L'Oreal looking pretty in the Chinese market

Updated: 2014-02-04 07:49

By Li Fangfang (China Daily)

|

||||||||

Global brands target affluent shoppers in third- and fourth-tier cities, as more people are attracted to luxury products

Before celebrating her 34th birthday with her husband in a Japanese restaurant, Yang Yi went to the nearby Yaohan shopping mall.

"I wanted to buy a set of Lancome eye cream and serum products as a gift to myself," said Yang, the owner of an advertising company in Zhenjiang, Jiangsu province.

Yang, who has been buying Lancome products since 2009, said that the serum, which is similar to a moisturizer and costs 1,080 yuan ($178), is affordable.

She added that the same product costs 300 yuan less in airport duty-free shops, but that she has stopped asking her friends to buy her some when they travel. She now prefers to interact with the shop assistants at her local Lancome shop.

The French brand started selling its products in Zhenjiang in 2011.

"Face-to-face purchases with professional beauty advisors help me to choose the most suitable products. Furthermore, I can try other products and get gift samples," she added.

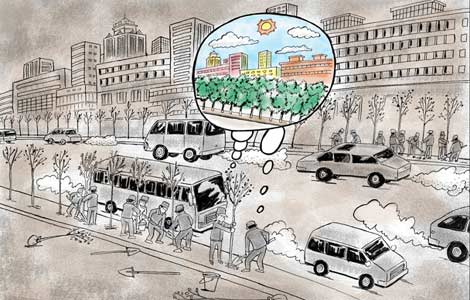

In recent years, due to increasing incomes, more people in lower-tier cities are buying high-end cosmetics and other beauty products. This has provided opportunities for luxury brands to boost their business outside the mature and saturated markets in first- and second-tier cities.

"The trend is clear and significant," said Cindy Yang, senior director at research and consulting firm Nielsen Holdings NV in China.

Nielsen's data showed that the market share of low-end cosmetics and beauty products in lower-tier cities in China dropped sharply from 47 percent to 28 percent in the past two years.

"In the last three years, third-tier cities, after first-tier cities such as Beijing, Shanghai and other provincial capital cities, have become the fastest growing markets for high-end cosmetics," said Yang.

"As disposable incomes continue to increase, third- and fourth-tier cities, where 70 percent of Chinese people live, will see rapid growth, faster than first- and second-tier cities, for high-end cosmetics," she added.

Lancome is a good example. In 2011, when the French company opened its first store in Yichang, Hubei province, the brand saw impressive daily sales of about 1 million yuan.

That record was soon broken, however, after Lancome sold 1.3 million yuan worth of products on its first day in Zhenjiang's Yaohan shopping mall.

"This is a unique phenomenon in the world and with our leading brand Lancome, we have always been a pioneer in China to plant the flag of luxury where no other brand has ventured before," said Stephane Rinderknech, vice-president of L'Oreal China and general manager of the group's luxury division L'Oreal Luxe.

"Lancome leads, others follow, but customers will always remember that Lancome brought luxury beauty products to them first," Rinderknech said.

In 1997, L'Oreal took Lancome to Hangzhou, Zhejiang province.

"Since then, the Hangzhou store has been one of the most successful Lancome outlets in the world," Rinderknech added.

Lancome now has 179 outlets in more than 80 Chinese cities. Last year, it opened stores in lower-tier cities such as Jiaxing, Shangyu, Zhuji in Zhejiang province and Weifang in Shandong province.

As the fastest-growing seller of luxury beauty products in China, L'Oreal Luxe allows the group to further boost its leading position in the country.

Last year, L'Oreal said that taking its Luxe unit to an increasing number of lower-tier cities will be the company's focus in the coming years.

"Our ambition with our beauty brands is to capture the growing Chinese middle class," said Rinderknech. "First-tier cities are important, however, more potential comes from lower-tier cities."

According to L'Oreal's data, people in first-tier cities consume 3.6 beauty products per person per year, on average, while those in third-tier cities buy 1.1 products and consumers in fourth- or fifth-cities purchase 0.4.

Nielsen also found that high-end cosmetics and beauty products have 16 percent of the overall market share in first-tier cities, while the share is below10 percent in lower-tier cities.

Though Rinderknech said that customers in higher-tier cities are more used to luxury brands and have more choices than those in lower-tier cities, she added that L'Oreal has noticed that those differences are getting smaller as many Chinese customers are traveling abroad and have higher expectations for luxury products.

Previously, Chinese customers were mostly looking to gain status and get recognition from others when choosing luxury brands. However, today they want brands that they know and that they like, Rinderknech said.

"This is a fantastic opportunity for us as we position each of our luxury brands to be desired by each Chinese customer and create a strong emotional connection," Rinderknech added.

Distribution channels

According to Yang at Nielsen, consumers in first- or second-tier cites can buy their favorite luxury cosmetics from diverse distribution channels, from brand boutiques, shopping mall counters, beauty chain stores, to duty-free shops at domestic and international airports.

However, "the current distribution channels in lower-tier cities cannot satisfy the consumers' desire for beauty," said Yang.

International brands "have conquered higher-tier cities, as local consumers spend 45 percent of their beauty budgets on foreign brands, while the figure is only 21 percent in lower-tier cities," she added.

To gain market share in lower-tier cities, Yang suggested boosting the presence of brands as the first step to approach local consumers.

"Also, the brands should pay attention to consumer habits and local environments in different markets to fine-tune products and sales strategies," said Yang.

"We bring luxury beauty products to people who used to travel far to get them," Rinderknech added.

For the different brands under L'Oreal umbrella, "the plans vary depending on each of our brands and its development stage, while the intention remains the same: conquer the rising middle class in China".

According to Rinderknech, Armani Cosmetics, which is distributed by L'Oreal, is already building a super-premium image in first- and second-tier cities, where it's "building desirability for its best-selling skincare product Crema Nera. Third-tier cities will follow when both the brand and its customers are mature enough".

Another L'Oreal brand, YSL Beauty, which was launched in May in Shanghai will be first established in higher-tier cities and will then be launched in lower-tier cities.

"I could say the same about Helena Rubinstein. The brand's mission is to offer the best premium skincare products with the best service to the most demanding customers," said Rinderknech.

"It takes very long to find and to train our beauty advisors so that they can provide the unique level of service that goes with our best innovations. We cannot compromise on our service quality, therefore although we would like to offer the brand to a larger number of customers in lower-tier cities, we must take our time to do things perfectly," Rinderknech explained.

Another example is Clarisonic, which L'Oreal launched with partner Sephora in January 2013 and is present in all Sephora stores.

"Sales in top-tier and lower-tier cities were well-balanced, which was quite surprising to us," Rinderknech said.

Meanwhile, online sales among young people are booming, especially in lower-tier cities, Yang at Nielsen said.

Rinderknech said that "the rise of digital is helping us to build better brand awareness in lower-tier cities".

For instance, a brand like Kiehl's, the American cosmetics brand that is the fastest-growing brand in the Chinese market, is very popular in lower-tier cities.

"Chinese digital platforms allow the buzz about brands to circulate in no time and accelerate the construction of brand awareness, which makes an exciting brand like Kiehl's already known and strongly desired in many places in China," said Rinderknech.

|

Products on display at a shopping mall in Xuchang, Henan province. China's third- and fourth-tier cities have become the fastest-growing markets for high-end cosmetics thanks to rising incomes. Geng Guoqing / for China Daily |

In teen star transition, Bieber may want to emulate Miley

In teen star transition, Bieber may want to emulate Miley

Thai caretaker PM urges protesters not to block voting

Thai caretaker PM urges protesters not to block voting

Holy waters in Nepal

Holy waters in Nepal

Kongfu stars wax shine in London ChinaTown

Kongfu stars wax shine in London ChinaTown

Obama pushes minimum wage hike

Obama pushes minimum wage hike

Getting ready for some football

Getting ready for some football

The Year of Horse gallops in

The Year of Horse gallops in

Musical celebration of Fab Four anniversary

Musical celebration of Fab Four anniversary

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Non-manufacturing PMI drops in January

Navy starts West Pacific drill

Shooting spree fugitive caught

WeChat cash gifts popular

Li signs regulation on state secrecy law

Obama speech on NSA welcome

Tape of King speech found

Norovirus blamed for cruise sickness

US Weekly

|

|