Small cities play growing role in film market

Updated: 2013-06-11 08:36

By Huang Ying (China Daily)

|

||||||||

|

Moviegoers line up to purchase tickets at a theater in Wuhan, Hubei province. China accounted for 8 percent of the global film market with annual box-office receipts of $2.7 billion last year, according to figures from the Motion Picture Association of America. Provided to China Daily |

1,000 digital movie theaters with 3,000 screens in county-level sites

Movie ticket sales have gone crazy in the city of Panjin.

Compared with two years ago, in one of the fourth-tier city's "cineplexes" there are now nearly as many tickets being sold in a month as there were in a whole year.

Annual box-office revenues in the city - in the southwest of Northeast China's Liaoning province - surged to 25.6 million yuan ($4.17 million) in 2012 from 2.65 million yuan the year earlier, a year-on-year growth of 867 percent, according to statistics from EntGroup Consulting, a Beijing-based entertainment industry consultancy.

In April alone, the city's CJ CGV cineplex, owned by a South Korean theater operator, sold two million yuan's worth of tickets to 50,000 customers, said Guo Jinsheng, the manager of the theater, which opened in January.

"And that performance is growing month-on-month," added Guo.

Panjin is now one of the fastest-growing third- and fourth-tier cities in terms of box-office receipts, and others cities enjoying similar growth include Langfang in Hebei province, and Yueyang in Hunan province.

Ticket sales are also gaining momentum in small cities in a country that is now the world's second-largest film market.

After the United States, China accounted for 8 percent of the global film market with annual box-office receipts of $2.7 billion last year, according to figures released in March by the Motion Picture Association of America.

By May 12, China's total box-office revenues for the year exceeded 8.1 billion yuan, up 39 percent year-on-year, according to official statistics from the film bureau under a new administration formed in March, which falls under the auspices of the State Administration of Radio, Film and Television, and the State Press and Publication Administration.

Domestic movies accounted for 63 percent of that, against 34 percent during the same period last year.

Small and medium-sized cities were the major driving forces of the domestic movie industry, and represent a massive potential growth market, said Mao Yu, deputy director of the film bureau, in an interview with People's Daily newspaper.

"Our customers in third- and fourth-tier cities tend to prefer domestic films to imported ones," added Yi Libin, marketing director at CJ CGV China.

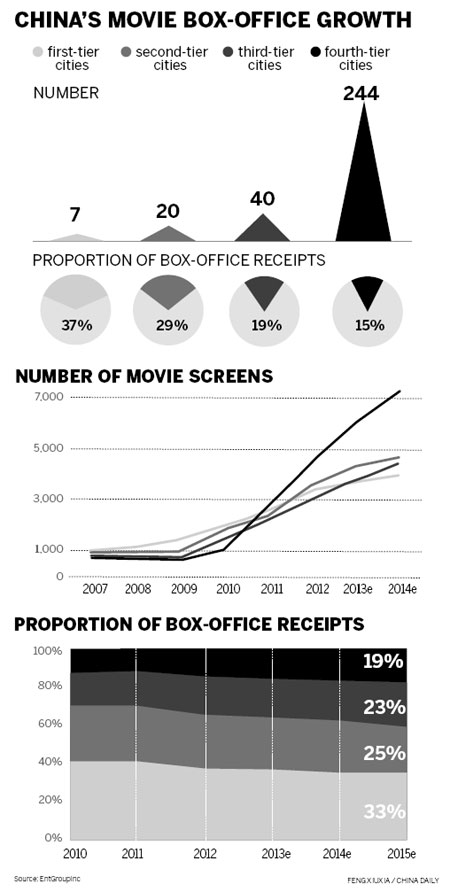

According to a survey by EntGroup Consulting in 2012, 284 third- and fourth-tier cities accounted for 34 percent of the country's total ticket sales, while seven first-tier cities accounted for 37 percent of sales.

The company expects that 34 percent to rise to 42 percent by the end of 2015, given the gradual saturation of the cinema market in first- and second-tier cities.

The number of screens in fourth-tier cities first overtook those in first-tier cities in 2011, according to EntGroup.

As the number of screens and theaters continue to increase in third- and fourth-tier cities, Shen Zheyan, a cultural industry researcher with the Shenzhen-based CIC Industry Research Center, expects their share of the national market to continue rising, as incomes rise and more people move into cities.

China's urbanization rate - the proportion of people living in cities - passed 50 percent in 2011, and the government aims to lift that to 60 percent by 2020.

Panjin now boasts 40 screens against just 19 in 2011.

The rise in popularity of film in third- and fourth-tier cities has been boosted by big investment in digital technology, supported in part by the government and related administrations, according to industry insiders.

Central and local governments continue to offer subsidies in various forms to movie theater construction projects in county-level cities.

A number of provinces and municipalities have already converted all of their cinemas to digital technology, including Beijing, Shanghai, Shandong and Zhejiang provinces and Ningxia Hui autonomous region.

By the end of last year, there were 1,000 digital movie theaters with 3,000 screens in county-level cities, according to statistics from the film bureau.

In the first quarter of the year, there were 172 new cinemas established in country-level cities, accounting for almost 45 percent of the total number of new theaters nationwide.

Another 525 screens were added in those cities, about 30 percent of the total new screens installed across the country.

There were six cinema chains that generated more than 1 billion yuan in box-office revenues in 2012, including Wanda Cinema Line, Shanghai United Cinema Lines, and Dadi Digital Cinema.

Dadi's annual box-office performance increased 63.35 percent year-on-year last year, while the country's top two, Wanda Line and Shanghai United, increased 37.64 percent and 26.61 percent respectively, according to EntGroup figures.

Dadi Digital has primarily focused on developed townships and second- and third-tier cities in the Pearl River Delta and Yangtze River Delta areas since it was established in 2005.

In 2010, of its 92 cinemas, only one-quarter were in provincial capitals. It added 85 theaters last year, mostly being bought from other groups rather than being built, said Yang Shuting, an analyst from EntGroup.

"It has seen significant growth in just one year," she said.

Theaters being run in third- and fourth-tier cities put their priority on the competitiveness of their ticket prices rather that the sophistication of their projection equipment - normally the opposite of those operated in first- and second-tier cities, said Shen from CIC Industry Research Center.

Group buying and discounts are critical to third- and fourth-tier cinemas, where consumers have less purchasing power than in the bigger cities, he said.

"People in first- and second-tier cities go to the cinema regularly, but in third- and fourth-tier cities, people show up at our cinemas only when there's an extremely popular film being shown," said Yi of CJ CGV China, which runs cinemas in first-tier to fourth-tier cities.

"For example, all of our cinemas were packed when we were showing Lost in Thailand, but when Les Miserables was on, things were different," Yi added.

Theaters themselves tend to be very different, too, in their furnishings and size, depending on where they are, said Zhang Zhao, CEO of Le Vision Pictures (Beijing) Co Ltd, one of China's leading private film companies.

Yang said it's hard to predict when and which Chinese cities will hit saturation point.

"For example, based on the per capita number of screens, Shanghai still enjoys growth potential," said Yang, "while other large cities might be there already."

But he agrees, the greatest domestic potential exists in third- and fourth-tier cities.

"It's expected that theater expansion in the domestic market will continue for another five to 10 years," he added.

huangying@chinadaily.com.cn

(China Daily USA 06/11/2013 page14)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|