Relax deposit rates in 2015: Minsheng head

Updated: 2013-09-12 07:53

By Wei Tian in Dalian (China Daily)

|

||||||||

China should consider lifting controls on deposit rates in 2015, when the preconditions for that move will be in place, the head of the nation's largest privately owned bank suggested.

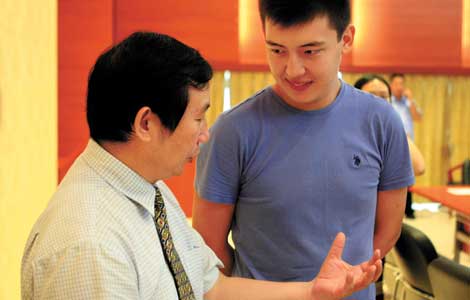

"It's been 17 years since China launched its market-oriented interest rate reform... Lifting the controls on deposit rates would be the last step in this process," said Hong Qi, president of China Minsheng Banking Corp, at the World Economic Forum in Dalian on Wednesday.

However, "this will be a progressive process to minimize the impact. An overly fast relaxation will lead to competition over interest rates among banks," he said.

The final move will come one or two years after the establishment of deposit insurance, Hong said. He added that a system for closing banks should also be introduced, as fierce competition might force some institutions to shut down.

"Shrinking margins between deposit and loan rates will force banks into high-risk areas, which will result in bank failures if risk management is not properly implemented," Hong said. "The year 2015 should be about time," he said.

The People's Bank of China ended the floor on loan rates on July 20. So far, the move has had little impact amid tight credit conditions and surging borrowing rates.

The central bank has maintained the cap on deposit rates, which are 1.1 times the PBOC's benchmark rates.

Wu Xiaoling, former deputy governor of the central bank, was quoted by China Securities News as saying last week that the conditions for removing controls on deposit rates are "not yet ripe." She said such a move was "not in sight within the next one or two years."

Wu also contended that deposit insurance was a precondition for the liberalization of deposit interest rates.

Ma Weihua, former president of China Merchants Bank, said at the Dalian forum on Tuesday that full liberalization of interest rates would be a "life-or-death" test for Chinese banks.

As the United States phased out interest rate ceilings on deposits in the mid-1980s, hundreds of banks failed. In Taiwan, a similar move led to broad losses in the banking industry, Ma said.

But Li Mingxian, president of China Guangfa Bank, who was speaking at the same forum on Wednesday, said most Chinese banks and companies are ready for deposit-rate liberalization.

He said the move will correct the misallocation of credit, and capital market participants expect a rapid removal of the controls to deepen the market.

"The impact of deposit rate liberalization will not be as severe as expected, because a maturing capital market in China has already adapted to volatility," Li said.

weitian@chinadaily.com.cn

(China Daily USA 09/12/2013 page16)

Premier stresses transformation of the economy

Premier stresses transformation of the economy

Soyuz capsule returns from space station

Soyuz capsule returns from space station

China's Christian churches reduce leaders' age ceiling

China's Christian churches reduce leaders' age ceiling

Student's rare blood bonds Kazakhstan and China

Student's rare blood bonds Kazakhstan and China

Apple's low-end phone price disappointing

Apple's low-end phone price disappointing

US marks 9/11 anniversary

US marks 9/11 anniversary

German Bach elected as IOC president

German Bach elected as IOC president

Implant surgery for boy's eyes a success

Implant surgery for boy's eyes a success

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China Daily Asia Weekly wins media award

Report questions US firms pursuing cloud computing in China

Reducing poverty gains momentum in Asia

China turns to US sorghum for animal feed

China's global firms face 'trust gap'

Li stresses transformation of economy

US delivers weapons to Syrian rebels

FM dismisses Philippine accusations

US Weekly

|

|