Chinese cut big African air deal

Updated: 2014-05-12 12:03

By Liu Lian and Zhang Yuwei in New York (China Daily USA)

|

||||||||

Hainan partners to provide civilian service in East Africa, Nairobi hub

China's HNA Group, parent company of Hainan Airlines and Hong Kong Airlines, and China-Africa Development (CAD) Fund, China's largest Private Equity fund focusing on African Investments, have signed a Memorandum of Understanding (MOU) with Astral Aviation Airlines , a Kenya's cargo airline to explore the aviation markets of Kenya and East African countries at State House in Nairobi on May 10.

|

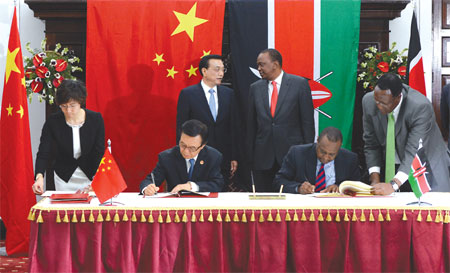

Chinese Premier Li Keqiang (third from left) and Kenyan President Uhuru Kenyatta (fourth from left) witness a signing ceremony of a number of cooperation documents in such areas as economy and technology, wildlife protection, public health, agriculture, animal husbandry and fishery, and finance, in Nairobi, Kenya on May 10. Liu Zhen / China News Service |

Investment in Africa is part of the global strategy of the HNA Group, said Daniel Chen, president of HNA Group North America LLC. "Hainan Airlines' US-China routes, including Beijing-Seattle, Beijing-Chicago and Beijing-Toronto, and the upcoming direct service between Beijing and Boston are all part of our commitment to the North America market," said Chen. The airline's daily, direct service between Boston and Beijing will begin on June 20. The company's next step in the US market also includes planning on services between Beijing and New York, said Chen.

The MOU was signed by Astral Aviation's Chairman Anwar Majid Hussein and Consolidated Bank's chief executive Japheth Kisilu on the Kenyan side and the HNA chairman Chen Feng and vice president of CAD Fund Lu Qingcheng on China's side.

The signing was witnessed by Chinese PremierLi Keqiang and Kenyan President Uhuru Kenyatta. Gao Hucheng, ChineseMinister of Commerce, was also present at the ceremony.

Under the deal, Hainan Airlines would take shares in Astral Aviation, and the new entity would provide civil aviation service in Kenya and other East African countries, with Nairobi as the center.

There are five 50-seat Embraer E-145 planes at the initial stage to fly between Nairobi and neighboring countries. The fleet may be expanded and air routes extended to West and South African air transport hubs, according to Xinhua.

A lack of high-volume transport infrastructure in East Africa has long been an obstacle to the region's natural resource development. The HNA- Astral Aviation deal is an important strategic push to help develop the region's aviation sector and boost the regional economy.Wang Xiaoyong, secretary-general of China-Africa Business Council, said the signing of the MOU means a beginning of a series of iconic projects for Chinese investors in the African continent because it involves in bringing new skills and technologies to Africa.

"The deals will for sure help create jobs and boost local economies, which helps build Chinese investors' track record in their investment," said Wang. "Recent visits of President Xi Jinping and Premier Li Keqiang showed that China-Africa relationship has entered a new, closer phase, and that has laid a good foundation for business exchanges," said Wang. The deals mentioned in the MOU also show that Chinese investors have brought more than capital but technology to Africa. "Industries including manufacturing, infrastructure and aviation services also show that Chinese investment in Africa has expanded its portfolio and has engaged in helping improve the local economies, which creates a win-win result," said Wang.

The HNA Group is a major entity established in 2000 with a total asset of over 64 billion USD. It has extensive international investments beyond the airline and transport sector, including logistics, real estate development, finance, tourist service among others.

Hainan Airlines is China's fourth biggest carrier by revenue. Its current fleet includes close to 500 airplanes. The airline operates in more than 190 cities and serves scheduled domestic and international services on over 580 routes.

HNA has previously taken a stake in Africa World Airlines (AWA), a start-up in Ghana that intends to launch low-cost operations in 2012, joining a crowded field in the West African nation that includes Starbow Airlines and FastJet.

As the growth of the Chinese economy slowed, Chinese companies are increasingly looking for opportunities that can help add strategic value to grow their business domestically and expand control over their overall wealth supply chain. The lessons of economic development they have learned in China could prove essential for Africa's emerging markets.

Chinese companies invested $2.5 billion in 2012, according to China's Ministry of Commerce. The CAD Fund, established in 2006, had by the end of 2012 pledged to invest US$2.385 billion in 61 projects in 30 African countries, and had already invested US$1.806 billion for 53 projects, according to China's Information Office of the State Council.

Investments in Africa's aviation industry could be costly and returns may come in the long term, according to experts. But HNA was well positioned to capitalize on future demands of the region such as opportunities for hotels construction and property developments that the group has been versed in China and the US markets.

HNA has previously set up a logistics joint adventure with the CAD Fund named Xiangfei in Beijing, aiming to supplyproject logistics for theoften complex logistics tasks in Africa. They also have further collaboration plans in aviation, airports, hotel, commercial and transportation centerand property developments.

HNA, through Brightness Action, has funded the treatment of more than 4,000 patients with cataracts in Zimbabwe, Malawi and Mozambique. HNA chairman Chen was honored a 2012 South-South award, co-organized International Telecommunication Union and the UN World Tourism Organization, for the charitable program.

Contact the writers at lianliu@chinadailyusa.com and yuweizhang@chinadailyusa.com.

(China Daily USA 05/12/2014 page1)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US-China 'Dialogue' will include S. China Sea

PLA chief tours US carrier

China accuses former GSK head of bribing doctors

Houston may see 55,000 new jobs from energy boom

Scholarship gets new partner to help find students

Li: More common interests with US

China warns US over sea issue

Former policemen convicted of forced confession

US Weekly

|

|