Riding the crest of a new wave

Updated: 2013-06-11 14:19

By Yan Yiqi (China Daily)

|

||||||||

|

Above: With a deepwater coastline and close proximity to China's largest offshore fishing grounds, Zhoushan has the potential to become an international logistics hub. Below: A bird's eye view of a fishing village in Zhoushan. Provided to China Daily |

If the tide of development turns in its favor, Zhoushan is ideally placed to become a leading international port

Perhaps because it seems so obvious that it is overlooked or taken for granted, but the ocean plays an essential role in China's economic development. More than 90 percent of China's foreign trade is conducted by sea. According to the State Oceanic Administration, about 19 percent of bulk commodities in the global shipping market flow to China, and the country accounts for 22 percent of the world's container exports.

"The Chinese economy is highly dependent on the ocean," says Wang Hong, deputy director of the administration.

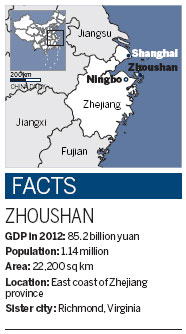

The country's leaders were well aware of the maritime sector's crucial importance when in November they decided to make Zhoushan, on the East China Sea coast of Zhejiang province, a priority national development zone.

Zhoushan Islands New Area was officially inaugurated on March 27, China's fourth such zone.

Zhejiang vice-governor Sun Jingmiao said at the inaugural ceremony that the new area will be bolstered by new marine industries and strive to realize an investment target of more than 300 billion yuan ($48 billion, 37.6 billion euros) in three years.

To this end, Zhoushan, China's largest archipelago with 1,390 islands, has announced a program to build bulk marine commodity storage, transportation and trading centers, and set up a free-trade park and a free-port area.

Zhoushan has a deepwater coastline of 282 kilometers and is on China's largest offshore fishing grounds.

"Zhoushan's geographical advantage is incomparable," says Luo Ning, deputy director of Zhoushan Port and Shipping Administration Bureau. "Its deepwater coastline is the longest in the world. It accounts for 18.4 percent of China's total and is longer than the combined length of Shanghai, Hainan and Guangxi's deepwater coastlines, and 10 times longer than that of Rotterdam.

"More importantly, Zhoushan's deepwater is close to the land, so the construction costs for docks can be greatly reduced."

On Cezi island of the Zhoushan archipelago, the docks are lined with tanks, which take crude oil directly from oil tankers through pipes running along a bridge of only 60 meters - believed to be the shortest such transfer bridge in the world.

"In comparison, Tianjin port built a bridge 8.8 km long for a dock of the same capacity," Luo adds.

Zhoushan's relatively straight coastlines also make it more convenient for ships entering and leaving, Luo points out and, more importantly, its central position on China's eastern coast makes it a very attractive location for shipping companies.

Zhoushan is within two days' sailing of chief ports in Asia, including Busan in South Korea and Singapore. It is also close to the Yangtze River, China's largest channel for inland shipping.

"Shanghai port's resources and facilities are almost fully utilized, but here in Zhoushan, there is still much room for development," Luo says.

Given these advantages, Zhoushan has ambitions of becoming an international logistics hub for bulk commodities.

"Zhoushan is aiming to become China's bridgehead to the Pacific Ocean," says Zhang Yi, an official with Zhoushan Municipal Development and Reform Commission.

Last year, Zhoushan port handled 290 million tons of cargo, an increase of 11.7 percent year-on-year. (Singapore's throughput grew only by 1.2 percent, Rotterdam's by 1.6 percent.)

"Zhoushan is the fastest growing port in the world," Zhang claims, adding that the port plans to have more than 60 docks with a capacity above 10,000 tons by 2015. By then, it should be handling 400 million tons a year, and sales revenue of bulk commodities should hit 500 billion yuan.

"Our goal is to make the output from the port's logistics industry account for 15 percent of Zhoushan's GDP," he says.

As most of the increase in Zhoushan's cargo comes from bulk commodities, such as coal, oil and mineral ores, Zhang says the port should not only be a transfer point for international bulk commodities, but a sales and manufacturing center for them.

"Zhoushan should use its geographical advantage to develop other industries," he says.

Zhejiang Zhoushan Bulk Commodity Exchange is planning to launch an iron ore trading platform by the end of the year.

Li Xinli, deputy manager of ZZBCE, says that the company serves as a bridge for Zhoushan to transfer bulk commodities from the warehouse to an exchange center.

"Zhoushan's ambition is to have a crucial say in the international bulk commodities market," Li says. "In five to 10 years, the Zhoushan Index will become an important index in the world." ZZBCE was established by several state-owned enterprises, including Shagang Group, WISCO and Guodian Group. Sales revenue reached 150 billion yuan last year, turning Zhoushan into the largest iron sand hub in Asia.

Chen Min, deputy director of the investment department of Zhoushan Port Co, says that most docks at present are owned by companies such as Baosteel and Sinopec. To better serve more ships and companies, the port is trying to change that situation.

"Public docks will make up a larger part of Zhoushan, and more (private) companies will get the chance to participate in the operation and management of the port," he says.

Quick to recognize an opportunity, an increasing number of private investors are setting up companies in Zhoushan.

Zhejiang Guangsha Co, the first private company to be granted management rights of crude oil by the National Development and Reform Commission, has set up an energy company in Zhoushan and is building oil tanks with a combined storage capacity of more than 1.5 million cubic meters.

"We benefited from preferential policies by participating in the construction of islands," says Hua Shengtian, vice-president of Guangsha (Zhoushan) Energy Group. "Crude oil management rights, which used to be monopolized by state-owned enterprises, are now open to private companies."

However, all accept the city is still regarded as a relatively minor port and still has a long way to go to realize its goals - and that the going will be tough.

Zhang, from the municipal development and reform commission, says the biggest problem affecting Zhoushan's development is its small economic base.

Last year, Zhoushan's GDP was 85.2 billion yuan, while Zhejiang province's was 3.46 trillion yuan.

"Zhoushan accounts for only 2.4 percent of Zhejiang's total GDP, let alone the Yangtze River Delta or the whole country," says Zhang. "It is very difficult for Zhoushan to really make a difference with such a small magnitude."

Although Zhoushan beats other Asian ports, such as Hong Kong, Singapore and Busan, in terms of the amount of goods and commodities it handles, its economy lags way behind due to its poor infrastructure to accommodate related industries.

Construction of advanced port facilities will take a long time, and Zhoushan is still at the beginning.

From this year, the city will invest 300 billion yuan over three years on infrastructure construction.

"It cannot, however, be all government investment," says Chen from Zhoushan port. "Private investment should account for 80 percent. But very few state-owned companies or foreign ones have come to invest here."

Lack of foreign investment has been a problem for Zhoushan. According to the development and reform commission, foreign investment in Zhoushan totaled $200 million last year.

"We really hope that international logistics companies can invest in Zhoushan so that we can benefit from their advanced experience," says Chen. "In return, Zhoushan's great potential will bring them profits."

The city is preparing campaigns in Hong Kong and Singapore to attract investors, and it is also seeking more preferential policies for foreign investment from the central government.

"Maybe we can provide tax exemption policies for certain foreign companies, just like the policy provided by Qianhai district in Shenzhen," Zhang says.

Zhang also believes more emphasis should be put on developing financial services in Zhoushan.

"Zhoushan's traditional economy was based on the fishing industry, which relies on traditional financing channels," he says. "With the development of modern port industries, financial services should be developed."

yanyiqi@chinadaily.com.cn

(China Daily USA 06/11/2013 page16)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|