Quantitative easing to be on the agenda

Updated: 2013-07-09 06:13

By Zheng Yangpeng (China Daily)

|

||||||||

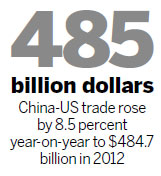

The upcoming China-United States Strategic and Economic Dialogue, also known as S&ED, should be a time for leaders of both sides to discuss the impact of the US scaling back its quantitative easing policy and better coordinate the two countries' monetary policies, analysts said.

"This should be one of the most important, possibly the most important economic issue for the upcoming event," said Lu Feng, a professor and vice-dean of the National School of Development of Peking University.

Following the remarks last week of Ben Bernanke, the chairman of the US Federal Reserve, financial market players expect the US to start withdrawing its monetary stimulus in coming months.

Based on this expectation, foreign capital has started its exit from some emerging markets, whose risk is particularly large for countries that depend on external financing.

"It's not how large the scale of the capital exodus will be, but the expectation (that matters)," said Guan Qingyou, deputy dean of the Minsheng Securities Research Institute.

For China, the issue is that the timing of the outlook for the end of the US' quantitative easing coincided with slowing domestic economic activity, and the fact that some international capital has flown out of China, placing some pressure on the yuan.

China's funds outstanding for foreign exchange - an indicator of foreign capital inflow - rose 67 billion yuan ($10.8 billion) in May, the least in six months, according to the People's Bank of China.

However, Guo Feng, a senior economist of the Institute of International Finance, said that compared with other emerging market economies, the impact on China should be smaller, given the country's capital controls, large foreign reserves, and structural surplus on the balance of payments.

"The easing of the US' monetary stimulus did add some pressure for the Chinese economy. But given China's economic scale and its exposure to the global capital market, China should have considerable room for maneuver," said Lu.

Still, Lu said that China should put the US' monetary policy on the table, and express the Chinese side's concerns and expectations.Open discussion of the issue could improve policy coordination between the two largest global economies and reduce uncertainty, Lu said.

Besides monetary policies, the two sides are expected to discuss issues such as China's market economy status, fair treatment for Chinese investors in the US, and the loosening of US restrictions on exports of high-tech goods to China.

As the bilateral talks loom, China is expected to release a series of lackluster economic figures for the second quarter, while the US is on a steady recovery track. This has led to concerns that China may lack bargaining power during the talks.

"Indeed, the scenario now is very different from that of 2008, when the US pinned hopes on China's massive stimulus program," Guan said.

The latest data from the US showed the economy added 195,000 payroll jobs in June, and the average monthly increase since September exceeds 200,000. In contrast, China's GDP in the second quarter may only have expanded 7.5 percent, compared with 7.7 percent in the first quarter, according to a median estimate of analysts surveyed by Bloomberg News.

But Lu argued that the real scenario is that the US economy is not as robust as it looks, and that China's economy is not all that sluggish.

"Despite the positive figures from US, which are mainly thanks to its quantitative easing policy, its structural weakness remains. The recovery is on the road but far from a boom," Lu said.

The upcoming talks are also expected to see progress on the investment treaty between China and the US, which started its negotiations in 2008 and has entered the ninth round of talks.

However, Guan said that we likely won't see a significant breakthrough on the issue, while the two countries should also exchange ideas on China's entry into the Trans-Pacific Partnership, or TPP.

"In the short term, the monetary policy issue is hot; while in the medium to long term, the talk of joining the TPP is on the strategic agenda. China should have an open attitude toward the issue," Guan said.

zhengyangpeng@chinadaily.com.cn

(China Daily USA 07/09/2013 page15)

China's youngest city glistens under palm trees

China's youngest city glistens under palm trees

Xinjiang tourism recovering

Xinjiang tourism recovering

Quebec disaster death toll jumps to 13

Quebec disaster death toll jumps to 13

Mourn for students in San Francisco air crash

Mourn for students in San Francisco air crash

Rolling stone finally settles

Rolling stone finally settles

Double-decker bus caught fire in Shanghai

Double-decker bus caught fire in Shanghai

China, Russia begin live-fire navy drill

China, Russia begin live-fire navy drill

Grape expectations for Xinjiang county

Grape expectations for Xinjiang county

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China improves maritime law enforcement

Air crash victims' families arrive in SF

Hopes are high for US, China talks

Laden's life on the run revealed

US mulls hastening withdrawal from Afghanistan

China's inflation grows 2.7% in June

Country singer Randy Travis in critical condition

Police look for suspects in Brazil soccer slaying

US Weekly

|

|