Debts threaten businesses

Updated: 2013-05-27 05:34

By Hu Yuanyuan (China Daily)

|

||||||||

|

In China, although the central government tried to loosen its credit policy, most loans made were actually provided to large companies or State-owned enterprises. Small and medium-sized enterprises are increasingly turning to the informal credit system, which applies usurious rates. There is a strong sign of the deterioration of the payment situation, according to a survey from global credit insurance group Coface. Provided to China Daily |

Customers' financial difficulties main reason for bleak situation

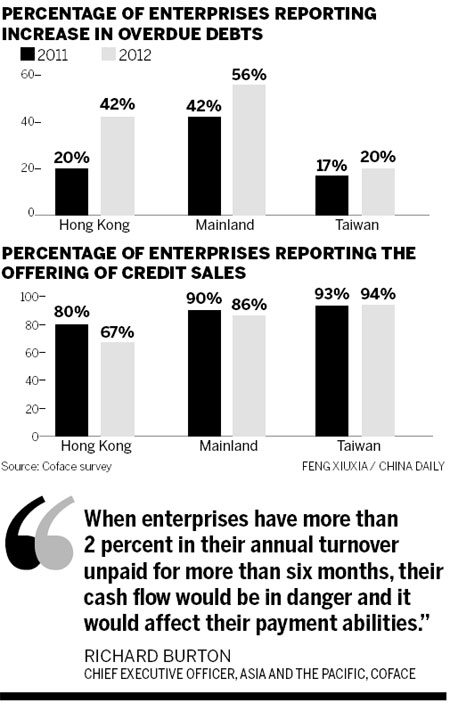

Chinese enterprises, including those from Hong Kong and Taiwan, are being exposed to higher credit risks as evidenced by sharply increased overdue debts, a survey from global credit insurance group Coface showed.

According to the survey, 42 percent and 56 percent of interviewed enterprises from Hong Kong and the Chinese mainland respectively indicated an increase in overdue money while only about 20 percent and 42 percent of them respectively reported the same in 2011.

This reflected a deterioration in good business practice. Moreover, the percentage of interviewed Hong Kong enterprises reporting more than 2 percent of their annual turnover had been overdue for more than six months increased from 34 percent in 2011 to 49 percent in 2012. On the mainland, enterprises reported the same situation increased from 31 percent to 36 percent in 2012, according to the survey.

"When enterprises have more than 2 percent in their annual turnover unpaid for more than six months, their cash flow would be in danger and it would affect their payment abilities," said Richard Burton, chief executive officer of Coface for Asia and the Pacific.

It is a strong sign of the deterioration of the payment situation. Hong Kong and mainland enterprises should pay more attention to the timeliness of payment by their buyers, Burton added.

Customers' financial difficulties are still the main reason behind overdue debts, the survey showed. More than 65 percent of Chinese enterprises reported fierce competition affecting margins caused financial difficulties for buyers.

The prolonged economic downturn of the United States and Europe affected the purchasing power of these markets, which further intensified competition.

On the other hand, more than 30 percent of Hong Kong enterprises mentioned the rising prices of raw materials as the second reason causing financial difficulties for buyers. The continuous appreciation of the yuan has led to the rise in the cost of raw materials and labor for Hong Kong enterprises, which further erodes profit margins.

Enterprises on the mainland, Hong Kong and Taiwan also said their buyers had difficulties in financing their operations.

"In view of the uncertainty of the global economy, banks and financial institutions are more cautious in granting financing to companies, especially to small and medium-sized enterprises," said Burton.

In the mainland, although the central government tried to loosen its credit policy, most of the loans were provided to large companies or State-owned enterprises. SMEs are increasingly turning to the informal credit system, which applies usurious rates.

"In the context of sluggish external demand, these SMEs, which account for 68 percent of exports, could quickly find themselves in difficulties," said Burton.

Although the economic growth in the mainland still stood at 7.7 percent in 2012, about 70 percent of interviewed enterprises in the mainland do not believe the economic slowdown will end in 2013.

They are even less optimistic about the global economy, with 82 percent not believing any recovery will happen in 2013.

China is still an export-driven country. The findings showed the prolonged euro debt crisis and slow recovery of the United States seriously hit the confidence of exporters.

Moreover, domestic consumption was not strong in 2012, standing at 30 percent of gross domestic product, revealing no change compared with 2011.

Enterprises are less optimistic and therefore put more hope on favorable industry policies, loosening monetary policy and access to credit to be carried out by the government to support growth in 2013.

The survey also revealed enterprises in the building and construction, steel, iron and other primary metals, textile, clothing and shoes and household electric/electronic appliances industries are at higher risk compared with other industries, given the trend in overdue debts.

Regarding the building and construction industry, the sector is highly sensitive to the government's real estate policies and the financial market. Construction related to public work and infrastructure development is less volatile in view of continuous expansionary policies and restoration after natural disasters in many Asian countries.

As for steel, iron and other primary metals, there is overcapacity in the sector and at the same time their exposure to credit risks makes them more vulnerable to the global and Chinese economic slowdowns.

With textile, clothing and shoes, the sector is traditionally risky because demand for consumer goods is easily affected by an economic downturn. The recovery of the EU and US markets is critical because a majority of enterprises in Hong Kong, the mainland and Taiwan rely on exports to these markets. Competition within the Chinese market is also very intense in this sector.

With household electric and electronic appliances, the sector is highly export-oriented in the region. Unlike high-end products such as smartphones and tablets, medium- to low-end appliances are badly hit by slow demand in the export market, high competition, fast-changing technology and rising production costs.

huyuanyuan@chinadaily.com.cn

(China Daily USA 05/27/2013 page16)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|