Coal sales, output fall as demand falters

Updated: 2013-08-21 08:05

By Lyu Chang (China Daily)

|

||||||||

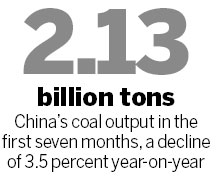

China's coal output and sales contracted in the first seven months amid weak demand, adding pressure on the industry to undertake structural adjustments, the China National Coal Association said.

Coal output fell 3.5 percent year-on-year to 2.13 billion tons, with sales down 3.9 percent to 2.07 billion tons, the CNCA said.

Due to more competitive prices, coal imports grew 14.1 percent to 187 million tons, while exports sank 22 percent to 4.9 million tons.

Jiang Zhimin, the body's vice-president, was quoted by the Xinhua News Agency as saying that domestic coal demand growth is expected to keep slowing for the rest of the year, amid decelerating economic expansion.

"Periodic changes in the coal industry always lag behind the overall economic cycle," Jiang said. "So even if China's economy maintains stable growth, the situation is that coal miners face huge pressure, and that won't change soon."

Coal producers should vigorously pursue structural change, such as promoting coal gasification, which can change the status of coal from a mere fuel into a raw material for other products, industry insiders suggested.

Yanzhou Coal Mining Co Ltd, China's fourth-largest producer of the fuel, announced a provision for impairment losses in a stock market filing on Monday.

"The provision for impairment losses was 2.099 billion yuan ($341 million), representing approximately 4.73 percent of the audited net assets of the Yanzhou Coal Mining Co Ltd as at 31 Dec 2012 [of 44.37 billion yuan]," the statement said.

The Shandong-based company warned earlier that China's coal market remained weak, as its Australian subsidiary slid into the red with a first-half net loss of A$749 million ($687.9 million) amid plummeting coal prices.

Increasing imports and soft demand have left many domestic coal miners with rising stockpiles, exacerbating their difficulties.

Economists said weak foreign and domestic demand, compounded by oversupply, has had widespread financial implications for producers.

The first-half net profit of mid-sized and large coal producers fell 43.3 percent year-on-year, the CNCA said. Miners' fixed-asset investment fell 1.6 percent to 258.9 billion yuan.

Pressures on the industry led coal-producing regions such as Shanxi, the Inner Mongolia autonomous region, Shandong and Henan, to roll out measures to help companies that had to cut or suspend production.

Shanxi is waiving environmental protection fees and industrial transformation development fees for coal mines. It has also cut coal trading service fees by 50 percent. The measures run from August to December.

lvchang@chinadaily.com.cn

(China Daily USA 08/21/2013 page15)

Merkel makes historic visit to Nazis' Dachau camp

Merkel makes historic visit to Nazis' Dachau camp

Chinese fleet sets sail for joint drills

Chinese fleet sets sail for joint drills

President Xi meets WHO director-general

President Xi meets WHO director-general

Everyman movie star

Everyman movie star

Rural boarding schools need dorm managers

Rural boarding schools need dorm managers

Center of hope and support

Center of hope and support

Chinese characters under threat in digital age

Chinese characters under threat in digital age

US, China to expand military exchanges

US, China to expand military exchanges

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China asked to help in African mining

Dispute slows positive trend on Korean Peninsula

Expanded Sino-US exchanges to stabilize ties

Chinese fleet sets sail for joint drills

Premier Li stresses need for reform

Children with HIV live in fear

Kidney trafficking operation smashed

Food safety tops public's concerns

US Weekly

|

|