Tuning up for 2014 reform

Updated: 2014-01-06 07:18

By Andrew Moody (China Daily)

|

||||||||

China has set a course of major economic changes but extent and pace of implementation remains the big question, Andrew Moody reports

The annual Central Economic Work Conference in Beijing last month attracted more international attention than usual.

Commentators and observers were looking for what reform steps the new leadership were likely to introduce in the first full year in charge.

The increased anticipation was partly a result of the Third Plenum Session of the 18th Communist Party of China Central Committee in November that laid out an ambitious 10-year program by announcing the setting up of a high-level commission to coordinate nationwide reforms.

The four-day economic work conference was attended by all seven standing committee members of the Political Bureau of the CPC Central Committee, including President Xi Jinping and Premier Li Keqiang.

The main focus, particularly for the markets, was an indication as to what growth target the government was likely to set for 2014.

With the outcome for 2013 still not known - although now expected to be about 7.6 percent - what analysts were looking for was whether the government was about to relax the target from "about 7.5 percent" this year to allow room for structural economic reform.

The actual new figure will not be known until the March meeting of the National People's Congress, the national legislature.

Those reading the tea leaves at the economic work conference anticipate that this is likely to be between 7 percent - what government officials have already stated is the absolute floor - and 7.5 percent.

With China likely to be buoyed by any pick-up in global economic demand, another 7.5 percent target may not indicate a lack of appetite for reform.

Growth targets also have a history of not changing very much. Until 2012, when it dropped to 7.5 percent, the figure had been held at 8 percent for eight successive years.

As for some of the language used in the official statement released on Dec 13 at the end of the conference, it was difficult to detect discernable change.

In fact, maintaining a "proactive" fiscal policy and "prudent" monetary policy was the same terminology used in the previous year's statement.

There was, however, a big focus this time on the problem of local government debt, which many hold is the central weakness of the economy. The statement called for local authorities to be held accountable for their budgets and to "put right any incorrect official performance orientation".

The conference also called for industrial restructuring and an end to excess capacity in certain sectors and the phasing out of obsolete industries in favor of those promoting innovation.

In other areas, the conference wanted to push forward agricultural reform to be less reliant on imports and also improve food security.

There was also emphasis on opening up the economy and the need to set up further free trade zones, such as the one in Shanghai launched last year.

This is likely to hold the key as to the pace of the opening-up of China's capital markets, which is seen as one of the most risky but at the same time vital reform processes the economy has to withstand.

Shuang Ding, senior China economist at banking group Citi in Hong Kong, says the risk of anticlimax following the third plenum had been avoided and it was clear the government was serious about economic reform.

"I would say that it is further confirmation that the leaders are very determined to push ahead with reforms."

Ding, a former economist at the International Monetary Fund, believes the reform agenda still has an inbuilt conservatism. He says the government is likely to stick to a 7.5 percent growth target for 2014.

"This is one of the key messages I got ... that the government is not ready to sacrifice growth in a very significant way and that they emphasize that a stable economic and social environment is still a necessary condition for reform."

He says he can understand the government's caution on this.

"I think not only policymakers but I would say most in the financial markets are not ready to accept below 7 percent growth yet. I think that would be a real gamechanger."

Michael Power, global investment strategist at Investec Asset Management, based in Cape Town, believes the conference indicated the government is intent on adopting a major reform strategy.

"My essential reading is that the authorities are going to surprise on the upside with regard to taking the tough decisions regarding implementing reform, even if this has the effect of marginally reducing GDP growth," he says.

"I think they realize that 7 to 8 percent real local currency growth, or some 13 percent if you add back inflation and currency appreciation, is hardly modest for a country which already ranks as the world's second-largest economy."

Ruchir Sharma, head of emerging markets and global macro at Morgan Stanley in New York, and author of Breakout Nations: In search of the Next Economic Miracles, says he was looking for pointers for growth from the conference.

"I will be more encouraged if China relaxes its growth target to below 7.5 percent," he says.

"I just think the current level of growth is just too high for a middle-income economy, and especially when it is taking on so much additional debt to meet that target."

He says that China with a per capita income of around $7,000, has reached the stage when the previous "miracle economies" of East Asia, such as Japan and South Korea began to slow from double digits to around 5 to 6 percent GDP growth.

"The popular narrative is that slower growth will feed joblessness and social tension. This fear is misplaced. Every percentage point of growth in China's maturing economy now produces 1.6 million to 1.7 million new jobs, up from 1.2 million 10 years ago. So even at GDP growth of 5 to 6 percent, China would generate enough new jobs, particularly at a time when the population is aging and fewer young people are entering the workforce."

Louis Kuijs, chief China economist of the Royal Bank of Scotland in Hong Kong, says the conference made clear that reform would not be carried out overnight and that the agenda set out at the third plenum should not be seen as a short-term project.

"It (the Central Economic Work Conference) was relatively cautious. I don't think we should expect any rapid breakthroughs relatively soon," he says.

Miranda Carr, head of China research at North Square Blue Oak, based in London, agrees with that assessment.

She says that although the government has a radical agenda, the conference for her made it apparent it was not going to be easy to implement.

"While China's reform program promises to lift China's economic development quite radically over the longer term, it is not going to be plain sailing," she says.

"The conference promised stability and steady development and not major change. This indicates that consensus has been difficult to achieve on more contentious issues."

Many were looking to see pointers that the government was intent on introducing financial reform, such as bringing competition into a banking sector dominated by the Big Four State-owned banks, and further opening up the capital markets.

Ding at Citi believes the conference pointed to a series of announcements on financial reform.

He expects progress on such measures as the widening of the renminbi trading band, the setting up of private banks and a pressing ahead with qualified domestic institutional investors, which will allow private individuals to invest in assets abroad such as equities and bonds and maybe even property. Chinese citizens are currently restricted to sending just $50,000 abroad in any one year.

"All these measures seem to be ready to be rolled out, so we may see a lot of small steps in 2014, " he says.

"Taking a longer view, I think complete interest rate liberalization and a free system is some time off. I do think Zhou Xiaochuan, the governor of the People's Bank of China, is, however, completely committed to that."

Carr at North Square Blue Oak says there were obvious risks with financial reform that the government had already encountered.

She points out that e-commerce giant Alibaba Group's Yu'ebao fund lured 100 billion yuan ($16.5 billion) away from the country's bank deposits in just four months.

"New innovative financial products such as this are already causing quite a lot of disruption to the financial system," she says.

For George Magnus, senior independent economic adviser at UBS AG based in London, reforming the banking system could prove risky.

He is worried about the over-indebtedness of the local government sector and says this makes it a difficult time to introduce such reforms.

"Financial liberalization could end up backfiring. If you allow interest rates to go up and the market a free rein in determining the cost of capital while you have a legacy of debt within local governments and SOEs (State-owned enterprises), you are going to get the problems of non-performing loans and asset prices going the wrong way. You can't afford to get the sequencing wrong."

There was also interest in a separate work conference, the Central Urbanization Conference, held in December.

It placed emphasis on the reform of the hukou or household registration system so that migrant workers enjoy the full social benefits of the cities they migrate to.

Some believe this is the key to China becoming a more consumer-led economy, because if workers move with their families to cities, they are likely to spend more rather than save money and remit it home

Some commentators are worried that the government is trying to make urbanization an object in itself rather than an outcome of other policy initiatives.

According to management consultants McKinsey & Co Inc, China's urban population might hit 1 billion by 2030.

Junheng Li, founder of JL Warren Capital LLC, a New York-based equity research company focusing on China, and author of Tiger Woman on Wall Street, says there did not seem to be any sense of urgency coming from the conference about hukou reform.

"When I grew up in Shanghai, they tried to urbanize fast, but they didn't have enough jobs for migrant workers, so the crime rate went up too fast. My mom used to say I needed to be extra cautious when I rode on the buses," she says.

"You can't just wield a stick at 300 million people and tell them to move to the cities without anything to go to in the first place. That goes right to the heart of the hukou system. When migrant workers go to the cities, they should not be treated as second-class citizens. They need to be provided with equal opportunities."

Kuijs at Royal Bank of Scotland Plc says at some point the government may have to throw some red meat to convince everyone that they are really serious about reform.

He says one key reform he would like to see is dividends from China's SOEs going directly to the Ministry of Finance and not, as at present, going to the State-owned Assets Supervision and Administration Commission, the body that runs SOEs.

"This would really send a strong signal about the resolve of the government," he says. "This is public money and if it goes back to the overall fiscal envelope there can be a proper discussion about what should be done with this money."

Magnus at UBS says the difficulty for the government is effecting change without the risk of creating dangerous imbalances.

"Economic history is littered with seemingly innocuous moves that have butterfly-wing effects. It was a small interest rate rise in Germany that precipitated the global stock market crash in 1987. It was also one of the last interest rate rises in Japan in 1989 that led to the great Japanese bust. These could be warning signs for China."

Ding at Citi says the government is aware of the risks but is determined to press ahead with the reform agenda. "I think the government will accelerate reform in 2014, particularly in the areas where they have reached a consensus, such as in the financial sector," he says.

(China Daily USA 01/06/2014 page13)

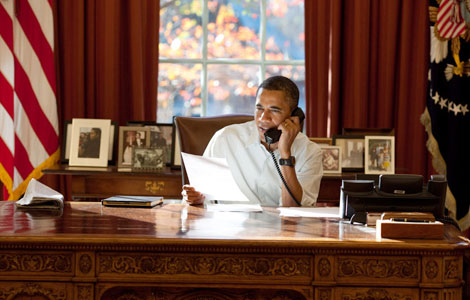

Offices of world leaders

Offices of world leaders

First Taiwan-born panda makes public debut

First Taiwan-born panda makes public debut

India successfully launches heavy lift rocket

India successfully launches heavy lift rocket

Xuelong waits for chance to break free

Xuelong waits for chance to break free

Fewer candidates take graduate entrance test

Fewer candidates take graduate entrance test

Frigate escorts transport of Syria chemical weapons

Frigate escorts transport of Syria chemical weapons

Putin, Belarussian president play ice hockey

Putin, Belarussian president play ice hockey

Federer, Hewitt to meet in Brisbane final

Federer, Hewitt to meet in Brisbane final

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Small plane crashes in Colorado

NYC Chinatown weathers killer storm

Program helps ex-inmates find work

'Life-threatening' cold bites US Midwest

Backing out of China to reshore

China keeps Africa as a key pillar

Major corruption cases up in 2013

New grads look abroad for first jobs

US Weekly

|

|