Qianhai poised for a breakthrough

Updated: 2014-04-18 11:40

By Wong Joon San (China Daily USA)

|

||||||||

Qianhai, the major financial center and experimental laboratory for the study of China's developing offshore renminbi business, expects impressive 'breakthroughs' this year, in financial innovation, cooperation with Hong Kong and urban construction. Wong Joon San reports.

The Qianhai economic zone, just across the border in Shenzhen, is wasting no more time moving forward with its three-pronged plan, announced on February 27, to counter the anticipated impact on local commerce from the Shanghai Free Trade Zone.

The 15-square kilometer Qianhai site, hailed as the prospective "Manhattan of the East," anticipates three major breakthroughs before the end of this year, in financial innovation, cross-border cooperation with Hong Kong and in construction of local infrastructure such as international schools, hospitals and other necessities required of a comfortable living environment.

Completion of current Qianhai agenda will spell vastly improved opportunities for Hong Kong's service sector, with lower investment thresholds for overseas investors. In addition to the "master plan", businesses are being urged to come up with their own innovations to deepen the collaboration between Shenzhen and Hong Long.

Li Qiang, deputy director general of the Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone of Shenzhen told delegates to the Asia Financial Forum conference in Hong Kong earlier this year, "Qianhai has the necessary conditions for development into a major financial center." He added, "Development is our top priority this year. All enterprises recently registered in our area are growing quickly."

The Qianhai Economic Zone project was approved by the State Council in 2010. By the end of last year, 3,553 companies had registered. More than 60 percent were financial institutions such as HSBC, Hang Seng Bank and Standard Chartered, and para-financials, operating from existing two-story and three-story buildings in Qianhai. Soon enough, the low rise structures will be replaced by 20- 30-story edifices.

Qianhai will major adjunct to the Shenzhen economic base, presenting trade financing for the tens of thousands of manufacturing entities established since the opening of the Chinese mainland in the 1970s.

As global concerns regarding pollution in various form destroying the general environment increases, the zone will also speed up on environmental improvements in all its subsequent projects next, following in the footsteps of the central government.

Development obstacles

Progress of development in the zone has come slowly. Little had been accomplished more than three years after the development plan was unveiled, owing to unforeseen setbacks. Things really didn't start moving forward until last year.

Officials acknowledged there have been problems with transportation, land reform, and cross-border management and those don't exhaust the list by any means. The new plan that came out on Feb 27, addressed five key areas of free trade development in the Qianhai and Guangdong-Hong Kong-Macao region

"With the implementation of Qianhai's detailed plan this year, the zone expects the number of companies registered there to exceed 10,000, yielding a combined GDP of 10 billion yuan," said Wang Jinxia, spokesman for the "Cooperation Zone."

There's still no clear sailing. Qianhai is still awaiting policy support for most of the 46 measures proposed in the plan.

Some of the leading initiatives are geared to closer cooperation with Hong Kong. More than 300,000 square meters of floor space has been set aside for occupancy by Hong Kong-based companies this year. The Hong Kong firms, employing Hong Kong professionals will get preferential treatment.

This year will see the completion of more temporary office projects, which will house at least 200 company headquarters. In addition, some internships will be offered exclusively to Hong Kong university students.

An entrepreneurship program to encourage young people in Shenzhen and Hong Kong to set up their own businesses in Qianhai is in the planning stage.

Plans are also afoot to introduce seven platforms for trading capital goods. "We are exploring ways to allow Hong Kong institutions and individual investors to participate in trades using the yuan," Li elaborates.

Much remains to be done at the new city in southern China, earmarked as a key area to boost cross-border trade with Hong Kong.

Qianhai aims to attract inbound investment of $7 billion from 30 of the world's top 500 companies in its 2013-15 development phase. That puts Qianhai on track to become a potential threat to Hong Kong's supremacy as the international financial center for the world's second-largest economy.

The western port city is the central axis of the Pearl River Delta. It has access to all parts of the city and in future, there will be 12 water ways from Qianhai to Hong Kong.

Some businessmen say there are insufficient details about incentives and policies within the Qianhai zone. The prospect of similar zones in other parts of China has caused some potential investors to become cautious.

Eighteen of the 46 proposals concern financial innovations. Qianhai residents and companies would be permitted to set up cross-border trade accounts with banks in the zone, for example. That would help make the yuan fully convertible under capital accounts; and prove a driving force to the Qualified Domestic Individual Investor Program.

"The QDII2 program is expected to be launched in Qianhai by the end of the year," the Qianhai spokesman says.

The program, or QDII2, as it's generally known, allows individual mainland investors to make direct equities trades overseas. The plan calls for financial regulators to be invited to set up in the zone to facilitate some planned experiments on financing.

The QDII2 initiative will not only give wealthy individuals wider exposure to securities, it will allow them to diversify their investments. There will be new business opportunities for professional brokerages and intermediaries to provide trading and consultancy services.

The China Securities Regulatory Commission (CSRC) is soon to open an office in Qianhai, making Qianhai the only free-trading zone to have an office of a national regulator within its boundaries.

"The CSRC will be in operation in no time, in a supervisory capacity," Li says, adding that will facilitate the opening of financial institutions in the near future.

Additional policies are on the drawing board for Qianhai and will be announced when they are ready.

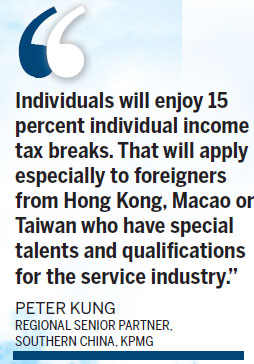

Tax breaks

Companies in industries specified in Qianhai's entry and preferred list will enjoy a preferential corporate tax rate at 15 percent.

"Individuals will enjoy 15 percent individual income tax breaks. That will apply especially to foreigners from Hong Kong, Macao or Taiwan who have special talents and qualifications for the service industry," Peter Kung, Regional Senior Partner, Southern China, at KPMG, points out.

Professionals and other specialists on Qianhai's preferential industry list will receive a provisional subsidy from the Shenzhen government equal to their salary tax, so that essentially they will be able to waive their salary taxes.

That will make Qianhai a better place to work than even Hong Kong, Li crows, adding there are no tax incentives in the Shanghai Free Trade Zone, although preferential terms are available to individuals in other areas.

Qualified modern logistics enterprises registered in Qianhai can also enjoy the preferential policy on business tax.

Li says: "Qianhai will have a favorable tax regime. There are 22 tax measures. We can offer professionals high tax rates similar to Hong Kong (16.5 percent corporate tax).

"We really believe in the power of the markets and we are learning from Hong Kong," he said.

"Hong Kong-based banks provided 15 billion yuan ($2.4 billion) in loans to companies registered in the Qianhai district of Shenzhen (till end of 2013). That marked the official start of the Qianhai cross-border yuan loan program, greater capital account openness and further interest rate liberalization," Li announced. He added that 17 companies had obtained approval to issue the RMB bonds.

"The focus of Qianhai this year, will be to develop and consolidate cross-border yuan loan accounts," Li explains.

Renminbi repatriation

Qianhai is expected to play a major role in the repatriation of renminbi from offshore companies via Hong Kong to the mainland, said Ngan Kim Man, head of the RMB business strategy and planning department at Hang Seng Bank.

"Guangdong Province is trying to cater to more business and financial clients. This is a great opportunity for the Hong Kong banking community to flourish and expand business to create more regional coverage."

Qianhai authorities have shown remarkable flexibility, Ngan said. Hang Seng, for example, has no branch in Qianhai, but Chinese authorities allowed the bank to rename its Shenzhen special zone branch with a Qianhai name.

Carmen Ling, global head, RMB solutions, Standard Chartered Bank, said Qianhai is all about financial innovation.

"With the current wave of financial internationalization, you will have noticed there have been major milestones to remove all regulatory barriers. The capital account opening allows for trapped capital to be repatriated. We're encouraging our clients to invoice in renminbi," she says.

Qianhai is a great location for renminbi internationalization due to its geographical linkage to Hong Kong and the Pearl River Delta, Ling says, but added that Hong Kong will maintain its status as an international hub.

Delegates to the Asia Financial Forum who attended a seminar on Qianhai, concluded that Qianhai would present immense opportunities for Hong Kong, especially with the inevitable internationalization of the RMB.

Contact the writer at joonsan@chinadailyhk.com

(China Daily USA 04/18/2014 page7)

Runners and their 4-legged friends race in New York

Runners and their 4-legged friends race in New York

Top 10 Chinese Internet firms eyeing IPOs in US

Top 10 Chinese Internet firms eyeing IPOs in US

Chinese cop cadets learn about US police work

Chinese cop cadets learn about US police work

In Boston, warming up for, remembering marathon day

In Boston, warming up for, remembering marathon day

Families of missing passengers face agonising wait

Families of missing passengers face agonising wait

Couple leave the city for 'Self-sufficiency Lab'in mountains

Couple leave the city for 'Self-sufficiency Lab'in mountains

Turning waste into something valuable

Turning waste into something valuable

Dignitaries put their foot down

Dignitaries put their foot down

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Scientists discover most earth-like planet

UN celebrates 2014 Chinese Language Day

4th US Navy official charged in bribery scheme

Nobel winner Marquez dies at 87

Chinese keen on Google Glass

Ferry's captain under probe

Texas seizes polygamist group's secluded ranch

In Boston, people remembering marathon day

US Weekly

|

|