Homing in on affordable housing units

Updated: 2014-01-27 15:29

By Hu Yuanyuan (China Daily USA)

|

||||||||

Move a priority to aid lower income families in capital, Hu Yuanyuan reports

On the first page of the 2014 calendar, Wang Yiguo, a 28-year-old company executive, wrote down his new-year wish: Good luck with my attempt to win an apartment subsidized by the government.

With a monthly income of 8,600 yuan ($1,387), the young man is finding it increasingly difficult to buy an apartment in the capital where the price of a home in a suburban area has now exceeded 25,000 yuan per square meter.

|

Government-subsidized homes in Beijing's Haidian district were equipped last year with environmentally friendly solar water heaters. The capital will provide 50,000 units of government-subsidized homes this year. Xinhua Photo |

Wang's wish came from the Beijing municipal government's commitment to further boost the supply of government-subsidized homes to address the housing difficulty of middle- and low-income families.

City Vice-Mayor Chen Gang said during the Beijing Municipal Committee of the Chinese People's Political Consultative Conference (CPPCC), the city's political advisory body, that the municipal government will add 50,000 units of government-subsidized housing into the market this year, which is expected to largely ease the housing difficulty for middle-income families.

In October, the Beijng municipal government announced it would encourage the availability of owner-occupied commercial residential projects at 70 percent of the market price. Buyers are not allowed to sell the home within five years and the government has the priority to purchase it back or share 30 percent of any price gain after that period.

Low-income housing

Priority will be given to those on Beijing's affordable-housing and low-income housing waiting lists, as well as to single people who are more than 25 years old and lack a home in Beijing.

Nearly 80,000 applicants were eligible for the capital's first such project in Dougezhuang township in Chaoyang district, but only 2,000 units are available, so a lottery system was implemented to select buyers, under the supervision of government officers.

For Zhang Wei, deputy head of the Beijing municipal bureau of land resources, the newly added 50,000 units of government-subsidized homes will greatly change the supply-demand structure because approximately 80,000 new commercial residential apartments are offered each year in Beijing.

According to Chen, the government will further promote the construction of homes with shared ownership between buyers and government.

The government will offer property developers a much lower land cost in building such types of homes, thereby helping buyers to purchase them at a price 30 percent or even 50 percent lower than regular common residential homes.

The policy was carried out in accordance with the government's overall guidelines for solving the housing problem - low income parties are guaranteed places to live, the middle classes can afford to buy apartments under favorable policies and the rich are limited in what they can buy.

While previous regulations to restrain demand have been effective, the policy has now shifted to focus more on the supply side to ease the supply-demand contradiction.

All these measures, according to Zhang Dawei, director of Centaline Property's research center, is pointing to a trend that will let the market play a bigger role.

The market is in urgent need of a long-term mechanism that will allow it to adjust by itself, said Zhang.

Zhu Zhongyi, deputy head of the China Real Estate Industry Association, said at a recent forum that a long-term real estate policy mechanism should be established, mainly through economic and legal measures.

The most obvious signal, according to Zhu, is to promote the reform of real estate taxation. The relevant government departments are actively working on the project, but a timetable is not available yet. As a premise, a unified real estate registration system will be established this year.

According to Zhu Haibin, a China economist with J.P. Morgan and Chase Co Ltd, the new administration may bring in a new policy framework in the housing market by relying less on short-term demand-side measures and introducing long-term supply-side measures.

Long-term measures

Such long-term policies include introducing real estate taxes, land reform in rural areas and increasing housing supply, especially affordable housing, Zhu said.

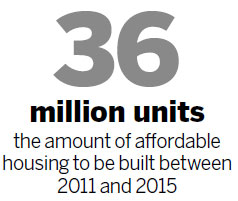

According to a research note by J.P. Morgan, the State Council announced it will start building 36 million units of affordable housing between 2011 and 2015. Based on official announcements, between 2011 and 2013, 24.9 million homes were started and 15.8 million homes were completed. The Ministry of Housing and Urban-Rural Development announced that the 2014 targets were 6 million units new starts and 4.8 million units for completion.

"The ambitious affordable housing project could be the game-changer in the coming years," said Zhu.

For Wang Rongwu, deputy head of the Beijing municipal commission of housing and urban-rural development, if the housing problem of low- and middle-income families is properly addressed, the prices of high-quality commercial housing will be decided by the market in the future.

At the Third Plenum of the Communist Party of China's 18th Central Committee in November, the Party pledged to let markets play a decisive role in allocating resources as it unveiled a reform agenda for the next decade.

A more decisive market role has become visible in many areas.

For instance, Wang Huamin, a member of the CPPCC Beijing Municipal Committee, put forward a proposal to reform Beijing's subway ticket pricing policy.

"In the short term, the government should raise subway fares to 4 yuan during the rush hour on work days and keep the price at 2 yuan during off-peak hours. In the long term, I think a refined system of ticket pricing should be established to provide different options for passengers, including an annual card for peak times, an ordinary annual card and a seasonal card."

Beijing's current flat-rate subway fare of 2 yuan, which allows passengers to ride on any line and make transfers, is even cheaper than 15 years ago, when it was first increased to 3 yuan in 1999. The fare was reduced to 2 yuan in 2007 to encourage public transportation and ease road congestion.

The more decisive role of the market also involves areas such as interest rate liberalization, moves to remove administrative barriers to private capital and other forms of financial liberalization.

However, such a process cannot be accomplished in one stroke.

When industry insiders all agree that a long-term mechanism should be established, the ending of administrative measures, it will not be easy to phase them out in the short term.

According to Liu Xiaoguang, chairman of Beijing Capital Group, it is a bit difficult to let the market play a decisive role in the property sector in the short term, especially in first-tier cities such as Beijing and Shanghai.

Chen also stressed that in Beijing, the policy to restrict the number of homes a family can purchase will continue. And the mortgage policy to prevent investment-oriented purchase will also persist.

Currently, a family with a Beijing hukou (full right of residency) is allowed to purchase no more than two apartments. The down payment for a second homebuyer is 70 percent with an interest rate of 1.3 times the benchmark interest rate.

Ren Zhiqiang, chairman of Huayuan Real Estate Co Ltd, said he hoped there will be a more clear-cut of the division of labor between government and property developers. If the government can do a good job in ensuring housing for middle- and low-income families, then the market could play a bigger role in allocating resources and deciding prices, he said.

Contact the writer at huyuanyuan@chinadaily.com.cm

(China Daily USA 01/27/2014 page16)

Tough Guy event in England

Tough Guy event in England

Syria talks bring offer of exit from siege of Homs

Syria talks bring offer of exit from siege of Homs

Anti-World Cup protests wane in Sao Paulo

Anti-World Cup protests wane in Sao Paulo

India celebrates 65th Republic Day

India celebrates 65th Republic Day

Motorcyclists brave windchill for homecoming

Motorcyclists brave windchill for homecoming

8.8% salary hikes expected for 2014

8.8% salary hikes expected for 2014

Holiday fireworks lose their sparkle amid smog

Holiday fireworks lose their sparkle amid smog

Three dead in US mall shooting

Three dead in US mall shooting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Talent returns to China, but progress slow

300 ill on Royal Caribbean ship

US mall shooting gunman identified

China's banks must evolve or perish

China takes measures against H7N9

Holiday fireworks lose sparkle

US tariff investigation clouds commerce

Uygur teacher involved in separatism

US Weekly

|

|