Market regulators need to fix loopholes: analysts

Updated: 2013-08-26 07:24

By Xie Yu in Shanghai (China Daily)

|

||||||||

After a trading glitch sent the Shanghai Composite into a historical buying frenzy two weeks ago and sparked an investigation by China's securities regulators, analysts say the nation's regulators are at a loss on how to fix the deficiencies.

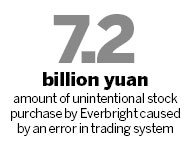

The China Securities Regulatory Commission said on Aug 18 that it was launching a probe into State-controlled Everbright Securities Co, which is suspended from trading on Aug 16 after it said an error in its trading system led to 7.2 billion yuan($1.18 billion) in unintentional stock purchases. The surge in orders pushed the benchmark Shanghai Composite Index by 5 percent in two minutes on Aug 16 before it ended 0.6 percent lower.

On Sunday, a bourse spokesman said at a news conference that they will improve its risk control measures to prevent similar incidents from happening. The CSRC, on the other hand, said it has wrapped up its investigation into Everbright and will announce its findings as soon as possible.

Analysts say the incident exposed the nation's regulatory shortcomings and loopholes in China's securities trading system.

Under the Shanghai Composite's current monitoring system, abnormal transactions can only be discovered after orders have been placed.

"The incident seems like a brokerage's credit crisis, but it reflects loopholes with China's securities and futures trading system," said Lu Hongjun, president of Shanghai Institute of International Finance.

Lu said the bourse's transaction system has clear defects. One measure it should take is to intervene when it has discovered that a brokerage's buy orders has surpassed its credit limit, he said. The bourse should also establish a mechanism to monitor quantitative trading, which involves the use of computers to find patterns in financial data.

Everbright said in an earlier filing to the Shanghai Stock Exchange that the company had set up an upper limit of 80 million yuan for its arbitrage-trading system, but an error in its quantitative trading system generated buy orders of 23.4 billion yuan, of which 7.2 billion yuan was traded successfully.

"The bourses should block trading when finding abnormal phenomena, including unusually large volume orders. The buy orders issued by Everbright that day were worth 107 percent of its net assets, which is obviously problematic," Lu said.

If unusual volume orders are placed, the bourse should report the movements to the market and investors immediately, he added.

On Aug 16, the Shanghai Stock Exchange issued a statement at 11:44 am on its official website, claiming its trading system was running normally. Everbright did not announce its error until 2:25 pm. The market closes at 5 pm.

During this timeframe, Everbright increased its short positions on index futures contracts, and got 7,023 contracts, worth about 4.82 billion yuan, as the trading day came to a close.

The company explained the move as a "remedy" for the error that occurred in its quantitative trading system. Analysts and lawyers are claiming that the move was insider trading that took advantage of investors who had no knowledge of what had happened.

"There seems to be a lack of cross-market supervision. When there is an unusual movement of large-volume capital in the equity market, the futures market should stay alert and take action," said Hu Yuyue, director of the securities and futures research institute under Beijing Technology and Business University.

The use of quantitative trading has in recent years made accountability more complicated, said Hu, adding that trading system designers and policymakers should think more about risk control in trading.

Lu said legislating bodies should offer more specific definitions of inside trading and market manipulation.

During the Everbright purchase frenzy, many small investors took the surge as an official support of the stock market and followed with purchases of their own. Short-sellers in particular suffered losses from the sudden surge in the index.

Gen Shuang, senior partner of Guangzhou-based Bestfound Law Firm, said courts will not accept their lawsuits for compensation unless the CSRC defines what Everbright did as "market manipulation".

Strict supervision

Two days after the Everbright incident, Xiao Gang, head of the CSRC, chaired an internal conference in Beijing, promoting a new guideline reinforcing investigations into stock and futures markets.

"It seems Xiao has the support from higher levels to cure the disease of the stock market," a source close to the CSRC told China Daily. The CSRC reports directly to China's State Council.

Xiao's new arrangements include doubling the number of market investigators to 600 and sending them to six securities and futures bourses.

In early August, Xiao published an article in Qiushi Journal, a political periodical run by the Central Committee of the Communist Party of China, saying that the CSRC investigators face a range of problems in detecting violations, from gathering evidence on misconduct to convicting violators.

"Coordination between the CSRC and public security is very important, as investigations into financial crimes are very complex and require professionals. Joint work from both financial authorities and public security organs not only facilitates investigation, but it also provides bigger deterrents," Lu said.

xieyu@chinadaily.com.cn

(China Daily USA 08/26/2013 page3)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Newly born panda cub at Washington zoo doing fine

Market regulators need to fix loopholes

Singapore PM aims to cement relations

Experts call for details on rumor cases

Joint sea drill shows improved relations

Bo insists he did not abuse power

UN to probe alleged chemical attack

Using stray cats for rat control sparks debate

US Weekly

|

|