Headwinds may buffet economic growth

Updated: 2013-07-10 08:02

By Chen Jia in Beijing and He Wei in Shanghai (China Daily)

|

||||||||

Economic growth may encounter greater resistance in the second half of the year underscored by lackluster factory production, economists said on Tuesday.

They were speaking after the National Bureau of Statistics reported a moderate increase in consumer inflation and persistent decline in factory-gate prices in June.

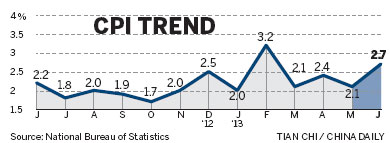

The consumer price index, a main gauge of inflation, rose by 2.7 percent year-on-year compared with a 2.1 percent increase in May. Food prices increased by 4.9 percent in June, remaining the major driving force of inflation.

The producer price index, a pricing indicator for output leaving factories, fell by 2.7 percent in June, the 16th consecutive monthly drop, reflecting sluggish market demand.

Economists say the world's second-largest economy is struggling with industrial overcapacity and potential financial risks, with the United States deciding to reduce quantitative easing as it sees GDP recovering slightly, and with Japan likely to have strong domestic demand and export growth based on monetary and fiscal stimulus measures.

Wang Tao, chief economist in China with UBS, said the central government, led by Premier Li Keqiang, wants to ensure stable albeit slightly slower growth and a stable financial environment without embarking on immediate de-leveraging or major restructuring that could be destabilizing.

"The most likely outcome, in our view, is that the Chinese economy will go through a period of sluggish growth and adjustment, restructuring some bad debt as well as overcapacity in the real economy," she said.

Li and central bank Governor Zhou Xiaochuan have reiterated since May that the monetary policy stance will remain "prudent", given an evaluation of the economic environment as "sound and stable".

The liquidity squeeze in the interbank market in June added to investors' concerns, with the People's Bank of China acting repeatedly since then to allay market fears and assure that the interbank rate - the rate of interest charged on short-term loans between banks - returns to normal.

Wang said a hard landing for the economy or a financial meltdown is unlikely in the near term, although serious structural challenges may not be solved soon.

Economists said that in the second half of the year, if the US and Japan see strong recovery and there is no sudden crisis in the European Union to drag gross domestic product into contraction, China's exports and corporate earnings may improve.

But a report from Nomura Securities said it is more likely that the US will continue its long-term asset purchases up to the end of the third quarter and reduce purchases after this, which may support a stronger US dollar. Emerging markets, including China, may then see capital outflows.

A report by Fudan University and the Center for European Economic Research said China's real economy - the manufacturing and service sectors - has been far from a revival.

Fifty-four of 100 economists and researchers surveyed from investment banks and securities companies at home and abroad expect a fall in income for the steel, metal and machinery industries.

Sun Lijian, co-author of the report and professor at Fudan University in Shanghai, forecast a pick-up in manufacturing only on the premise that the US economy rebounds in the second half of the year, raising commodity prices.

Yao Wei, chief economist in China at Societe Generale, said the government is expected to maintain its policy stance, and the inflation rate may remain muted in coming months.

"The government is unlikely to resort to any quick reforms, which it has been resisting since last year. The trend of soft growth and muted inflation may well last in the near term," Yao said.

Contact the writers at chenjia1@chinadaily.com.cn and hewei@chinadaily.com.cn

(China Daily USA 07/10/2013 page3)

Thousands pay final tribute to US firemen

Thousands pay final tribute to US firemen

Dozens feared dead in Quebec derailment

Dozens feared dead in Quebec derailment

Breathe deep, this is the real thing

Breathe deep, this is the real thing

Families of crash victims in SF

Families of crash victims in SF

Rainstorms cause severe flooding and landslides

Rainstorms cause severe flooding and landslides

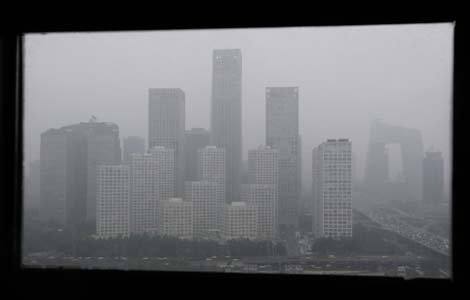

Coal burning in China's north can shorten lives

Coal burning in China's north can shorten lives

Some solar companies see brighter first half

Some solar companies see brighter first half

Thousands flock to Texas Capitol over abortion

Thousands flock to Texas Capitol over abortion

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Watchdog: Trans-fat levels meet standards

Most passengers on crashed plane reported safe

China, US hold talks on cybersecurity

Shenzhen Red Cross denies organ claim

Rainstorms cause severe flooding and landslides

Japan tags China as 'security threat'

Honesty is a challenge for CPC

Snowden hasn't accepted asylum

US Weekly

|

|