Nation's aircraft fleet set to triple: Boeing

Updated: 2013-09-06 07:18

By Wang Wen (China Daily)

|

||||||||

China will need 5,580 new planes valued at $780b in next 20 years

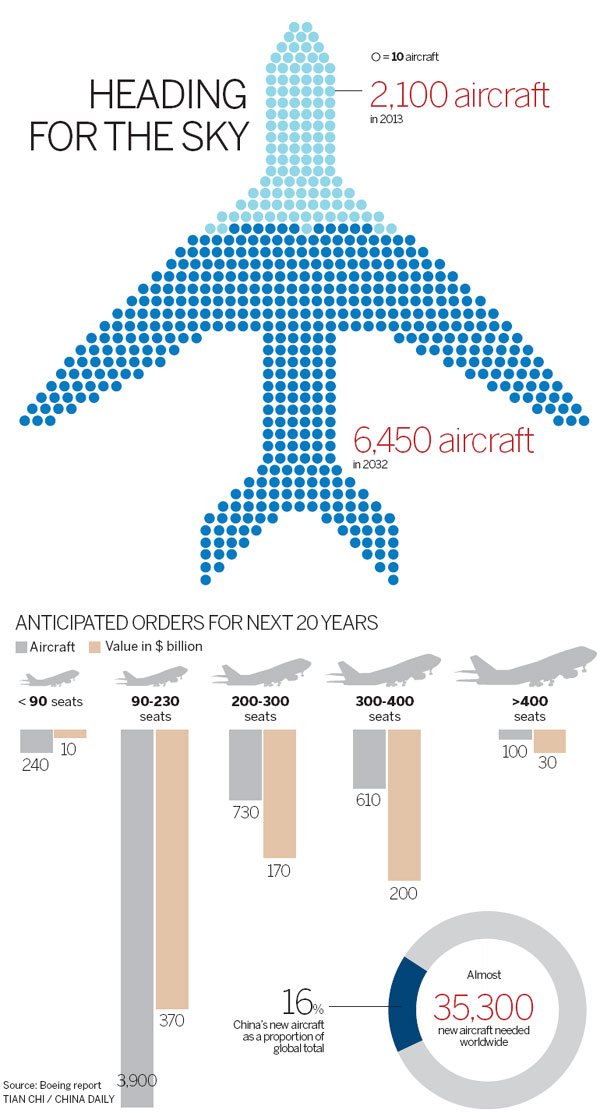

China's civil aviation fleet will triple to 6,450 aircraft over the next two decades, and Chinese airlines will grow faster in the international market than in the domestic sector, Boeing Co said on Thursday.

China will need 5,580 new aircraft valued at $780 billion during the period, the United States-based plane manufacturer said in its market outlook.

China's new aircraft market accounts for about 16 percent of the global total in terms of new deliveries and market value. More than 35,000 new commercial airplanes valued at $4.8 trillion are forecast to be delivered worldwide during the next 20 years, Boeing said.

Three-fourths of the new planes in China will be for growth rather than replacement, which shows that China is a fast-expanding market, said Randy Tinseth, vice-president of marketing of Boeing Commercial Airplanes.

"Thanks to strong economic growth and increased access to air travel, we project China traffic to grow at nearly 7 percent each year," he said.

Chinese airlines' share in the international market will also continue increasing, Tinseth said.

Long-haul international traffic to and from China is forecast to grow at an annual rate of 7.2 percent, primarily driven by anticipated passenger traffic gains between China and North America, Europe, the Middle East, Oceania and Africa, Boeing said in its market outlook.

Also, growth in the long-haul segment is expected to result in demand for an additional 1,440 new wide-body aircraft in China by 2032.

Foreign airlines said it is getting difficult to add flights to China, because of Chinese airlines' ambitions for the international market.

"I do not blame the government in China, because China has its own domestic airline expansion and it has to give priority to domestic airlines," said Akbar Al Baker, CEO of Qatar Airways Co.

In 2011, the Middle Eastern carrier launched a two-year plan to double its services to China from 35 a week, but as of now, it's only running 41 services weekly, including a new route between Chengdu and Doha that began on Tuesday.

The domestic market will remain the major market for Chinese carriers, and the size of China's domestic air traffic market will be close to North America's by 2031, Boeing forecast.

"China will surpass the US and become the world's largest domestic air travel market in the next 20 years," said Tinseth.

Growth will not just come from the big cities but also from second-tier markets, he added.

Beyond Beijing, Shanghai and Guangzhou, there are more than 50 other Chinese cities with populations exceeding 3 million people. Fast economic development in these cities is spurring air travel demand.

China's top 50 cities will account for 12 percent of global economic growth in the next 10 years, since they already represent an "economic entity" valued at $2.9 trillion, said Kin Keung Fung, managing director Greater China of real estate firm Jones Lang LaSalle Inc.

Growing domestic and regional routes also will spur a strong demand for single-aisle airplanes, with total deliveries in that segment reaching 3,900 through 2013, according to Boeing.

Some analysts warned that the aircraft manufacturer's forecast is too optimistic, as China's economic growth is slowing and Chinese carriers actually have excess capacity.

Boeing has adjusted its forecast for China's annual GDP growth over the next 20 years. In 2011, it put the figure at 7 percent; now, the forecast is for 6.4 percent - still double the global rate.

"The economic growth slowdown will lead to a slowdown of air traffic and capacity investment, definitely," said Li Lei, a civil aviation analyst with China Minzu Securities Co Ltd.

In the second quarter of 2013, international passenger traffic in China, as the largest economy in the Asia-Pacific region, continued to decelerate, the International Air Transport Association said on Sept 3. China's domestic traffic also slowed in July from June, according to IATA.

"China's air travel market may be showing its first signs of weakness," IATA said in its monthly results for July.

Chinese carriers have to adjust their capacity from this year going forward, since they invested too much in capacity growth in past years, when the market was booming, Li said. "The capacity adjustment will be painful."

To maintain an acceptable load factor, ticket prices are being cut, and carriers' profits are falling, he noted.

But Chinese airlines may invest more to add capacity on international routes, especially in North America, Li said.

For example, the capacity of Air China Ltd for its North American routes increased 17.6 percent year-on-year in the first half, while capacity growth on the European routes was only 4 percent. The carrier even cut 24 percent of the capacity on its Japan routes.

wangwen@chinadaily.com.cn

(China Daily USA 09/06/2013 page18)

China, Russia a step closer on gas supply

China, Russia a step closer on gas supply

18-year-old panda conceives triplets

18-year-old panda conceives triplets

Testing times for G20 leaders

Testing times for G20 leaders Homemade choppers make aerobatic stunt debut

Homemade choppers make aerobatic stunt debut

World-class partners bring NBA global games to Chinese fans

World-class partners bring NBA global games to Chinese fans

Shanghai's visa-free policy lifts tourism

Shanghai's visa-free policy lifts tourism

Panda twin cub born at Atlanta Zoo

Panda twin cub born at Atlanta Zoo

Xi, Mexican president meet for third time

Xi, Mexican president meet for third time

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Beijing's new product briefing a first for Apple

China, Russia a step closer on gas supply

Brazil asks for apology from US on spying

Japan to test wall for leaking water

Low-budget education abroad for working-class

Shanghai's visa-free policy lifts tourism

Films aim for success abroad

Xi vows economic reform at G20 summit

US Weekly

|

|