Anti-corruption campaign forcing change in SOEs

Updated: 2014-07-03 07:40

By Xinhua (China Daily USA)

|

||||||||

China's huge State-owned enterprises are seen by the public as both too corrupt to save and too powerful to fail. But with dozens of high-profile cases exposed since 2012, China's ongoing anti-corruption drive offers hope for change in SOEs.

On Monday, Jiang Jiemin, former head of the State-owned Assets Supervision and Administration Commission and one-time chairman of oil giant PetroChina, was expelled from the Communist Party of China for serious discipline and law violations.

He was found guilty of taking advantage of his post to seek benefits for others and extorting and receiving a huge amount in bribes, according to the CPC Central Commission for Discipline Inspection.

In April 2013, Song Lin, then the chairman of State-owned China Resources, was put under investigation for suspected serious violations of discipline and law.

Jiang and Song are among a long list of high-ranking executives and managers at SOEs who have been taken down since 2012. More than 50 people have been felled in the fight against corruption.

"Chinese SOEs have become a field for the play of power and money and collusion between officials and businessmen. Thus, they are an unavoidable part of the anti-corruption drive," economist Hua Sheng said.

China has thousands of SOEs, and 113 of them are directly administered by the country's central authority. These enterprises are deemed the backbone of the economy, but their monopolies in many areas, unchecked spending and corruption have long been a source of public complaints.

The latest crackdown on SOE corruption is viewed as the government's effort to clear obstacles in the push to reform wasteful and inefficient SOEs.

One of the solutions to the system's reform is to bring in social capital.

A decision released after a key reform meeting in November pledged to actively develop a diversified ownership economy and allow more SOEs and other firms to develop into mixed-ownership companies.

Since the meeting, several SOEs have taken the initiative in implementing reforms.

In February, China's top oil refiner, Sinopec, decided to restructure its lucrative distribution business and allow social and private capital to take up to 30 percent of shares, followed by the State Grid Corp's decision to open two business sectors in May.

(China Daily USA 07/03/2014 page5)

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China, US agree to boost cooperation on fighting terrorism

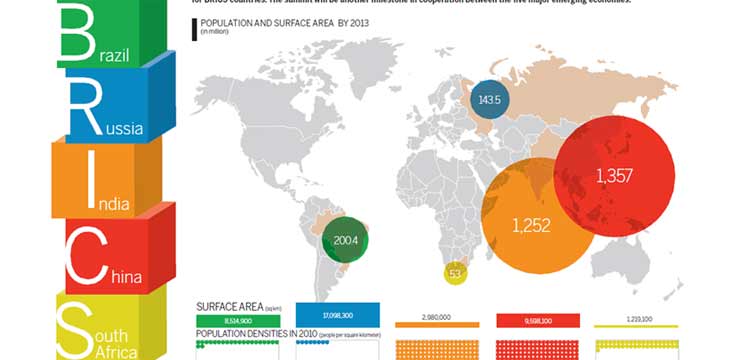

BRICS form new development bank

China to get new dairy hub

Classic China novel will be AMC series

Henry Kissinger undergoes heart surgery

BRICS bank to be headquartered in Shanghai

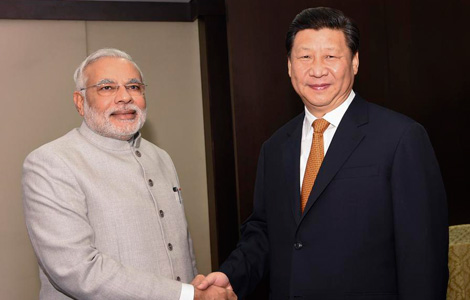

Xi attends sixth BRICS summit

Xi, in Brazil, talks with Obama over the phone

US Weekly

|

|