Chinese pesticide producers eye US

Updated: 2013-08-15 11:14

By Caroline Berg in New York (China Daily)

|

||||||||

In the world of the "Big Six" agriculture chemical (ag-chem) companies, marketing your product is like trying to find shelf space on the cereal aisle dominated by a handful of brand names, but that's what Chinese pesticide producers are looking to do - compete.

These days, the Dow Chemical Company, Syngenta AG, Monsanto Company, Bayer AG, BASF SE and E.I. Du Pont De Nemours and Company are producing the majority of their ag-chem products in China, according to Telisport Putsavage, a pesticide industry expert and environmental counsel at Sullivan & Worcester law firm in Washington, DC.

On the other hand, the Chinese government expects to see an increased effort by domestic ag-chem companies to sell their own brands of products in the US to increase China's market share of the industry.

"One of the difficulties for any company, particularly offshore companies looking to enter into the US, is figuring out a way to break into distribution," Putsavage said. "These products do not go to the farmers and they don't even go directly into farm retail stores. They all go through distributors."

In 2011, China's largest generic ag-chem company, ChemChina, with nearly $32 billion in annual sales, put up $2.4 billion to acquire the world's largest generic ag-chem producer, Israel-based Makhteshin Agan Industries.

Pesticide companies have played a key role in driving the growth of China's chemical production output, which surpassed that of the US for the first time in 2010.

In 2012, chemical pesticide output from China increased by 34 percent year-on-year to 3.6 million tons, according to the China Pesticide Industry Report, 2012-2015. In 2012, the operating revenue of Chinese pesticide manufacturing increased by 21 percent year-on-year to $38.5 billion, while total profit reached about $2.9 billion.

Noting recent success in the industry, the Chinese government has launched a five-year plan to reduce the number of pesticide plants - there are more than 2,000 pesticide makers in China - to create a field of about 20 Chinese ag-chem firms with strong international presence.

"The big companies in the US aren't encouraging the Chinese to come in," Putsavage said. "But we believe it's inevitable. The Chinese produce the largest part of the product."

The increased presence of Chinese ag-chem in the US market would help lower prices for farmers as a result of greater competition.

In turn, China's involvement in the US ag-chem market will force the Chinese government to pay more attention to environmental concerns, since each chemical manufacturing plant making a product for sale and distribution in the US will have to register with the US Environmental Protection Agency.

"The interesting aspect is these materials are now made in China," Putsavage said. "It's not like all of a sudden we're going to have materials that are made in China that were being made in Germany or in the US or somewhere else. They're made in China now."

During a business trip to Shanghai in 2010, Putsavage and his fellow counsel at Sullivan & Worcester Leonard Miller made a presentation to members of the Chinese crop protection industry and gave advice on successfully entering the US market: find a joint venture or some arrangement with a US company.

"We strongly discouraged Chinese companies from thinking they could come to the US and enter the US market and market directly to the US market without assistance from people who knew the US market and have been active in the US market," Miller said. "We believe the winners will be those people who effectively integrate themselves into the US distribution system."

carolineberg@chinadailyusa.com

(China Daily USA 08/15/2013 page2)

Ride to fly on the top of mountains

Ride to fly on the top of mountains

Nadal beats Isner to win first Cincinnati crown

Nadal beats Isner to win first Cincinnati crown

Wild Africa: The new attraction to Chinese tourists

Wild Africa: The new attraction to Chinese tourists

Azarenka beat Williams for Cincinnati title

Azarenka beat Williams for Cincinnati title

500th eruption of Sakurajima Volcano in 2013

500th eruption of Sakurajima Volcano in 2013

A cocktail that's a treat for the eyes

A cocktail that's a treat for the eyes

Private sector to care for the elderly

Private sector to care for the elderly

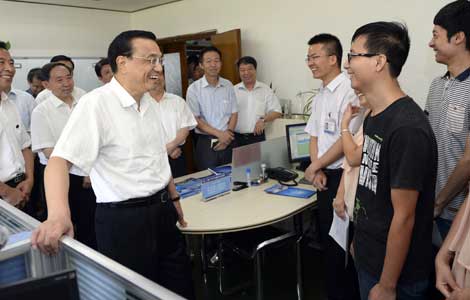

Be innovative, Li tells graduates

Be innovative, Li tells graduates

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China defense chief in DC

Trading mishap reveals flaws

Senior care opens wide for investors

Iran signals willingness to resume nuclear talks

Baby formula sales to be shifted to pharmacies

CIA document release acknowledges Area 51

36 killed in Egypt's prison truck escape attempt

Trustee council may be answer for reforming

US Weekly

|

|