Price data send out soothing signals

Updated: 2013-09-10 07:00

By Chen Jia (China Daily)

|

||||||||

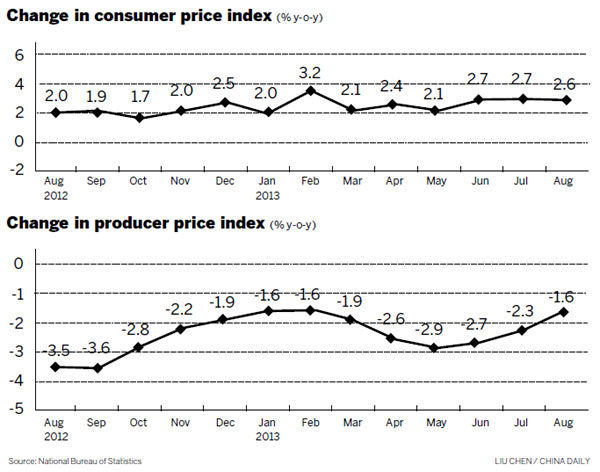

A moderate CPI and deflationary PPI leaves room for more growth in the remainder of 2013

Moderate consumer inflation and narrower producer price deflation in August sent out positive signals indicating the steady growth of the Chinese economy and cheering up investors amid the implementation of supportive measures by the government.

The benign inflation figures are expected to provide more space for policy-makers to take macroeconomic adjustment steps in response to any sudden headwinds from the external environment and concentrate on structural reforms, analysts said.

China's Consumer Price Index in August was up 2.6 percent year-on-year, compared with the 2.7 percent annual increase seen in July, the National Bureau of Statistics said on Monday.

Food prices, which increased 4.7 percent year-on-year in August, contributed 1.54 percentage points to the overall inflation figures, and were down from the 5 percent annual growth seen in July, while non-food price growth was 1.5 percent in August, slower than the 1.6 percent in July, the statistics bureau said.

Pork prices rose 6 percent year-on-year in August, compared with the 3 percent increase in July, vegetable prices rose 5.2 percent from a year earlier, down from July's 11.8 percent rise, and fruit prices rose 7.5 percent compared with 7.3 percent in the previous month.

Meanwhile, the country's Producer Price Index has dropped for 18 consecutive months, but PPI deflation continued to narrow down in August.

The PPI dropped 1.6 percent from a year earlier, compared with a 2.3 percent decrease in July, while it increased 0.1 percent from July, indicating a positive tone for the industrial production sector and the whole economy.

"Inflation is not a priority policy consideration this year," said Zhu Haibin, chief economist in China at JPMorgan Chase & Co.

Zhu expects full-year CPI figures to show a 2.6 percent growth, with a moderate boost to 3 percent in the fourth quarter, lower than the government's target of 3.5 percent in 2013.

"This provides room for the government to focus on stabilizing growth and pushing economic restructuring measures," he added.

Premier Li Keqiang wrote in an article for the Financial Times on Monday that the nation's "economy will maintain its sustained and healthy growth and China will stay on the path of reform and opening up."

The bullish economic data and the Premier's confidence boosted the Chinese stock market, which hit a nine-month high on Monday.

Yu Qiumei, a senior economist at the National Bureau of Statistics, said that the economic improvement was due to the government's efforts since the second quarter, which helped to facilitate the industrial restructuring process and maintain stable growth.

"Obviously, the overall economy is on a steady rebound trend," she said.

Ma Xiaoping, a Chinese economist at HSBC Holdings, said on Monday that some initial signs have already indicated an improvement in domestic demand, including the improved manufacturing Purchasing Managers' Index, as well as export data.

"We expect to see more upside surprises in growth data as recent policy stimulus measures filter through the economy," Ma said.

The National Bureau of Statistics will release the August industrial output, fixed-asset investment and consumption figures on Tuesday.

Since the second quarter, the National Development and Reform Commission - the nation's top economic planner - has been releasing guidelines to boost investment in the railway, infrastructure, environment protection and energy sectors, which is seen as an important factor to stabilize growth.

But aggressive stimulus measures are unlikely to be seen in coming months, as rising property prices, local government debt and the expansion of the credit-to-GDP ratio remain concerns for the country's leaders.

"We continue to expect prudent monetary policy with a slight bias towards tighter liquidity, as measured by total social financing, especially as economic growth starts to show signs of stabilization," said Chang Jian, a senior economist in China with Barclays Capital.

chenjia1@chinadaily.com.cn

(China Daily USA 09/10/2013 page14)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Is Alibaba using a 'negotiating ploy' with HK?

Diplomacy gets under way on Korean front

China loses nearly 20% of grains

China's premier warns on Syria

Trending news across China

AIDS is biggest killer among infectious diseases

China vaults to world's 3rd-largest investor

War could derail global recovery

US Weekly

|

|