Smartphone firm rockets into the US

Updated: 2013-10-15 07:37

By Shen Jingting (China Daily USA)

|

||||||||

ZTE is launching a charm offensive in a tough market, in a major bid to promote its brand among American consumers, reports Shen Jingting from Houston

Few Chinese companies have managed so far to gain a footprint in the huge and profitable United States market. But more Chinese firms are trying to establish a presence there, especially smartphone makers such as ZTE Corp.

On Oct 5, in the Toyota Center, in downtown Houston, Texas, Cheng Lixin, the chairman and chief executive officer of ZTE USA Inc, looked a little bit nervous. A big fan of the NBA, Cheng was about to watch a preseason game featuring the Houston Rockets and the New Orleans Pelicans.

Cheng tried to keep calm by taking deep breaths. However, it was not only the game that was making him nervous. There was something much more important at stake. That night, he would make an important announcement to the thousands of people present at the venue and to many more outside the Toyota Center.

For the first time ever, ZTE was taking a bold move to market itself in the US market by using an NBA team's appeal. In the past several months, Cheng and his team had held frequent meetings with the management of the Houston Rockets to forge an alliance to boost ZTE's profile in the US smartphone market.

"This is the biggest overseas investment ZTE has made so far," Cheng told China Daily in an interview before that preseason game.

And the timing could not be better, since the Rockets' newly added Dwight Howard is playing this season together with James Harden, Jeremy Lin and others, making for a formidable team.

Many reasons made ZTE choose the Houston Rockets, Cheng said. Among them is the fact that Houston is one of the five biggest markets for ZTE in the US. The city can help ZTE conquer the country's smartphone market, which is now dominated by Samsung Electronics Co Ltd and Apple Inc.

"The Houston Rockets boast 350 million fans worldwide, and the team's popularity can also lift ZTE's branding in the United States," Cheng said.

That positive influence may even stretch to China, as well as to many markets in emerging countries, such as Indonesia and the Philippines, where a large percentage of young people are Rockets fans.

Branding

Under the terms of the deal, the ZTE is now the Houston Rockets' official smartphone supplier. The partnership will prominently feature ZTE's brand and products during Rockets games, as well as billboards and kiosks in Toyota Center - the team's main arena. In addition, Chandler Parsons, 24, a Rockets' rising star, will endorse ZTE's smartphones.

ZTE's partnership with the Houston Rockets has had an impact in Wone Brown's daily routine.

Brown, in his 30s, is a salesman at a Houston-based Aio Wireless store. Aio is a sub-brand under the telecom carrier AT&T and Brown's store sells several smartphone models, including ZTE handsets.

"People buy ZTE smartphones because they're quite cheap and of high quality," he said, on a sunny afternoon in the store, which is decorated with three glass walls. However, few mobile phone buyers know the ZTE brand and he needs to make an extra effort to promote the Chinese company's devices.

The most popular ZTE handset is a model priced at $49.99. That device is also the cheapest smartphone in the store.

"Maybe the Houston Rockets can help draw the customers' attention to ZTE smartphones, other than the pricing factor. The company is for sure making the right move," Brown said.

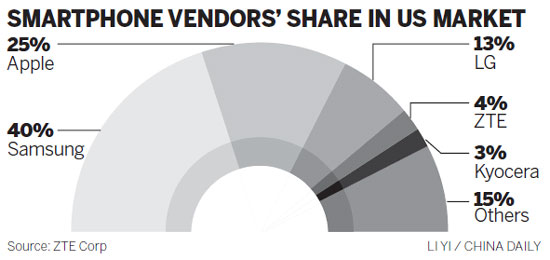

To many people's surprise, ZTE has already made inroads into the US smartphone market, quietly and steadily. ZTE is now the fourth-largest mobile phone vendor in the US, with a market share of about 4 percent, according to the company.

But the figure is still lagging far behind those of the top three players - Samsung, Apple and LG Corp. Samsung has an about 40 percent share, while Apple and LG have 25 percent and 13 percent, respectively.

Branding is the major obstacle for ZTE to overcome so that it is able to narrow the gap with the market leaders and to truly penetrate into the mid- and high-end smartphone sectors.

He Shiyou, executive vice-president of ZTE, recently said that there's only a three-year window for ZTE to survive and thrive in the global smartphone industry.

"In three years, either we go to heaven or we go to hell," He said in an interview in Beijing in September.

He admitted that ZTE is being urged to lift its branding amid the company's transformation from a low-end mobile phone maker to a vendor that is posing real challenges to Samsung and Apple in the mid- to high-end market.

He recalled that Samsung became an overnight sensation after its corporate sponsorship of the 1988 Seoul Olympics. After the event, the South Korean company successfully expanded to other parts of the world.

In He's opinion, similar things may happen to ZTE after the Houston Rockets deal.

"We hope that ZTE's alliance with the NBA can boost our brand awareness and reputation in the United States, China and even all over the world," He said.

US market

After more than a decade's development in the US, ZTE has gradually gained in-depth knowledge of the market. And since no other Chinese telecom companies set an example before, ZTE has to crack the market on its own.

The US has a population of 316 million and about 93 percent of the people are mobile service subscribers. Eight out of every 10 Americans own a smartphone, compared with the world's average smartphone penetration rate of 59 percent.

"Although you see many telecom carriers in the United States, the top 4 carriers - Verizon, AT&T, Sprint and T-Mobile - have almost 90 percent of the wireless market," said Shen Junjie, an official with ZTE USA.

Three-fourths of US mobile subscribers choose the postpaid model, which means that they sign contracts with carriers first and pay their bills later in accordance with their usage of the mobile services, Shen explained.

ZTE's US revenue mainly comes from its mobile phone sales, with its telecom equipment business contributing less than 10 percent of the company's revenue in the US.

ZTE, founded as a telecom gear manufacturer in the southern city of Shenzhen in Guangdong province in the 1980s, failed to get a major part of its revenue from its traditional business sector - but has flourished with its new focus area - smartphones.

"Because of political reasons, ZTE, as well as other Chinese telecom gear makers, are prohibited from entering the mainstream US telecom infrastructure market," Cheng said.

He recalled that in 2010, when ZTE took part in the bidding for a Long Term Evolution (LTE) project for Sprint, ZTE demonstrated a competitive edge over rivals and was expected to win at least one-third of the contract.

However, the US government intervened in the deal and asked Sprint to block ZTE. The government's move was based on a vague reason - "national security concerns". ZTE denied all the allegations.

In order to survive in the US market, ZTE had to seek new ways out. It found that the terminal business, especially the smartphone business, showed plenty of promise.

"Selling mobile phones avoids sensitive political issues," Cheng added.

The strategy shift has started to bear fruit. ZTE's sales in the United States, a mere $200 million in 2010, have almost doubled in 2011, and last year, revenue surged to $1 billion.

However, it is not an easy task to secure healthy and long-term success in the US. In the mobile phone industry, many famous companies rose, had dazzling performances and then tumbled. Those cases even included one-time local giants, such as Motorola Inc.

Taiwan-based HTC Corp used to be of the top smartphone vendors in the US. But the company has seen a shocking slump in the past two years. HTC's market share dropped to less than 5 percent in the US this year, from about 25 percent in 2011.

South Korean brand LG also stumbled in the US market because of wrong strategies, said Larry Liu, chief operating officer of ZTE USA.

"When most companies developed Android-based smartphones, LG made a bet on Windows Phone devices. Samsung and Apple widened the gap with LG in recent years," Liu added.

Cheng described ZTE as a leader in the challengers' group in the US smartphone market. Dominant players like Samsung and Apple still hold sufficient barriers to protect their market shares and profits.

Since ZTE entered the US market in 1998, the company has already built up partnerships with almost all of the US telecom operators, and that's the major reason, Cheng said, contributing to ZTE's current success.

"We firmly invested resources to support our carrier partners," Cheng said. He added that more than 95 percent of ZTE mobile phones are sold through telecom operators' channels in the US.

Partnership

There are 42 ZTE mobile phones selling in the US market now, with eight smartphones supporting LTE fourth-generation (4G) networks, he said.

"The next goal for ZTE is to be a top three smartphone vendor in the United States," said Cheng. That means the company is targeting LG, and the Houston Rockets partnership officially kicked off that strategy.

Neil Shah, a research director at Hong Kong-based CounterPoint Research, said in an interview with the Houston Chronicle that ZTE has been helped by weaker US performances from companies like Motorola and HTC.

But for long-term success, the Chinese company needs a positive brand pull, like the ones that HTC, Samsung and LG had, Shah said.

"ZTE needs to actively invest in invigorating its own brand in addition to state-of-the-art shiny hardware. Partnering with the Houston Rockets is a good step in the right direction for ZTE," he added.

Among ZTE's 300 staff in the United States, about 80 percent are local residents.

"Another experience for us is that we need to highlight the importance of localization," said Liu at ZTE.

It is critical to communicate with your customers in a way they easily understand, Liu added. Therefore, all the salespeople who deal with customers face to face are local staff. ZTE also set up a research and development center in Dallas.

Many Chinese handset makers have made their way into the top 10 globally, thanks to high-volume shipments of low- to mid-end mobile phones. Some of them reached leading positions in emerging markets, but few companies have made major progress in mature markets, such as in Europe and North America.

ZTE's US expansion may provide ideas to Chinese peers, said Xiang Ligang, a Beijing-based telecom industry expert.

"Chinese mobile phone vendors have ambitions to go global, but they need to figure out effective methods to conquer different markets. The North American market, no doubt, is the most difficult," Xiang said.

Huawei Technologies Co Ltd, a leading telecom gear and smartphone vendor, pays great attention to the European market, since it faces overwhelming political pressure in the US.

Huawei launched its new flagship smartphone, the Ascend P6, in London in June. Yu Chengdong, chief executive officer of Huawei's Consumer Business Group, said that Huawei would invest 270 million yuan ($43.98 million) in branding and marketing in Europe.

Lenovo Group Ltd, one of the fastest-growing smartphone companies in the world, aims to reduce its reliance on the home market and grow its businesses internationally, according to Liu Jun, senior vice-president of the company.

Contact the writer at shenjingting@chinadaily.com.cn

|

A model displays a ZTE smartphone in Taipei on Saturday. ZTE has signed a partnership to become the official smartphone supplier of NBA team Houston Rockets, which are playing preseason games in Taipei. Zeng Peng / Xinhua |

(China Daily USA 10/15/2013 page16)

New Yorkers celebrates Columbus Day

New Yorkers celebrates Columbus Day

Storm swamps car insurance firms

Storm swamps car insurance firms

Smartphone firm rockets into the US

Smartphone firm rockets into the US

3 US economists share 2013 Nobel Prize in Economics

3 US economists share 2013 Nobel Prize in Economics

Canton Fair to promote yuan use

Canton Fair to promote yuan use

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing

Senate leads hunt for shutdown and debt deal

Senate leads hunt for shutdown and debt deal

Chinese education for Thai students

Chinese education for Thai students

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Airport bomber sentenced to 6 years in jail

Conference salutes China-US ties progress

The itch that Kobe just can't scratch

Cosmetics is a mirror to China's economy

Chinese may have discovered the future of batteries

4 dead, power cut as M7.2 quake rocks Philippines

Row over NASA's ban should be wake-up call

Baidu 'worry ranking' exposes netizen anxieties

US Weekly

|

|