Stock market needs effective regulation

Updated: 2013-09-18 07:49

By Hong Liang (China Daily)

|

||||||||

Many economists have expounded on the view that deregulation, or the lifting of government control, is essential to financial reform. But their often repeated argument that too much control is strangling innovation has become a tiring clich that is anything but innovative.

The Everbright Securities' debacle has forcefully demonstrated that deregulation is more like a poison than an elixir for an immature market where intermediaries and investors, both institutional and retail, believe that they can get away with virtually anything to make a fast buck. Otherwise, how could Everbright be so crass and cavalier in weaving a web of lies to cover potential losses caused by an honest mistake?

It was good that the misdeeds of this wayward stock brokerage, one of the largest in China, were exposed although many angry investors believe that the penalties meted out by China Securities Regulatory Commission were too lenient to have much of a deterrent effect. But this case, together with the bank credit squeeze in June, serves as a stark reminder that the mainland financial markets are not ready for deregulation anytime soon.

However Hong Kong has shown that financial reform can be accomplished without deregulation, at least during the initial phase, as stronger and tighter regulations were needed to rein in market excesses and pave the way for financial reform.

The unruly Hong Kong stock market in the late 1960s and early 1970s was a free-for-all playground for the numerous sharp operators, or market sharks, both foreign and domestic. The music stopped abruptly in the great stock market crash of 1973, which wiped out the savings of many local punters. The carnage forced the government to step in to restore order in the investment market by forcing the merger of the four stock exchanges, drafting a new securities ordinance, establishing a watchdog agency with legal teeth and tightening the stock exchange listing rules as well as those applied to mergers and acquisitions.

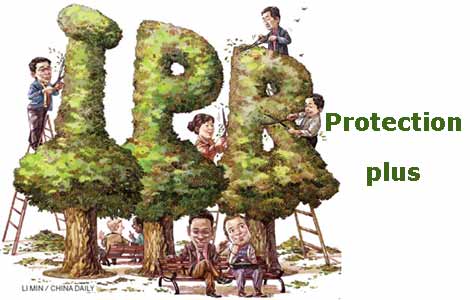

The process of financial reform has been continuing since then. In its latest move, the Hong Kong authorities amended the listing rules to provide greater investor protection against IPO malpractice. An important provision in the amendment holds the sponsors of IPOs criminally liable for improper statements in the prospectus.

There are people who claim the tightened rules will hurt Hong Kong's competitiveness against other capital markets in enticing IPOs from mainland enterprises. But that should not be a concern. Hong Kong is just catching up with other major financial markets in sprucing up its regulatory regime. Singapore, for instance, recently raised the bar for entrance into its stock market.

Xiao Gang, head of the China Securities Regulatory Commission has made known his intention to beef up the enforcement capability of his agency. In doing so, he will have a tough task overcoming the objection of the vested interests who have been reaping the biggest benefits from the lack of transparency, regulatory gray areas and a toothless watchdog agency.

The first step in a meaningful financial reform program is to eliminate the bad influence of vested interests by buttressing the regulatory regime, giving the watchdog agency greater legal power and providing it with sufficient manpower and other resources to combat market irregularities. The securities law must be tough, and the enforcement, effective, enough to convince the stock market charlatans that their dirty tricks won't pay.

Indeed, what the Chinese stock market needs to lift it from its prolonged gloom is tougher regulations and more effectual enforcement. These are the essentials of financial reform.

(China Daily USA 09/18/2013 page11)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China supports US-Russia deal on Syria

Trending news across China on Sept 18

EU ready for talks with China on investment pact

All's fare as apps take roads to upgrades

Space station to open for foreigners

Fine-particle pollution climbs in August: report

Number of China's female billionaires on the rise

Gun control debate gathers little steam

US Weekly

|

|