Company Special: Mercuria: Structural challenges in China's energy sector

Updated: 2013-10-29 07:26

By Zhang Zhao (China Daily USA)

|

||||||||

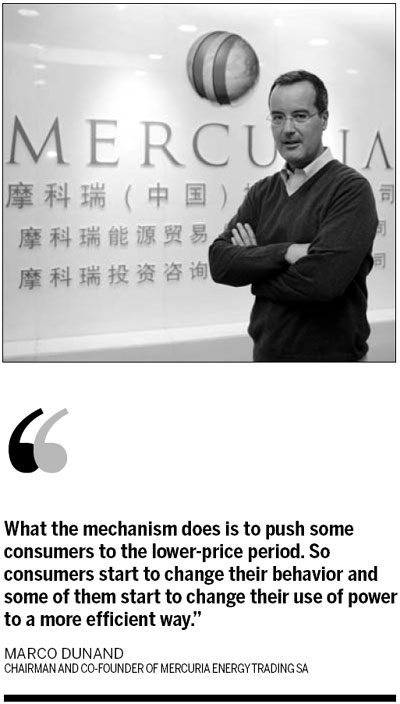

While Asia remains an engine for world economic growth, there will be some changes in its path to further development, said Marco Dunand, chairman and co-founder of Mercuria Energy Trading SA, a specialist in the energy commodity sector.

"Over the past decade, economic development in China has essentially focused on manufacturing," he said.

But in the next 10 years, the economy "will grow more internally".

He said that China before "produced many products that the world needed", but it will focus on its own domestic consumers in the future, and the service sector will gradually take over from manufacturing as a bigger segment in the economy.

|

Marco Dunand and his family at the Beijing Music Festival. Photos provided to China Daily |

"As services require fewer commodities than manufacturing, the big boom in commodities will slow and we will have more stability," he said.

Dunand said that traditional energy industries such as coal, oil and refining will still be strong, but efficiency must be improved to save energy.

He said that today China consumes "quite a bit energy" and some is not efficiently used.

He also suggested China learn from advanced countries and regions.

One example he noted is a system used in the United States and Europe that tags different prices for electric power at different hours in the day-when the power demand is higher, the price is higher.

"What the mechanism does is to push some consumers to the lower-price period," he said.

"So consumers start to change their behavior and some of them start to change their use of power to a more efficient way."

He suggested that China push forward renewable energy, as energy will remain a challenge in the future in term of cost.

He noted that the crude oil price for a refiner in the US is on average $15 per barrel cheaper than a Chinese refiner and the entire oil industry in the Middle East pays less for crude oil, so it will be difficult for Chinese refiners to be profitable in the long term.

Using shale gas and oil technologies, the US recently surpassed Saudi Arabia to become the world's top oil producer, which gives the US economy "a massive advantage, especially in industries that require a lot of energy".

"So there are challenges for China because shale gas and oil will last for very long time in the US and they will give the US a price advantage," he said.

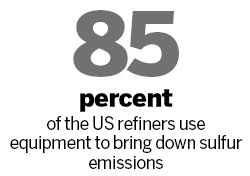

One solution for China in cheaper energy is to resort to coal, but that brings the problem of more pollution, which is already a challenge in China's refining industry, he said, noting that 80 percent of the US refiners use equipment to bring down sulfur emissions.

Only 35 percent of Chinese refiners now have that capacity.

He said it will take long time and a lot of investment to bring the Chinese refining industry to the level of advanced regions, but the Chinese government is aware of it and is acting.

Mercuria has been doing business in China for nine years.

It sells energy including oil to China, but its future focus will change.

The chairman said the company's Chinese offices and its partners in China will cooperate to promote clean and renewable energy.

As the son of a music conductor, Dunand has a special affection for music and art.

The company sponsors many art programs around the world, each with a theme.

In China it has sponsored the annual Beijing Music Festival seven years in a row.

By sponsoring the event, he would like to promote Western fine arts including music and opera.

He said music is a common language for people from different cultures and complimented the organizers of the Beijing Music Festival for their professionalism in setting up this high profile event.

zhangzhao@chinadaily.com.cn

(China Daily USA 10/29/2013 page14)

Ellis Island reopens for 1st time since Sandy

Ellis Island reopens for 1st time since Sandy ABC apologizes for 'Kimmel' joke

ABC apologizes for 'Kimmel' joke Lang Lang named UN Messenger of Peace

Lang Lang named UN Messenger of Peace

Snowfall hits many areas of Tibet

Snowfall hits many areas of Tibet  Antiquated ideas source of Abe strategy

Antiquated ideas source of Abe strategy

Storm wrecks havoc in S Britain, leaving 4 dead

Storm wrecks havoc in S Britain, leaving 4 dead

Women's congress aims to close income gap, lift status

Women's congress aims to close income gap, lift status

Sao Paulo Fashion Week held in Brazil

Sao Paulo Fashion Week held in Brazil

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Hawaii debates over gay marriage legalization

Kerry urges Iran to show nuke program peaceful

Albright counsels fact not myth in relations

Is Obama's lack of transparency really his fault?

San Diego Symphony debuts at Carnegie

Lang Lang takes on UN `Messenger of Peace’ role

Fonterra botulism scare laid bare in board inquiry

At 72, China's 'Liberace' still wows fans

US Weekly

|

|