'Third board' expands over-the-counter equity market

Updated: 2013-12-16 15:09

By Cai Xiao (China Daily USA)

|

||||||||

The State Council released a statement on the National Equities Exchange and Quotations on Saturday, allowing domestic micro, small and medium-sized enterprises to be listed on the equity exchange system.

The statement shows China's efforts to build a multilevel capital market and ease companies' financing problems.

The National Equities Exchange and Quotations, the so-called "third board", will be a national equity exchange, offering services for innovative, startup or growing micro, small and medium-sized enterprises, the statement said.

The exchange was founded in 2012 and put into operation this January. Previously, unlisted enterprises from four high-tech industrial parks in Beijing, Tianjin, Shanghai and Hubei's provincial capital Wuhan could apply to trade equities on the third board.

Domestic companies meeting related requirements can apply for listings on the National Equities Exchange and Quotations through brokers.

Companies listed on the third board can apply for initial public offerings on the Shanghai and Shenzhen stock exchanges. Companies transferring shares on regional equity exchanges can apply for third board listings.

The number of shareholders of third board-listed companies can exceed 200. And the China Securities Regulatory Commission will regulate these companies as unlisted public companies.

Companies with no more than 200 shareholders do not need to be approved by the CSRC when applying for third board listings.

The statements also said China will set up and perfect an investor-eligibility system and strengthen regulatory cooperation.

The CSRC will implement the State Council's requirements, and develop and revise related rules and working processes, the CSRC said on Saturday.

The commission said it will revise regulations of unlisted public companies and make rules controlling their mergers and acquisitions.

Yi Jigang, president of the Beijing-based private-equity firm Orient Jiyi Investment, said the National Equities Exchange and Quotations statement is very positive for the Chinese capital market.

"The third board can help companies and investors find good cooperative partners and negotiate deals by themselves, which is very market-oriented," Yi said.

Yi said the development of the third board may attract some stock market funds, but the amount will not be big because third board-listed companies require small funds.

A banker at a globally leading investment bank, who declined to be named, told China Daily the bank had heard the news earlier and had reserved some companies.

If third board companies can apply for IPOs on the stock exchanges, more securities firms will do deals with SMEs, he said.

He said it is difficult for securities firms to find IPO programs, and third board listings can create many ways for them to earn money.

But in the long-term, he said, the National Equities Exchange and Quotations should make itself an independent equity exchange, rather than serve as an incubator of the Shanghai and Shenzhen stock exchanges.

It is called the third board because it is China's third national equity exchange, after the Shanghai and Shenzhen stock exchanges. It is also the only over-the-counter market regulated by the China Securities Regulatory Commission.

caixiao@chinadaily.com.cn

(China Daily USA 12/16/2013 page6)

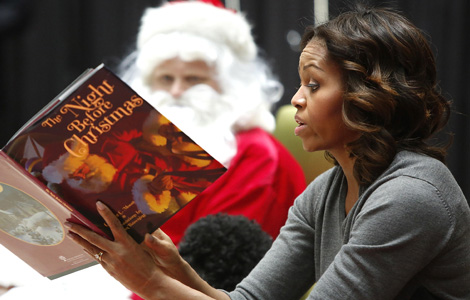

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

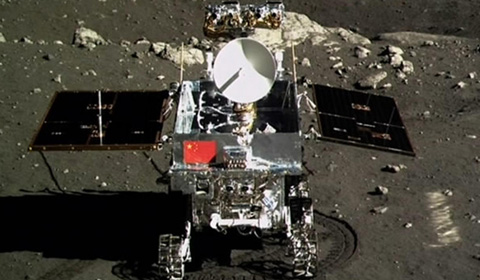

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Japan to bolster

military build-up

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

Kerry offers Hanoi aid in dispute

14 terrorists killed in Xinjiang

US Weekly

|

|