SocGen to ease African trade

Updated: 2013-06-13 07:35

By Li Xiang in Paris (China Daily)

|

||||||||

|

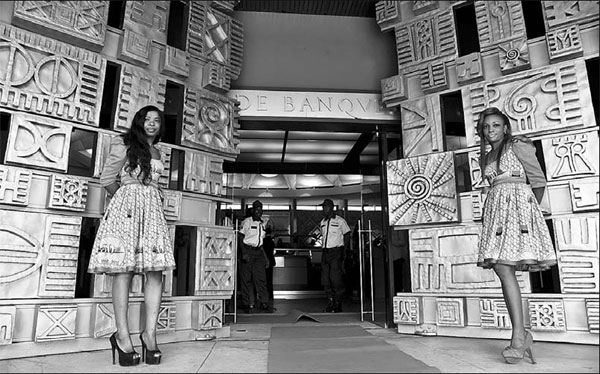

Staff members welcome guests to a ceremony to mark the 50th anniversary of the Societe Generale de Banque headquarters in Abidjan, Cote d'Ivoire. The French bank has now opened yuan-denominated accounts to facilitate China-Africa trade. Provided to China Daily |

French bank Societe Generale SA is seeking to expand into Africa to tap the boom of Sino-African trade and the rapidly growing commercial activities of Chinese enterprises in the region.

While foreign banks remain highly regulated in China's domestic financial markets, the French bank is looking to capitalize on the rising demand for Chinese currency in African trade settlements.

Six banks in Africa, including SG-SSB in Ghana, Fina Bank Group in East Africa and Commercial Bank of Africa in Kenya, are currently in discussions with SG China to open yuan-denominated accounts.

So far, SG's Cote d'Ivoire subsidiary has already successfully opened yuan-denominated accounts, according to Harry Liu, head of commercial banking at Societe Generale China.

"As Chinese companies go to Africa, they will need supporting banking services and it will take some time for Chinese banks to build their networks in Africa. Such demands will create opportunities for foreign banks in China, especially for those who have a strong network presence there," he said.

SG has one of the largest networks in Africa among European banks. It operates 870 branches in 15 African countries, according to Liu.

Leveraging on its extensive network in Africa, the French bank has been able to access the growing business activities of Chinese companies that are engaged in various sectors including energy, infrastructure, agriculture, telecommunications and manufacturing.

The bank is now providing financial services - including import and export financing, bond issuances and bank guarantees - to its Chinese clients in Africa, especially in the northwestern part of the continent, Liu said.

He said that SG has especially benefited from the rapid growth of Sino-African trade, and the fact that Africa has started to develop an appetite for yuan-denominated financial products.

Trade between China and Africa reached a record high of $198.5 billion last year, according to the Ministry of Commerce. Trade is expected to hit $325 billion by 2015, providing a strong base for growth in yuan trade settlements and yuan-denominated bonds.

French Finance Minister Pierre Moscovici said during a recent trip to Hong Kong that France and China have a mutual interest in making the Chinese currency more heavily used in trade in Africa.

In fact, Paris has been keen to build itself into a financial hub for yuan settlements in the eurozone and a bridge between Europe and Africa for Chinese companies.

Besides the strength of its network, SG also provides advisory services for Chinese companies in Africa that are often exposed to regulatory, legal and foreign exchange risks, Liu said.

"For example, many African nations have very tight foreign exchange controls. Many countries only accept guarantees issued by local banks, and some require all documents to be in French. SG's expertise and local knowledge can give Chinese corporates a valuable head start in unfamiliar markets," he said.

France' historical link with Africa is viewed as a key advantage in deepening the Sino-French strategic partnership. Widening the scope of Sino-French cooperation in Africa was also emphasized during French President Francois Hollande's visit to China in April.

Experts said that the intention of Chinese and French leaders to deepen cooperation in Africa will offer enterprises on both sides a greater incentive to jointly seek business opportunities in the region.

"Instead of seeing China as a threat or a concern, French enterprises are more and more likely to see an opportunity," said Isabelle Fernandez, director of UBiFRANCE's office in China, an organization that promotes French business internationally.

"In fact, it will be a win-win game to play as French and Chinese companies have complementary roles to play in the region's development," she said.

lixiang@chinadaily.com.cn

(China Daily USA 06/13/2013 page16)

Philippine, US start Naval exercise in S China Sea

Philippine, US start Naval exercise in S China Sea

Supreme Court gay rights ruling celebrated across US

Supreme Court gay rights ruling celebrated across US

Rudd returns as Australian PM after Gillard

Rudd returns as Australian PM after Gillard

Brazil protests intensify before Confed Cup semifinal

Brazil protests intensify before Confed Cup semifinal

Long lost weekend

Long lost weekend

Park ready to charm China

Park ready to charm China

Prices climb as police crack down

Prices climb as police crack down

China 'most promising' in FDI

China 'most promising' in FDI

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Proposed law puts curbs on family visas

Markets will stay volatile, continue to struggle: Expert

Promising outlook on US, China investment

US adoptees visit Chinese roots

Ecuador refutes Washington Post accusation

IBM to make Chinese job cuts

PBOC ends credit crunch, to go further

Snowden still at Moscow's airport, asylum pending

US Weekly

|

|