investors," said Lu Jinyong, director of the China Research Center for FDI at the University of International Business and Economics. "The changes will improve the FDI environment and facilitate the business operations of foreign companies."

Real estate investment picks up

Real estate investment quickened in the first four months of the year, but property sales growth dipped slightly due to the government's latest round of policy tightening.

Property investment, which affects more than 40 industries ranging from steel to furniture, increased 21.1 percent year-on-year from January to April, up 0.9 percentage points on the first quarter, the National Bureau of Statistics said.

"The improvement was probably as a result of the still robust housing sales," said Yao Wei, China economist with Societe Generale SA.

"The tightening measures seem slow to bite, which may allow developers to contribute some more strength in the second quarter."

Construction of new homes rose 1.9 percent in the first four months of 2013, up from a decline of 2.7 percent in the first quarter, according to the NBS.

Wednesday

____________________ May 15China may be top rice importer

China, the world's largest rice consumer, is expected to become the largest rice importer this year, according to a new report.

Rice imports this year will surge to 3 million metric tons from 2.34 million tons a year ago, according to the report by the United States Department of Agriculture.

If the forecast is correct, it would represent a sharp increase as the country's rice imports hovered around 450,000 tons per year over the five-year period that ended in 2011, official data showed.

Analysts said that the country has no shortage of rice supplies and blamed the expected import surge on the price discrepancy between domestic and global markets. The discrepancy is a result of the government's minimum grain purchase price, which aims to shore up domestic grain prices after they declined in the global market due to weak demand and increased rice yields in recent years, analysts added.

Shanghai will have free trade zone

A 10-year plan for Pudong, or the eastern part of Shanghai, will establish a new economic order with its own set of rules for commerce and finance, the first of its kind in China.

The Shanghai free trade zone, as it is temporarily called, was approved this week and will be submitted to the State Council later this month for official approval. The project is expected to start in the second half of this year at the earliest.

The plan covers 28 square kilometers, including Waigaoqiao Free Trade Zone, Yangshan Free Trade Port Area and Pudong Airport Comprehensive Free Trade Zone. The area is almost the size of Macao, and its trade volume topped $100 billion last year, the highest on the mainland.

Thursday_________________ May 16

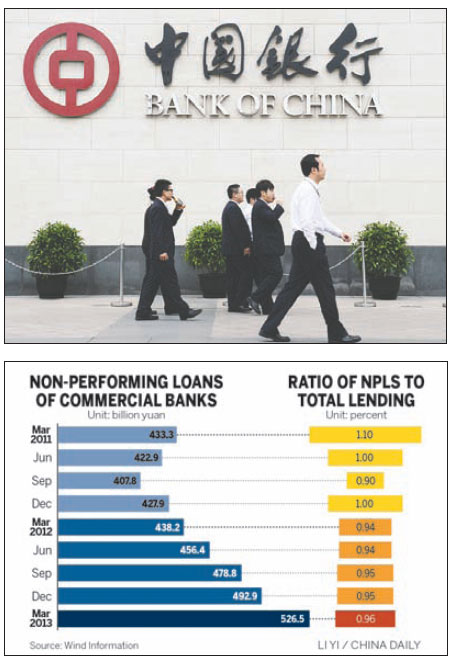

Banks' bad loans at highest level in four years

Bad loans held by Chinese banks reached their highest level in four years by the end of March, while lenders' total assets rose by 17 percent, according to the China Banking Regulatory Commission.

Outstanding non-performing loans, or NPLs, stood at 526.5 billion yuan ($85.67 billion), up by 33.6 billion yuan from the end of 2012. The ratio of bad loans to total lending rose by 0.01 percentage point to 0.96 percent, during the first quarter of the year.

Total assets of the banking sector stood at 141.3 trillion yuan, meaning total banking assets have increased by 113.6 trillion yuan, or fivefold, in the past decade.

The soured-loan increases were reported across all categories, including State-owned lenders, joint stock banks and regional banks in cities and rural areas.

Airlines to get Boeing 787 Dreamliners

Chinese airlines will get several Boeing 787 Dreamliners before June, as Boeing Co resumes deliveries of the jetliners, Boeing China's president said.

China Southern Airlines Co Ltd and Hainan Airlines Co Ltd will be the first Chinese customers to get 787 Dreamliners, Marc Allen said.

The Dreamliner's airworthiness certification in China is in its phase-out period now, he added.

All 50 flying Dreamliners were grounded in January after two incidents on Japanese jetliners in which a battery overheated. (Photo 2)

|

An investigation is under way into what caused the deflating of Rubber Duck, the inflatable sculpture by Dutch conceptual artist Florentijn Hofman, shown above in Hong Kong's Victoria Harbor. The 16.5-meter sculpture, which made its first public appearance in the territory on May 2, was scheduled to stay at Ocean Terminal for a month. Photo / Agencies |

(China Daily 05/17/2013 page8)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|