Bright future for white spirits

Updated: 2013-06-17 07:36

By Li Woke (China Daily)

|

||||||||

|

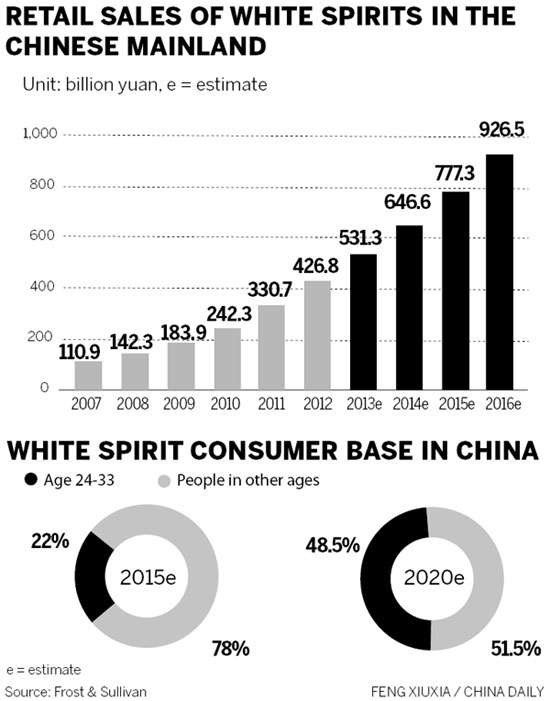

Workers packing Moutai at a workshop belonging to Kweichow Moutai Co in Zunyi city, in Southwest China's Guizhou province. In China, sales revenue from white spirits is expected to grow from 110.9 billion yuan ($18 billion) in 2007 to 926.5 billion yuan in 2016, according to Frost & Sullivan, a US-based market consultancy. Provided to China Daily |

But opinions differ on length of time to deal with difficulties

The Chinese liquor industry is expected to have impressive growth potential in the future despite the present downturns caused by the government's crackdown on luxury banquets, said Frost & Sullivan, a US-based market consultancy.

According to a recent report by the consultancy, the white spirit production will reach 17.05 billion liters in 2016 from 4.94 billion liters in 2007 with a compound annual growth rate of 14.8 percent. Sales revenue from white spirits is expected to grow from 110.9 billion yuan ($18 billion) in 2007 to 926.5 billion yuan in 2016, with a compound annual growth rate of 26.6 percent.

The report attributed the robust growth potential to the following factors. First, the white spirit industry is closely associated with the macroeconomy and currently China is still at a stage of rapid economic development as well as rising disposable incomes.

Second, multi-sales-channels marketing strategies have been vigorously used by domestic alcohol makers, such as group purchases and online sales, which have been greatly welcomed by younger customers.

According to the report, Chinese white spirit is one of the seven renowned distilled spirits in the world. Sichuan, Guizhou, Shaanxi, Anhui and Shanxi provinces are the most recognized origins of it in China. Each province has its own special drinking habits and brands. There is Wuliangye in Sichuan, Moutai in Guizhou, Xifeng in Shaanxi, Gujing in Anhui and Fenjiu in Shanxi.

Sichuan is the most high-yielding province in China. In 2011, white spirit output in Sichuan made up around 30 percent of total output in China and has maintained a compound annual growth rate of 38 percent for nearly five years. There are numerous famous white spirit brands in Sichuan, including Wuliangye, Luzhoulaojiao and Swellfun (Shuijingfang).

Shandong is anther traditional high-yielding province, said Frost & Sullivan. In 2011, the output of baijiu in Shandong made up around 10 percent of the total output in China, with stunning revenue of around 30 billion yuan. Taking Confucian Family Liquor (Kongfujiajiu) as an example, since 2007, its sales volume has maintained an annual growth rate of 100 percent.

But, there are also some restraints on the industry, said Frost & Sullivan, such as local governments' protection of local brands, which jeopardizes fair competition in the market, as well as a lack of product research and innovation capabilities, as the new generation of young customers seek personalized and diversified products.

Other major obstacles also exist, said the consultancy.

At the end of last year, the central government unveiled a series of anti-graft rules called "The Limitation of the Three kinds of Government Consumption". They include the regulation that receptions for high-ranking military officials should no longer include liquor or luxurious banquets, which has led to a sharp decrease in the purchase of white spirit by government and business organizations. Some high-end white spirit brands have faced a sharp decrease in demand and sales volume.

It did not take long for the stock market to feel the effects.

Just two days after the announcement, shares in Chinese distillers such as Wuliangye Yibin Co and Kweichow Moutai Co fell.

Shares in Moutai fell 5.55 percent on the Shanghai Stock Exchange, while shares in Wuliangye slid 3.02 percent on the Shenzhen stock market. Moutai's market value shrank by 12.5 billion yuan on the same day.

"Moutai and another two high-level alcohol brands, which are popular with government officials and military officers, account for 20 percent of the total liquor market," said Jian Aihua, a researcher with CIConsulting, a leading industry research institution.

Yuan Renguo, Kweichow Moutai's chairman, said recently that the company will slow its growth rate to reach an 18 percent year-on-year rise by the end of this year.

"There has been a slump in Chinese liquor sales and in the catering industry since late last year, mainly caused by the government's anti-corruption calls," said Su Qiucheng, head of the China Cuisine Association. "Restaurant sales in some big cities even posted negative growth, such as Beijing and cities in Jiangsu and Zhejiang provinces."

Duan Kaiyun, assistant secretary-general of Beijing Cuisine Association, said: "The difficult time will last for a long time because it's a key part of the new government's vow to curb corruption."

But Bian Jiang, assistant director of the China Cuisine Association, said the habit of pleasing business clients with extravagant banquets has been deeply rooted in Chinese culture and will not be reversed overnight.

In addition to government's anti-graft calls, food safety scandals have also damaged development of the industry.

Last year, the Hunan Provincial Administration of Quality and Technological Supervision said liquor samples from Jiugui Liquor Co contained 1.04 milligrams of plasticizer per kilogram, higher than the 0.3 mg per kg standard set by the Ministry of Health.

Jiugui products were taken from shelves and shares in the Shenzhen-listed company were suspended when the scandal broke.

According to a statement released in March by the Hunan-based liquor maker, its first quarter profits plummeted 90 percent year-on-year and it expects its first quarter profits to be 8 million to 12 million yuan compared with 119 million yuan during the same quarter last year.

The China Alcoholic Drinks Association said earlier this month large-scale tests on China's liquor products show that almost all alcohol products contain plasticizers, with an average level of 0.537 mg/kg. They are used to thicken liquids.

"Although some alcohol brands are facing difficulties in the short term, the Chinese liquor industry is expected to have impressive growth potential in the future because the post-80 generation will gradually become major consumers," Frost & Sullivan forecast.

"The drinking habits of the post-80 population will determine the future of the Chinese white spirit market. The industry players who strengthen their marketing efforts toward the post-80 generation, such as their drinking habits and culture, will eventually win more market share," said Bian, of the China Cuisine Association.

According to the association, in 2015, the number of primary white spirit customers who are between the ages of 30 and 49 will be 441 million. The post-80 generation will make up 22 percent of them. In 2010, primary white spirit drinkers will number 444 million and the post-80 will make up 48.5 percent of them.

"The growth rate of high-end white spirits such as Moutai and Wuliangye might slide in the short term but, in the long run, the two brands, especially Wuliangye, will rebound quickly. The sales growth of middle or moderate high-level brands such as Yanghe and Langjiu will rapidly speed up. And the distiller that is successful in the middle to high-end white spirit market will be the ultimate winner," research and investing firm Rising Securities Co said in a report.

liwoke@chinadaily.com.cn

(China Daily USA 06/17/2013 page16)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|