It's about performance, not ownership structure

Updated: 2013-07-08 07:42

By Hu Haiyan and Andrew Moody (China Daily)

|

||||||||

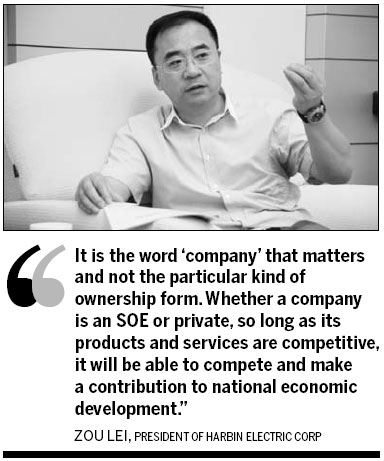

Zou Lei believes State-owned enterprises will continue to play a key role in China's economic development.

The president of Harbin Electric Corp, one of China's largest domestic power generation equipment manufacturers, says that in the current SOE-reform debate there is a danger of becoming too obsessed with ownership structures.

"It is the word 'company' that matters and not the particular kind of ownership form. Whether a company is an SOE or private, so long as its products and services are competitive, it will be able to compete and make a contribution to national economic development," he says.

Zou, who at 46 is one of the youngest leaders of a major SOE in China, was speaking in his office in Harbin's Sandadongli Road. He worries the achievements of SOEs since reform and opening up risk being undervalued amid the current calls by some for wholesale privatization.

"They have played an important role in China's progress and will continue to play an essential and indispensable role. The debate should not all be about privatization," he says.

HEC, which has 27,000 employees and had sales last year of around 30 billion yuan ($4.9 billion), is one of the 118 SOEs directly under the central government control of the State-owned Assets Supervision and Administration Commission of the State Council.

Zou says the company, which listed on the Hong Kong stock exchange in 1994, has always embraced reform.

"HEC is a typical example of SOEs that have made tremendous achievements during the past 30 years by making continuous reforms," he says.

"We have brought on board European institutional investors as well as individual investors and the ownership structure has already been diversified. I think we are a very vivid example of an SOE that can develop and adapt to modern market circumstances and conditions," he says.

Zou, an engaging and urbane personality, sees no need to alter the company's status as an SOE, particularly since it is engaged in a strategic sector.

During its 60 years in existence, it has installed more than 300,000 million kW capacity of power generation equipment, about one-third of China's current electricity generation capacity of 1 billion kW.

"I think if you are in an industry that is strongly connected with the national economy and people's livelihoods such as the electricity sector, it is better for the major players such as ourselves to be SOEs," he says.

Zou joined HEC after graduating in engineering from college in 1988 and worked his way up into senior management.

He became president in 2008 after an unusual global selection fair held by the company's personnel department that evaluated 300 candidates for the post.

That Chinese SOEs are insular and are not open to the idea of recruiting foreign managers is a criticism often leveled against them.

Zou says he was asked why SOEs do not recruit foreign managers by a professor at a training program he attended two years ago at Churchill College, Cambridge in the United Kingdom and made clear at the time there were no real barriers.

"As long as you introduce talented individuals who are potentially beneficial to the company and can promote its development, there is no issue about recruiting them so long as it is in accordance with the necessary laws and regulations," he says.

"We have no objection to recruiting people, whatever their nationality. We haven't so far recruited anyone to senior management but we have recruited many foreigners in other positions, particularly in overseas operations. This is actually a major change from the past."

He says it is important for a modern SOE to offer incentives to its own workforce and get away from the old time-serving mentality of the past.

"The group has transformed its salary and benefits system. Those who make bigger contributions to the company's development get more money," he says.

Zou points out that compared with Western counterparts such as General Electric Co in the US and Alstom SA in France, SOEs like HEC have a relatively short history.

"This should be remembered in discussions about SOEs. It is not just our ownership status that is an important factor but that we have a long way to go before we have the deep knowledge of operating as some of our competitors," he says.

"Part of the reforms we have made is to change the mindset of our staff from that of an old planned economy to one that is more market-oriented."

He says the management structure of the group has also had to be modernized to fit in with the business world in which it competes.

"With the development of the global economy, our corporate structure also needs to advance with the times and be in line with that of the foreign multinationals so that we can succeed while facing at times severe market competition," he says.

"We have recognized the need, in particular, to make our management structure flatter and less hierarchical so that we can be more responsive."

Zou says modernizing has also meant adapting to the demands of the market, which requires increasingly more involved solutions.

"In the past the group just provided the electricity generation equipment but now this is no longer enough and you have to provide a systematic overall solution for your client," he says.

Zou says Chinese SOEs often get unfairly criticized by both foreign multinationals and also private companies in China for the preferential treatment they are supposed to receive from the central government.

"The reality is that China's SOEs often have a lot more responsibilities than private companies. They have a wider remit which requires them to take on social responsibilities. Sometimes SOEs have to shoulder responsibilities which are outside those you would expect a corporate to take on such as operating schools and hospitals."

Instead of drastic reform, Zou believes Chinese SOEs like HEC will evolve and improve their efficiency by engaging in international competition.

The group has sold in more than 40 countries, with Africa, Asia and Central and South America being key markets.

Zou says the target is for 20 percent of the group's 50 billion yuan by the end of 2015 to come from exports.

Contact the writers at huhaiyan@chinadaily.com.cn and andrewmoody@chinadaily.com.cn

(China Daily USA 07/08/2013 page14)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boeing 777 passenger 'mumbled a prayer'

Ex-minister gets suspended death

Workers return after dispute

Job seekers should be cautious abroad

River pollution sparks criticism

Terror attack was planned: suspect

Booming security industry needs skilled youth

A bright future for native black pigs?

US Weekly

|

|