Building equipment sector shifts overseas to get in gear

Updated: 2013-06-27 05:49

By Deng Zhangyu (China Daily)

|

||||||||

|

The revenue of the Chinese construction machinery industry was 562.6 billion yuan ($91.81 billion) last year, a rise of 2.98 percent from 2011, according to data compiled by the China Construction Machinery magazine. Provided to China Daily |

China's construction machinery industry is bracing for sluggish growth, with more domestic companies being forced to build plants overseas to grab market share there, industry insiders said.

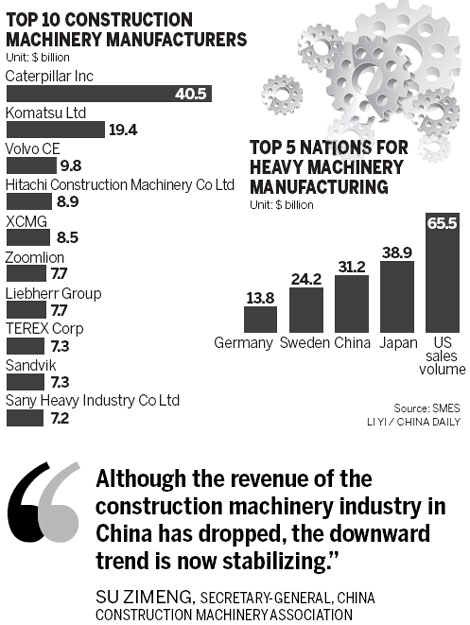

Three Chinese construction equipment makers among the top 10 global firms in the sector saw steep revenue slides in the first quarter of the year, with Zoomlion Heavy Industry Science & Technology Development Co Ltd's revenue down 47.9 percent, according to data compiled by the China Construction Machinery magazine.

In total, 11 Chinese companies are in the magazine's Top 50 Construction Machinery Manufacturers List.

With Caterpillar Inc and Komatsu Ltd taking the lead, three Chinese companies - XCMG Group, Zoomlion and Sany Heavy Industry Co Ltd - are in the fifth, sixth and 10th places, respectively, almost the same as last year.

Half of the top 50 companies saw increased revenues. Nineteen of the companies on the list are from Europe and the United States. Meanwhile, 18 Asian companies saw declines.

"Although the revenue of the construction machinery industry in China has dropped, the downward trend is now stabilizing," said Su Zimeng, secretary-general of the China Construction Machinery Association.

The revenue of the Chinese construction machinery industry was 562.6 billion yuan ($91.81 billion) last year, a mere rise of 2.98 percent from 2011, and much lower than the 21.7 percent increase seen from 2010 to 2011.

"The solid growth of our industry in the last 10 years went hand in hand with China's robust economic growth. Now with the sluggish global economic scenario, it may be a good time for our companies to go abroad," Su said.

The Changsha-based Zoomlion, which posted a profit of $1.43 billion last year, has been making overseas acquisitions since the early 2000s. In 2001, it acquired the United Kingdom-based Powermole Co and bought Italian machinery maker Compagnia Italiana Forme Acciaio SpA, known as Cifa, in 2008.

"We'll not stop our acquisitions overseas," said Guo Xuehong, Zoomlion's vice-president.

A plant built in India last year is already operating, and the company is building another factory in Brazil, Guo said. And Zoomlion is also considering setting up factories in Russia and South Africa.

Guo added that because of the mounting trade barriers across the world, Zoomlion has had no choice but to build factories overseas. It's the only way for the company to expand its market share in other countries, he added.

Meanwhile, the Xuzhou-based XCMG saw exports of $1.3 billion last year amid declining exports for the whole industry.

Sun Jianzhong, the company's vice-president, said that XCMG expanded to the overseas market only five years ago. It bought some small companies in Germany and Poland, and its products have so far been exported to 156 countries.

Sun said that sales revenues from the European and North American markets are still small, but that it plans to put more money and energy into building up those markets.

Although the leading Chinese construction equipment makers are optimistic about their development prospects in overseas markets, that doesn't mean that they've already taken the lead in the global market.

In terms of revenue, construction equipment makers from the US are at the top of the list, with a global market share of 32.78 percent, and with revenues of $65.47 billion last year. The gap between US and Japanese companies, which take the second place on the list, has widened to more than $26 billion.

Major Chinese construction machinery makers remained at the third place for the last two years, with a shrinking market share of 15.63 percent last year, down 2.27 percentage points from 2011.

"We can say that Chinese construction equipment makers have advanced technology, but it's still too early for us to take the lead in terms of both technology and market share," said Su at the China Construction Machinery Association.

He said he believes the industry's future growth will be steady.

"We'll see rational growth for our whole industry," he added.

dengzhangyu@chinadaily.com.cn

(China Daily 06/27/2013 page17)

Philippine, US start Naval exercise in S China Sea

Philippine, US start Naval exercise in S China Sea

Supreme Court gay rights ruling celebrated across US

Supreme Court gay rights ruling celebrated across US

Rudd returns as Australian PM after Gillard

Rudd returns as Australian PM after Gillard

Brazil protests intensify before Confed Cup semifinal

Brazil protests intensify before Confed Cup semifinal

Long lost weekend

Long lost weekend

Park ready to charm China

Park ready to charm China

Prices climb as police crack down

Prices climb as police crack down

China 'most promising' in FDI

China 'most promising' in FDI

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Proposed law puts curbs on family visas

Markets will stay volatile, continue to struggle: Expert

Promising outlook on US, China investment

US adoptees visit Chinese roots

Ecuador refutes Washington Post accusation

IBM to make Chinese job cuts

PBOC ends credit crunch, to go further

Snowden still at Moscow's airport, asylum pending

US Weekly

|

|