Stephen Roach: China, from fascination to addiction

Updated: 2014-07-04 12:12

By Amy He in New York (China Daily USA)

|

||||||||

|

Stephen Roach, senior fellow at Yale University's Jackson Institute of Global Affairs, gives remarks in New York about the codependent US-China relationship. Roach published a book titled Unbalanced: The Codependency of America and China in January this year. Amy He / China Daily |

The Asian financial crisis hit East and Southeast Asia hard in the summer of 1997 after a currency collapse in Thailand went on to devastate other countries in the region. At the time, Morgan Stanley had one of the highest-ranked global economics teams on Wall Street, led by chief economist Stephen Roach, but was failing to properly forecast what was going on in Asia.

"We had the worst forecast of anybody in the business, because we did not know and really didn't have an understanding of what was going on in Asia," Roach said. "So I was personally humiliated by that, and committed myself to try to figure out how the Asian financial crisis would unfold. This was 1997. I had a hunch - and I didn't really know this for sure - that China would hold the key to the endgame."

Thus began Roach's almost two-decade long focus on China's economy and its rapid growth. What started as a fascination "born in the depths of a crisis" eventually turned into an addiction, Roach told China Daily in an interview.

As a US-based economist at Morgan Stanley through most of his career there, Roach always visited China briefly once a year or so, but after the crisis hit, he made trips almost every month, studying the genesis of China's economic model, the history and roots of China's macro leadership. He wanted to learn how the leadership would maintain social stability through economic policy and what the threat of crisis would pose to stability.

"It quickly became evident to me that China was cut from a very different cloth than the Asian crisis-torn economies like Thailand, Korea, Indonesia, and the likes," he said.

Government leadership had "unwavering commitment" to stay the course of development amidst global turmoil and its ability to execute policy was what Roach thought was superior to other models he had studied both in developed and underdeveloped economies, said Roach, who became the Hong Kong-based chairman of Morgan Stanley Asia in 2007 until he retired in 2012 to teach at Yale University in Connecticut.

That attitude to maintain economic growth has persisted two decades after the Asian financial crisis, Roach said. But China's economy has not been without its problems in the time since, mainly that the country's manufacturing-led economy supported exports and investment, but brought on a host of other problems, such as weak private consumption and reliance on selling cheaply-made goods.

"Their current model is now evolving in a way that's very different than the one in the 1990s, but at its core, is really a critique that was first offered by former premier Wen Jiabao in March of 2007, when he said that while China on the surface looks strong at the time, beneath the surface, he was concerned about an economy that's decreasingly unstable, unbalanced, uncoordinated. That sparked a very intense internal debate over what came to be known as 'rebalancing' the Chinese model," he said.

China's desire to transition to a services-based economy has been emphasized in recent policy making, such as in the 12th Five-Year Plan enacted in 2011, with reforms ratified in 60 articles presented at the Third Plenum of the 18th CPC Central Committee in November last year. The plenum called for a more market-based economy as well as more private consumption.

This year has seen panic from some China experts and economists about the country's economic viability, with China facing burgeoning debt, slowing growth, credit and liquidity problems, and geopolitical tensions between China and the US as well as China and its neighbors. But Roach said that the debates on China have been "pretty one-sided" and that high-profile concerns - shadow banking, the property bubble - may be "overblown".

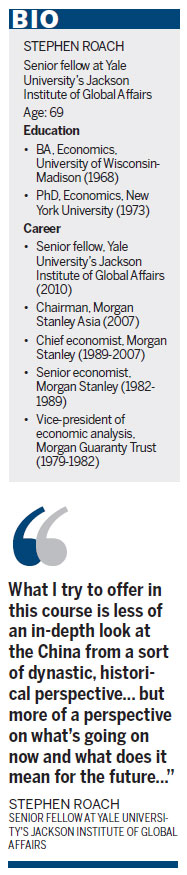

"The structural transition from manufacturing to services is not widely appreciated; the benefits of urbanization and raising income that is providing a framework to drive services-sector development is not appreciated," said the 69-year-old. "I think the new leadership's commitment to reforms as itemized by the Third Plenum is generally not appreciated in the West for being as significant a breakthrough as it deserves to be."

Roach will return to China soon to launch a Chinese version of his latest book, Unbalanced: The Codependency of America and China, which focuses on how both the US and China's overreliance on each other has allowed both economies to "grow more rapidly than ultimately they should have", and how both have ignored imbalances that arose from excess economic growth.

In the fall, he will continue to teach a course called The Next China, where he lectures on what's in store for China, a class that has increased to more than 250 from 80 since he began teaching it in 2010.

"What I try to offer in this course is less of an in-depth look at the China from a sort of dynastic, historical perspective - although I start out with a little of that - but more of a perspective on what's going on now and what does it mean for the future, and there's a big appetite for that among the students that I'm in contact with at Yale," he said.

amyhe@chinadailyusa.com

(China Daily USA 07/04/2014 page10)

Chinese Navy leave Pearl Harbor to join RIMPAC drill

Chinese Navy leave Pearl Harbor to join RIMPAC drill

'Cracking Tech Fortune Cookies'

'Cracking Tech Fortune Cookies'

US, China keen on fixing ties

US, China keen on fixing ties

Traditional Chinese medicine enlivens RIMPAC crowd

Traditional Chinese medicine enlivens RIMPAC crowd

Hainan provides limo service in Seattle

Hainan provides limo service in Seattle

Wanda's Chicago deal is first in US realty

Wanda's Chicago deal is first in US realty

Insurer's office to serve Chinese community

Insurer's office to serve Chinese community

Xi gives speech at SED opening ceremony

Xi gives speech at SED opening ceremony

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese are No 1 buyers of US residential property

College addresses need for experts in anti-terrorism

China-US investment treaty on fast track

Minister: US 'key' to global recovery

Snowden applies for asylum extension in Russia

5 killed in Houston shooting, standoff underway

Xi: World big enough for two great nations

China, US unite against illegal wildlife trafficking

US Weekly

|

|