The 11-square-mile experiment

Updated: 2013-10-25 10:19

By Zhang Yuwei (China Daily USA)

|

||||||||

|

China launched its new free trade zone in Shanghai on Sept 29. Photo shows an entrance to the 11-square-mile zone. Gao Erqiang / China Daily |

Shanghai's pilot Free Trade Zone is meant to be a showpiece for a possibly broader reform agenda by China's government. Will it work? Opinions range from high expectations to doubts, reports Zhang Yuwei from New York.

There are more than 90 policies concerning five major economic areas. There is a 10-page "negative list" of 18 main sectors of the national economy that are off-limits to foreign investors and further subdivides them into 1,067 subcategories. And the 10-page list has 190 special regulatory measures, which outline more sectors closed to foreign investors.

Welcome to China's pilot Free Trade Zone (FTZ), a 29-square-kilometer (11-square-mile) area in Shanghai established late last month that holds high expectations - as well as questions and doubts - from people within and outside the country.

Frequently compared to Shenzhen - a special economic zone set up in 1980s in Southern China that has boosted manufacturing and exports and attracted overseas investments - some predict the FTZ will threaten Hong Kong's position as an established financial hub.

"If we think about the Shanghai Free Trade Zone as a test market - the way Shenzhen was - so what's learned in Shanghai can be rolled out to the rest of the country, and that would be a very big deal, that would be truly a reform and opening up 2.0," said Carlos Gutierrez, former US Commerce Secretary and now vice-chair of Albright Stonebridge Group, a global strategy firm led by former US Secretary of State Madeleine K. Albright.

"I don't think it is unrealistic to have high expectations," Gutierrez said in an interview with China Daily. "China has always exceeded expectations. Nobody expected that when Shenzhen opened up and we've been looking at this unprecedented level of growth that China has had."

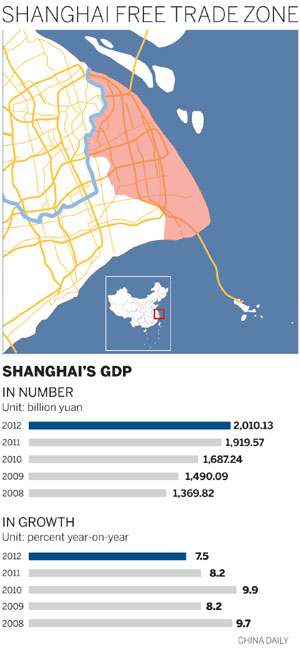

Located on the outskirts of the city of more than 23 million people where the Yangtze River empties into the East China Sea, the 11-square-mile FTZ is expected to navigate new ways of reducing government intervention and opening up the world's second-largest economy to international investments to create win-win benefits.

"It follows the tendency of global economic developments and reflects a more active strategy of opening-up," said China's Commerce Minister Gao Hucheng at the zone's opening ceremony, emphasizing that it was a "crucial" decision made by the government.

Test site

The timing of the zone's formation - just before the Third Plenum of the 18th Communist Party of China Central Committee in November - has also been widely talked about. Experts believe that the zone is a test site for something that will expand into other parts of China and represents a commitment by the country's new leadership to deepening market-oriented reforms and boosting the domestic economy.

"In the build-up to the party's Third Plenum, there has been much speculation over the policy priorities and reform initiatives," said James Sinclair, managing partner of InterChina, a strategy and merger-and-acquisition advisory firm that focuses on China.

"The establishment of the Shanghai FTZ has been feeding this speculation," added Sinclair, who has resided in Shanghai for the past decade. "The China bulls are using the FTZ to project their hope for sweeping reforms ahead. The China bears remain skeptical, pointing to the FTZ's lack of detailed policies and initiatives, and concern about the prospects of the Third Plenum unveiling meaningful reforms."

Gutierrez said creating the zone shows that the new Chinese leadership is serious about economic reform and is a way to "offset" the pressure of losing manufacturing due to wage increases.

"They are serious about reform and they understand that manufacturing is changing - as wages increase - manufacturing may go overseas, so China needs another growth engine," said Gutierrez. "And that growth engine could be the combination of a more open economy and more liberalization of financial services and other services."

As many link the rationale behind the creation of the new zone to the new leadership's economic reform agenda, Bo Chen, a professor who advised the government on the zone, thinks it was also driven by slower growth in the world's second-largest economy and "foreign aggression".

The influence of the Trans-Pacific Partnership Agreement is one example of that aggression, Chen wrote in a recent online commentary. Initiated by Singapore in 2005, the TPP requires member countries to eliminate all tariffs and open up their agricultural and financial services as part of the pact's bid to build a unified market in the Pacific Rim by 2020. Membership in the trade pact grew significantly after the United States signed up in 2008.

The US-led TPP was not immediately welcomed by some Asia Pacific countries. Japan and Vietnam have been persuaded by the US to join the negotiations, and China said it would consider doing so in the recent round of US-China Strategic and Economic Dialogue in July.

"Despite rumors about what reforms the FTZ may herald, its long-term policy objectives will generally remain consistent with the requirements of the TPP," said Chen.

A close look at the zone shows that it does offer some policies that potentially would attract foreign investment, especially when every global firm wants a success story in China.

A government-released blueprint of the FTZ shows those more than 90 policies concerning five major areas, including China's transforming its government functions, easing restrictions on foreign investments, facilitating international trade by further opening the service sector, deepening financial reforms and improving regulatory and taxation systems.

"While previously other similar zones, including the Shenzhen Special Economic Zone, focused on 'incentives' by adopting favorable income tax policies, customs and VAT (value added tax) breaks, the Shanghai FTZ is intended to be a testing ground for a largely free and open economy as measured by international standards," said Steven Zhang, managing director at New York-based Fund Tax Services LLC.

But Zhang, a Shanghai native, said the FTZ's tax policies will be "expected to be in line with the direction of overall tax reform in China and international practice".

"They will remain subject to study and adaptation, so as not to erode the tax base and to align with China's overall tax system for foreign investments," he said.

Giant duck to exit after drawing the crowds

Giant duck to exit after drawing the crowds

Miss Universe 2013 to be held in Moscow

Miss Universe 2013 to be held in Moscow

Ministry to begin inspecting most heavily polluted regions

Ministry to begin inspecting most heavily polluted regions

Spy claims stir rebuke to Obama

Spy claims stir rebuke to Obama

Paint the world a picture

Paint the world a picture

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

Latin American clown convention

Latin American clown convention

Prince George baptized in London

Prince George baptized in London

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US, China broadband companies join forces

Chinatown restaurants learn how to get an 'A'

Snuff bottle 'gems' on display at Met

Beijing airport set to become world's busiest

US firms urge easier process for investment

Wal-Mart plans to open 110 new stores

Spy claims stir rebuke to Obama

China calls for strengthened EU ties

US Weekly

|

|