Nation faces shift to sustainable growth

Updated: 2013-06-25 15:35

By Chen Jia in Beijing and Fu Jing in Brussels (China Daily)

|

||||||||

|

An Agricultural Bank of China Ltd branch in Qionghai, Hainan province. Premier Li Keqiang said at a State Council meeting on June 19 that banks must make better use of existing credit and step up efforts to contain financial risks. Meng Zhongde / For China Daily |

Analysts see little chance of fund injections to prop up expansion

China's leaders seem to be bracing for painful therapy in return for sustainable growth, as they are determined to tame liquidity risks rather than pacify cash-strapped banks, which are the major driver of an investment-oriented economy.

Economists have interpreted the move as evidence that a policy shift from rapid growth to quality growth has made the central government less sensitive to lower GDP growth and more focused on adjusting the country's overall imbalances.

The authorities showed little willingness to pump fresh funds into the financial markets despite a worsening cash crunch that squeezed banks and prompted the country's key stock index to record its biggest daily loss in nearly four years on Monday.

The Shanghai Composite Index sank 5.3 percent to 1,963.24, the largest single-day loss since September 2009. Hong Kong's Hang Seng Index slid 2.2 percent, extending six weeks of losses.

However, the People's Bank of China, or central bank, reiterated on Monday its intention to maintain a prudent monetary stance and strengthen liquidity management to prevent excessive debt growth.

"Currently, overall liquidity in the domestic banking system is at a reasonable level," it said in a statement.

The statement came a day after a commentary from the official Xinhua News Agency that indicated the government is unlikely to pump cash into the banking system to contain financial risks.

It blamed speculation and non-bank lending, often called "shadow finance", for the problem.

The cash squeeze has seen banks put the brakes on new lending, which has in turn dragged on the economy.

Economists say there is a likelihood that the new cabinet, led by Premier Li Keqiang, may tolerate a lower growth rate in the remainder of 2013 while preparing to launch new development programs and policies.

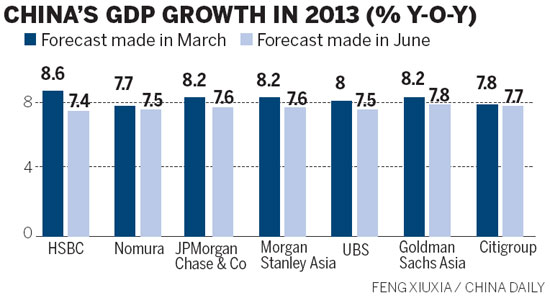

Over the past few weeks, nearly all major investment institutions have cut back their forecasts for China's 2013 GDP, in some cases below the government's target of 7.5 percent.

Most international investors were confident of 8 percent-plus growth three months earlier.

"Liquidity tightening can be very damaging to a highly leveraged economy," said Zhang Zhiwei, chief economist in China with Nomura Securities. It can lead to rising financing costs and a slowdown in fixed-asset investment, which is seen as the strongest driving force of China's economy.

"While we expect GDP growth to slow only moderately to 7.4 percent in the third quarter and 7.2 percent in the fourth, we now attach a 30 percent probability to a scenario in which growth falls below 7 percent in either of the two quarters," Zhang said.

Chang Jian, a senior economist with Barclays Bank, said unexpectedly weak industrial production and an "export collapse" in May were among the factors that could suggest a slowdown.

Downside risks were seen to grow when investment and output of the industrial sector, which accounts for about 40 percent of China's GDP, gave negative signals in May and June.

HSBC Holdings Plc released its preliminary June Purchasing Managers' Index last Thursday. The index declined to 48.3 from 49.2 in May, the lowest level in nine months and indicative of a contraction in the manufacturing sector.

Industrial output growth weakened to 9.2 percent year-on-year last month, compared with 9.3 percent in April.

Exports in May increased only 1 percent from a year earlier, the slowest pace in 10 months, said the General Administration of Customs.

Chang said that as the medium-term outlook for China's potential growth has dropped to 7-8 percent, the new leaders are increasingly aware of this, and may tolerate a growth rate of as low as 7 percent.

She and other economists believe that China should take the unavoidable pain of a period of structural economic transition, with challenges from a deflating of global demand and domestic investment bubbles.

No aggressive stimulus is expected to prop up growth in the short term.

The National Bureau of Statistics will release figures for second-quarter GDP growth on July 15. The world's second-largest economy, a driver of global growth, expanded 7.8 percent in 2012, its slowest pace in 13 years.

GDP grew a surprisingly weak 7.7 percent in the first quarter, well below forecasts.

Duncan Freeman, a researcher at the Brussels Institute of Contemporary China Studies, suggested "the only way to sustain long-term growth is through a reform dividend", which has been adopted by the government.

As any reform dividend will take time to materialize, there are short-term risks that could reduce growth. This situation may force the government to use traditional means to boost growth and weaken reform efforts, Freeman said.

He stressed that easing administrative burdens of the government can boost businesses and jobs and sustain GDP growth.

Zhu Haibin, the chief Chinese economist at JPMorgan, is confident about local governments' ability to repay debt even as economic growth further decelerates, as "the current debt level is within a healthy range".

"But we have more concern about large companies with high debt ratios. Once the economy continues to slow, non-performing loans will rise and that may trigger a financial crisis," Zhu added.

In the short term, a relatively more efficient way to keep up growth is to promote infrastructure construction and increase property investment.

However, pursuing that course will present a deep dilemma for policymakers who need to monitor systemic risks, he added.

AFP contributed to this story.

Contact the writers at chenjia1@chinadaily.com.cn and fujing@chinadaily.com.cn

(China Daily USA 06/25/2013 page13)

Philippine, US start Naval exercise in S China Sea

Philippine, US start Naval exercise in S China Sea

Supreme Court gay rights ruling celebrated across US

Supreme Court gay rights ruling celebrated across US

Rudd returns as Australian PM after Gillard

Rudd returns as Australian PM after Gillard

Brazil protests intensify before Confed Cup semifinal

Brazil protests intensify before Confed Cup semifinal

Long lost weekend

Long lost weekend

Park ready to charm China

Park ready to charm China

Prices climb as police crack down

Prices climb as police crack down

China 'most promising' in FDI

China 'most promising' in FDI

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Proposed law puts curbs on family visas

Markets will stay volatile, continue to struggle: Expert

Promising outlook on US, China investment

US adoptees visit Chinese roots

Ecuador refutes Washington Post accusation

IBM to make Chinese job cuts

PBOC ends credit crunch, to go further

Snowden still at Moscow's airport, asylum pending

US Weekly

|

|