Chinese law firm expands US presence

Updated: 2013-12-16 11:47

By Amy He in New York (China Daily USA)

|

||||||||

|

Zoe Qiao, managing partner of Yingke Law Firm New York |

With China's investments in the US steadily increasing this year, Chinese law firms are looking to help investors navigate US legal territory.

As part of its expansion in the US, Yingke Law Firm, which opened its first US office in New York's Rockefeller Center in 2012, opened an office in Chicago's downtown business district in November.

"This opening reflects the importance that Yingke places on its business relationships in the US, the Midwest, and the city of Chicago specifically," Yingke said in a statement. "Yingke helps its clients to understand how important local governments are to creating success in Chinese business."

In addition to Chicago and New York, Yingke, whose headquarters is in Beijing, has 14 other offices outside of China and 21 branches in China.

"It's been a fruitful year for us," Zoe Qiao, managing director at Yingke Law Firm New York, told China Daily. "This year has been a relatively busy year because we have a lot more expansion, and it's been a good time for cross-border transaction."

Chinese investors were involved with a lot of outbound investment in the US, Qiao said, which is in line with the country's broader economic transformation and restructuring. Chinese IPOs are making a comeback after almost two years of silence, and China became the third largest exporter of foreign direct investment in the world, with firms spending $7.5 billion in the third quarter of this year alone, according to research firm Rhodium Group.

As US-China economic cooperation grows, Chinese business leaders are learning how important it is to deftly navigate the rule-laden waters of the US legal system.

"A lot of Chinese companies make the step to go outbound, but the rate of failure is really high," Qiao said. "From previous examples, we saw a lot of publicly-listed Chinese companies get delisted due to SEC compliance and accounting issues."

In October, research firm Muddy Water called mobile security company NQ Mobile a "massive fraud," sending the company's stock plummeting. Muddy Water's report followed a long string of accounting scandals from Chinese companies doing business in the US, sending Chinese IPOs in the US to a standstill for the past two years.

"We saw record loss from these Chinese companies due to the fact that they're not familiar with business operations in the US and not familiar with the legal system," Qiao said. "It's been 'muddy water' for these Chinese companies, but they're learning their lessons - they're learning hard lessons through these failures and people realize that having a professional service team is really important."

Traditionally, Chinese companies think that being listed in the US is an easy route to internationalizing a company, Qiao said. But once they begin the process they find that the regulatory framework "requires more knowledge and patience" in dealing with the complexities of compliance issues.

Before stepping into the capital market, companies have to be aware of US Securities and Exchange Commission rules and make sure their accounting practices are up to standards, she said. "Conceptually, companies have to be 'international' before coming to the US," Qiao added.

Vice versa, for US clients venturing into China to do business, the legal minefield can be just as tricky. Intellectual property law is a particularly vexing issue, one that Qiao said US clients find intimidating.

"Although China is not a case-law country, there have been cases indicating that change will occur," she said. "We always tell our clients, 'It's not full of uncertainties and unpredictable problems.'"

amyhe@chinadailyusa.com

(China Daily USA 12/16/2013 page2)

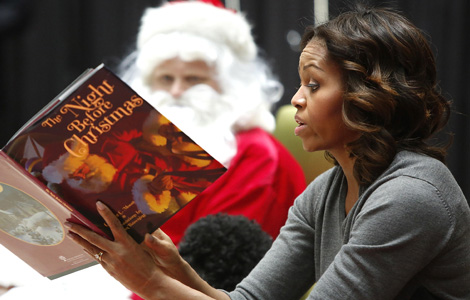

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

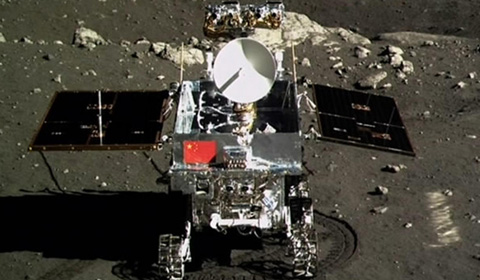

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Wall Street little changed as Fed set to meet

China hopes trade meeting fruitful

Japan to bolster military build-up

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

US Weekly

|

|