Digital currency gains virtual interest

Updated: 2013-06-03 08:09

By Wu Yiyao in Shanghai (China Daily)

|

||||||||

|

Critics say the "mining" process is virtual labor and is not productive for the real world in any way, but bitcoiners see it as equivalent to the real labor of constructing the infrastructure for a currency system in the real world. Provided to China Daily |

|

A pile of newly minted bitcoins arranged for a photograph in Sandy, Utah, in the United States. Created four years ago by a person or group using the name Satoshi Nakamoto, bitcoins are a virtual currency that can be used to buy and sell a broad range of items - from cupcakes to electronics. People can also pay with bitcoins in various coffee shops, phone and computer stores and bookstores in big Chinese cities including Beijing and Shanghai. Provided to China Daily |

Bitcoins increase in popularity but reservations held in some quarters

While the debate over whether the 4-year-old bitcoin is a revolutionary invention or a Ponzi scheme rages, some people have already used them to buy real things and appreciate the smooth and fast transaction process.

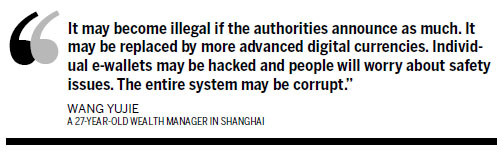

"When you use the bitcoin payment system, it's like an online payment but it's more convenient," said Shen Yu, a 23-year-old postgraduate student who is majoring in telecommunications at a university in Beijing.

With 20 bitcoins, worth 6,000 yuan ($979) at the time of payment, Shen bought a laptop from an e-commerce platform in the United States.

"When you pay with bitcoins, the transaction is fast and you don't need a foreign currency credit card such as MasterCard or Visa, which is usually required by websites that do not accept bitcoin payments," said Shen.

Most of those involved in the trading of bitcoins, known as bitcoiners, are students and information technology professionals. They favor transactions using bitcoins because they can't be bothered using complicated online payments or with currency exchanges, said Shen.

In China, acceptance of bitcoins as something valuable first became known to the public when holders of the digital currency donated the coins to the e-wallet account for the victims of the Sichuan Ya'an earthquake. In China, some online retailers selling products ranging from three yuan phone cases to 1,000 yuan ($163) bedding announced that they would accept payment using bitcoins. People can also pay with bitcoins in various coffee shops, phone and computer stores and bookstores in Beijing and Shanghai.

Shen's 200 bitcoins were earned through "mining", a process of intensive computer calculation based on specific cryptographic rules.

Bitcoiners make money, or bitcoins by laboring, which is setting up a better environment for the bitcoin society through the Internet, said Shen.

Bitcoin.org, one of the most viewed websites for bitcoiners, says the currency has no intrinsic value, no real world counterpart, no guaranteed exchange rate and is not backed by precious metals. Transactions involving bitcoins rely on the good faith and credit of the issuing authority.

Although critics say the "mining" process is virtual labor and is not productive for the real world in any way, bitcoiners see it as equivalent to the real labor of constructing the infrastructure for a currency system in the real world.

"Why do banks charge fees when you transfer money or withdraw cash and exchange currencies? Because certain infrastructures are used that cost money and when we conduct mining, we are contributing to the safety and smoothness of transactions involving bitcoins, which deserves a reward in the form of bitcoins," said Shen.

For Chang Jia, the pen name of a science fiction writer who prefers not to reveal his real name, bitcoins have already established their position as a digital currency and have been accepted in many countries.

Chang sold 10 copies of his latest piece of fiction and received a total of 0.7 of a bitcoin, about 400 yuan, based on the exchange rate on May 7.

The income is just a tiny part of Chang's bitcoin deposits, which amount to about 2,000 and could have been sold for 4 million yuan when the exchange rate was at its peak.

Fluctuation in value

Most of the coins were traded from "miners", the bitcoiners who earned the digital currency through "mining", said Chang, at quite a cheap price when the exchange rate was really low because the business had just started in China.

"I don't care much about how much money I can earn through trading bitcoins or how many things they can buy for me. I care more about how the system is developed and accepted by a wider audience," said Chang.

As a decentralized virtual currency that rules out the possibility of manipulation by the authorities over exchange rates, bitcoins are exposed to a fluctuation in value by speculators, especially when the current total market value is no more than $2 billion.

By May 7, as many as 11,123,450 bitcoins had been issued. As many as 882,165 coins flew from one account to another in the 24 hours between May 6 and May 7, according to data from Mtgox.com, one of the biggest bitcoin trading platforms in the world.

The volatility of the bitcoin price is understandable because the total market value is small and it is fragile in the face of speculators when they inject big sums of money into trading. The fluctuation of the bitcoin exchange rate may be problematic to some investors or holders of bitcoins, said Chang.

"However, I don't think this situation will last long. If the market value of bitcoins expands to a certain degree, it is strong enough to present a stable price," said Chang.

For many bitcoiners in China, the acceptance of bitcoins can be further expanded and more groups of people can get involved in the digital currency system.

Guo Wei, a shoe dealer who announced that he would accept bitcoin payments, said currently most of his revenue is still from online bank payments and cash.

"Some people ask how to pay with bitcoins just out of curiosity but pay with cash or bank cards," he said.

Sun Yan, a 22-year-old holder of bitcoins in Wuhan, said he believes that even if bitcoins fail to achieve widespread recognition and survive in the long term, it is meaningful in that it pushes forward the development of digital currency. Sun holds three coins, all of which were bought from online traders.

"Just as bank cards in many ways have replaced banknotes, digital currencies will do the same thing. All we need is a wider network that accepts digital currency," said Sun.

Risks remain

Chang said he and many other bitcoiners have been aware of the potential risks of holding bitcoins. One possibility is that governments may decide bitcoins are illegal and conduct a crackdown on the exchange platform.

The US Commodity Futures Trading Commission is exploring whether bitcoins may fall under the United States regulator's purview, reported the Financial Times.

"It's not monopoly money we're talking about here. Real people can have real risks with these instruments so we need to ensure that we protect markets and consumers even in what at first blush appear to be 'out there' transactions," said Bart Chilton, one of the five commissioners at the US Commodity Futures Trading Commission, the Financial Times reported on May 7.

For bitcoiners in China, the news is a signal that the currency may become more widely accepted.

"Putting bitcoins under regulation means they are not regarded as something outlawed and so they are recognized as a currency. If authorities want to see the currency die, they can just announce it is illegal," said Chang.

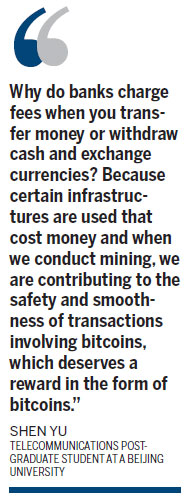

Wang Yujie, a 27-year-old wealth manager in Shanghai and a holder of bitcoins, said he has considered the possible risks that may affect the value of his bitcoin deposits.

"It may become illegal if the authorities announce as much. It may be replaced by more advanced digital currencies. Individual e-wallets may be hacked and people will worry about safety issues. The entire system may be corrupt," said Wang.

In March, a branch of the US Treasury Department said all exchanges or transfer platforms of bitcoins will be considered as "money services business", which means companies involved must provide information to the government and introduce policies to prevent money laundering. Since then, at least three companies in North America have reported having their business accounts closed by their banks. Bitfloor, a New York-based Bitcoin exchange, said it was shutting down entirely and it has not yet been able to return funds to customers.

In China, the transferring and trading platforms of bitcoins are run by individuals and the prices and exchange rates are affected by overseas platforms, said Beijing postgraduate student Shen.

Currently no domestic authorities claim responsibility for regulating the bitcoin market in China.

"The safety of trading bitcoins on these platforms mainly relies on people's trust and good faith," said Shen.

Wang, the wealth manager, said he has explored the currency and understands how it works because some clients asked him whether bitcoins are worth investing in.

"My answer to my clients at the current stage is: 'Wait for another year to see how regulators may respond to it' because I regard it as a big risk if bitcoins are declared illegal," said Wang.

The mechanism of bitcoins, which challenges many banking industry insiders' current knowledge and understanding of currencies, may be obscure to wealth managers and investors even if they have decades of expertise in investments in traditional areas.

"Bitcoins are highly technical in almost every step from their issuance to payment. It takes time for people to understand how the system works and decide whether it is worth real money," said Wang.

The issuance of bitcoins based on computational calculation sets a benchmark that is too high for investors without much knowledge or interest in information technology, said Liu Xinyue, an investor in gold and silver futures in Shanghai.

"I heard my son talking about the bitcoin and I got a headache just two minutes after he started explaining it. It's all too complicated and bizarre to me. I think this may be one of the biggest barriers for investors like me," said Liu.

wuyiyao@chinadaily.com.cn

(China Daily USA 06/03/2013 page13)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|