PBOC will act 'if necessary'

Updated: 2013-06-26 07:40

By Wang Xiaotian (China Daily)

|

||||||||

|

The Shanghai headquarters of the People's Bank of China. The central bank said on Tuesday that it has boosted liquidity support to "cautious" financial institutions, and added that the credit crunch in the country's interbank market will gradually ease. Yan Daming / For China Daily |

Central bank says there's no overall liquidity shortfall

China's central bank said on Tuesday that it will intervene to adjust market liquidity if necessary, following the nation's worst cash crunch in a decade.

The bank said it would act to ease short-term, abnormal fluctuations and stabilize market expectations. The People's Bank of China added that currently, there is no shortage of overall liquidity, and the recent crunch will gradually ease.

In a statement on its official website, the PBOC said it will keep the money market stable with a combination of tools, including open market operations, re-lending, rediscounting, short-term liquidity operations and standing lending facilities.

"For financial institutions that extend loans to the real economy and develop with a prudent lending pace, the central bank will provide liquidity support if they lack capital temporarily."

It said for those with liquidity management problems, it would also adopt measures to maintain the overall stability of the market.

The central bank said it has already provided funds to some institutions to ease market tensions.

China's liquidity risks are "controllable", and the central bank will keep market rates at a "reasonable" level, said Ling Tao, deputy director of the central bank's Shanghai branch on Tuesday in Shanghai.

"The monetary authorities will closely watch interest rates in the future and keep them at a reasonable level."

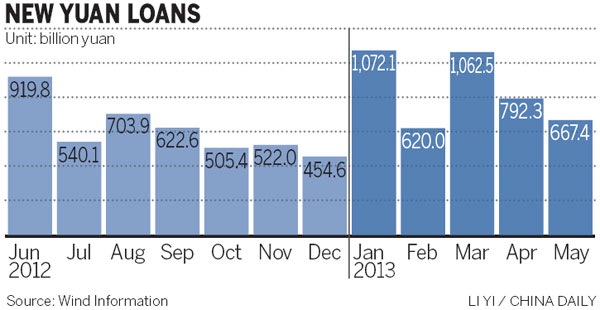

According to the central bank statement, as of June 21, financial institutions had total provisions of 1.5 trillion yuan ($242 billion). "Usually, provisions of 600 to 700 billion yuan could meet the needs of normal payment and settlement," it said.

The Shanghai interbank overnight rate, a gauge of interbank borrowing costs, declined for a third straight day on Tuesday to 5.736 percent, compared with an all-time high of 13.44 percent last Thursday.

The central bank's lack of intervention to curb the rise in overnight borrowing rates could hurt economic growth and particularly the asset quality and profitability of banks, said Standard & Poor's Ratings Services in a report on Monday.

It said the central bank intends to contain the aggressive growth of wealth management products, which banks have been using as an alternative channel to increase credit disbursal.

The banking sector has excessive liquidity, said the report. Cash and central bank reserves accounted for about 14.8 percent of the banks' balance sheets at the end of May.

Ritesh Maheshwari, S&P's credit analyst, said banks may initially not be able to swiftly adjust their asset portfolios when liquidity supply drains concurrently, but they could reallocate assets in a few months,.

Liu Ligang, chief China economist at ANZ Group, said most of the off-balance sheet assets of banks are still lending business, but instead of ordinary companies, the loans were extended to sectors restricted by regulators, such as the property industry and the financing vehicles of local governments.

"For banks, such assets mainly originate from the wealth management products sold to ordinary investors, as well as interbank borrowing."

To ease liquidity tensions, commercial lenders only have two options, he said. "They could choose either to cut their off-balance sheet lending scales, which means they have to wait until the extended loans mature, or sell a large amount of wealth management products at high yields to ease the crunch, which can be poison."

A decline in extended loans might be more possible if the liquidity situation does not improve and regulators maintain their current stance, according to Liu.

"Many banks have chosen to slow their lending pace or even stop extending any new loans. Obviously, this would have a negative impact on banks' profits and affect the manufacturers and service providers," said Deng Zhongwu, general manager at Bank of Sanmenxia.

China's largest commercial bank, Industrial and Commercial Bank of China Ltd, said in a statement on Tuesday that it has maintained a stable liquidity stance with prudent management since the year started.

"After setting aside the required reserves, we have more than 4.6 trillion yuan worth of highly liquid assets, including bonds, interbank financing, excess reserves and cash."

Xu Junqian in Shanghai contributed to this story.

wangxiaotian@chinadaily.com.cn

(China Daily USA 06/26/2013 page13)

Philippine, US start Naval exercise in S China Sea

Philippine, US start Naval exercise in S China Sea

Supreme Court gay rights ruling celebrated across US

Supreme Court gay rights ruling celebrated across US

Rudd returns as Australian PM after Gillard

Rudd returns as Australian PM after Gillard

Brazil protests intensify before Confed Cup semifinal

Brazil protests intensify before Confed Cup semifinal

Long lost weekend

Long lost weekend

Park ready to charm China

Park ready to charm China

Prices climb as police crack down

Prices climb as police crack down

China 'most promising' in FDI

China 'most promising' in FDI

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Proposed law puts curbs on family visas

Markets will stay volatile, continue to struggle: Expert

Promising outlook on US, China investment

US adoptees visit Chinese roots

Ecuador refutes Washington Post accusation

IBM to make Chinese job cuts

PBOC ends credit crunch, to go further

Snowden still at Moscow's airport, asylum pending

US Weekly

|

|