Debate heats up on role of govt giants

Updated: 2013-07-08 07:41

By Andrew Moody and Hu Haiyan (China Daily)

|

||||||||

Private sector has yet to replace SOEs in generating business growth

Where now for China's State-owned enterprises?

SOE reform is at the center of the Chinese government's plan to transform the country's economy.

Yet there is a debate within and outside of China as to how far these reforms should go - from those who argue for wholesale privatization to those who say that with their secure funding and ability to plan for the long term, SOEs offer the economy a stable platform.

Despite an increasingly significant private sector in China, the State-invested giants still play the most dominant role in the economy.

The largest of them are the 118 controlled by the central government and supervised by the State-owned Assets Supervision and Administration Commission, which together accounted for 43 percent of China's GDP in 2012.

These include the likes of Sinopec, the petroleum corporation, China National Offshore Oil Corporation and shipping giant COSCO and many others including telecom giants and banks in key sectors of the economy.

There are some 145,000 SOEs around China under local government control.

The role of SOEs has come increasingly under the spotlight in recent months as private companies have complained about a drought of funds and a credit crunch in the banking sector.

The major Chinese banks State-owned - have always shown a preference to lend to the major SOEs and not riskier private concerns.

This was never more the case than in 2009 when SOEs were the recipients of some 85 percent of bank loans associated with the government's 4 trillion yuan ($652 billion) emergency stimulus package in the wake of the financial crisis.

Such imbalances are said by some to create major distortions in the Chinese economy.

The financial performance of the State behemoths has also been questioned recently with total profits of the SASAC SOEs down 0.6 percent to 1.2 trillion yuan last year.

While further reform is seen as inevitable, some warn of the risk of wholesale privatization.

Many SOEs in Russia were privatized in the 1990s and fell into the hands of billionaire oligarchs who enjoy oligopolistic market positions. Privatizations in central and eastern Europe led to a similar outcome.

Hu An'gang, dean of the Institute of Contemporary Chinese Studies, one of China's leading think tanks, and professor of economics at Tsinghua University, is against major sell-offs.

"It is the wrong way to go for China to privatize its State-owned enterprises. The private sector should develop but it should compete against the State sector and not replace it," he says.

He points to the fact that 64 of the 70 companies China had in last year's Fortune 500 were SOEs - equivalent to the total number of Japanese companies which made the list.

"It is these large companies that are driving the national GDP. So I say Japan's sun is going down, China's sun is rising," he says.

Northeast China has traditionally been home to some of China's heavy industry SOEs that have played a key role in the development of the economy over the past 30 years.

Instead of holding out against reform, the mood among many in Harbin, capital of Heilongjiang province, is that further SOE reform is necessary.

Zhu Hai is committee secretary of the Harbin State-owned Assets Supervision Committee, which oversees the SOEs that the Harbin government controls.

"It is a continuous process and it will go on. It is not about getting rid of the SOEs but about improving their management and the way they operate, so they can be as efficient and effective as the private economy," he says.

His organization came into being in 2003 when SOEs had perhaps their most radical overhaul in their history so far.

It was when SASAC took over control of the key strategic national SOEs and others were put under local government control such as in Harbin.

Zhu, who was speaking in his offices on the 18th floor of the Harbin government building in the city's Songbei district, points out the great strides that have been made since then.

In 2004, Harbin had 1,800 SOEs that employed 717,000 people and made a collective loss of 2 billion yuan. By last year the number was down almost two-thirds, to 604, and they had returned to the black, making a profit of 3.2 billion yuan.

Despite the rationalization, the value of the assets held by the SOEs has risen over the past decade from 8 billion yuan to 190 billion yuan.

"We have made a lot of progress but it is the intention of the new central government leadership to speed up the reform," he says.

However, some would like to see much more significant progress.

Zhang Weiying, one of China's leading economists, takes an almost polar opposite position to that of Hu An'gang, the arch defender of SOEs.

The professor of economics at the Guanghua School of Management at Peking University says China now needs the sort of privatization that Margaret Thatcher carried out as British prime minister in the 1980s.

"We can learn from Mrs Thatcher's privatization program to reduce State shares gradually. If State control was brought down from 70 or 80 to 40 or 50 percent, it would still hold the biggest share but it would be an important signal about which direction the country was going," he says.

He believes the dominance of the SOEs crowds out the private sector and there needs to be a more level playing field.

"Technically, it wouldn't be very difficult because most State-owned firms are already listed on the stock exchange."

Diluting State holdings is very much on the agenda for reform, as are encouraging joint ventures with foreign companies and new listings on China's stock markets.

In recent years, SASAC has focused on three main reform areas: driving economic efficiency, getting SOEs to internationalize and getting them to reorganize their internal procedures and share ownership.

By the end of last year, 953 SOEs had gone public, accounting for 38.5 percent of all the companies listed on the A-share market, according to SASAC.

The companies had a total market value of 13.71 trillion yuan, worth more than half of the total market.

Miranda Carr, head of China research at NSBO, a strategic investment research company, who is based in London, says SOE reform is a more difficult process than many imagine.

"It is certainly not as straightforward as saying that we need to get the State out of everything because some sectors, particularly the strategic ones, are fairly natural monopolies or oligopolies.

"Some of the heads of SOEs are also very powerful figures in their own right and are often resistant to reform imposed from the center."

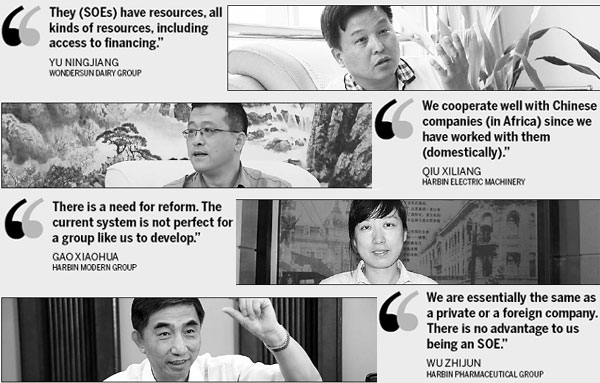

Back in Harbin, Yu Ningjiang, 53, vice-general manager of Wondersun Dairy Group, says the existing SOE operating model has certain strengths.

His company, one of China's major milk producers, is part of the Beidahuang Group, which is controlled by SASAC.

"Of course there are advantages. They (SOEs) have resources, all kinds of resources, including access to financing," he says.

The company, recently voted among the top 500 Asia brands according to China Central Television, employs 20,000 people and is well-known throughout China for its dairy products.

"The State-owned enterprises under the control of the central government are the pillar industries of China," Yu says.

Yu, who joined the company as a college graduate 30 years ago and whose father was a manager in the company, also hits back at foreign companies which complain that SOEs have unfair advantages in China.

"For the first three years, foreign companies entering China don't have to pay any tax, and for the next two years they pay just half the tax. This is not a benefit that SOEs enjoy."

For David Shambaugh, author of the recent book, China Goes Global: The Partial Power, it is not the ability of SOEs to compete in China that is in question but their performance in overseas markets.

The professor of political science and international affairs at George Washington University says that only three of the 64 Chinese companies on the Fortune 500 list that Hu An'gang cites as trailblazers for the economy make more than half their revenue outside China.

"They are not multinational corporations; they are Chinese companies," he says.

"Chinese corporations will never be innovative, at the cutting edge of product lines and technologies, on a global basis and they will always be followers and copiers rather than pace setters so long as State-owned enterprises get the lion's share of state investment."

Qiu Xiliang, president and general manager of Harbin Electric Machinery, says his is a Chinese company that has gone global, with an export record to prove it.

The SOE, which was listed in 1994, has sold its power generation equipment to more than 50 countries with exports making up 29 percent of sales last year.

It has been particularly successful in Africa, working for companies such as Sinohydro and Gezhouba Group Co in such countries as Sudan, Ethiopia and Nigeria.

"We cooperate well with Chinese companies since we have worked with them in the domestic market for several years, and so we know each other well. That is not to say that we haven't also had export success in the United States and Europe," he says.

In the somewhat retro wood-paneled boardroom of the company's imposing new offices in Harbin, Wu Zhijun argues that too many people try to caricature SOEs as merely State-owned leviathans.

He is vice-manager of Harbin Pharmaceutical Group, one of China's leading pharmaceutical companies. Despite being State-owned, it has two listed subsidiaries, Harbin Pharmaceutical Group Co Ltd and Sanjing Pharmaceutical, and has outside investment from Citic Capital and US investment company Warburg Pincus.

"We are essentially the same as a private company or a foreign company. There is no advantage really to us being a SOE.

"Our strength is not the status of our organization but the fact we are able to compete effectively in the market with our own strong brands."

Wu, 56, says it is possible the remaining 45 percent of the Harbin government's investment in the company may be reduced over time.

"You can see that with our two quoted subsidiaries all the capital has been listed, so maybe in the future the State investment in the group will be gradually reduced," he says.

Gao Xiaohua, board secretary of Harbin Modern Group, believes some element of privatization would benefit smaller SOEs like hers.

Her company is best know for running events like the 80-day Harbin Ice and Snow World and the Harbin International Beer Festival, which takes place this month. It also makes the well-known Modern ice cream and owns the Modern Hotel, the landmark local hotel built in 1906.

"There is a need for reform. The current system is not perfect for a group like us to develop. Sometimes we want to implement big projects but we are short of funds."

Gao, who joined the company as a graduate in 1996, says the SOE model of ownership only tends to benefit the companies in key strategic sectors.

"We really don't get the government support like the SOEs in the utility or power generation sectors. We would actually like to form partnerships with international companies that might invest in us. That would improve our brand recognition."

Carr at NSBO argues that the dominance of the larger SOEs not only affects the smaller ones but the private sector in general in China.

"Being part of the government, they get all kinds of preferential treatment. The other advantage is that they get cheap capital, and this makes it very difficult for private companies to compete because they can't match the returns on capital when their costs are so much higher."

Martyn Davies, chief executive of Frontier Advisory, a research and strategic advisory firm based in Johannesburg, believes the Chinese economy will stall without major reform of its SOEs.

"They have done their job driving growth for the past three decades but now it is time to move on. Every Chinese SOE friend I speak to knows this. They also tell me it is going to change quicker than people think."

Kerry Brown, executive director of the China Studies Center at the University of Sydney, says the slowdown in the Chinese economy makes SOE reform even more vital since new growth will only come through driving efficiency.

"China now needs to deliver growth through efficiency. No one pretends SOE reform is going to be straightforward but it is extremely necessary in the battle to produce the efficiency the economy now needs.

"I don't think that the central government can put off reforms. The issue is how quickly, and how far they go."

Qiu, 45, of Harbin Electric Machinery, looks the very epitome of a modern industrial boss, wearing the company's blue uniform.

He says he is aware that China's SOEs still need to bridge a gap between them and the major foreign multinationals.

His company has sent 60 employees to train with General Electric Co in the US and Hitachi Corp in Japan as well as being involved in collaborative ventures.

"Many of the major multinationals have been operating for more than 100 years, and we have a lot to learn from their techniques, their marketing and their project executions. It is our dream to be as famous as them in the world."

Contact the writers at andrewmoody@chinadaily.com.cn and huhaiyan@chinadaily.com.cn

(China Daily USA 07/08/2013 page13)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boeing 777 passenger 'mumbled a prayer'

Ex-minister gets suspended death

Workers return after dispute

Job seekers should be cautious abroad

River pollution sparks criticism

Terror attack was planned: suspect

Booming security industry needs skilled youth

A bright future for native black pigs?

US Weekly

|

|